Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

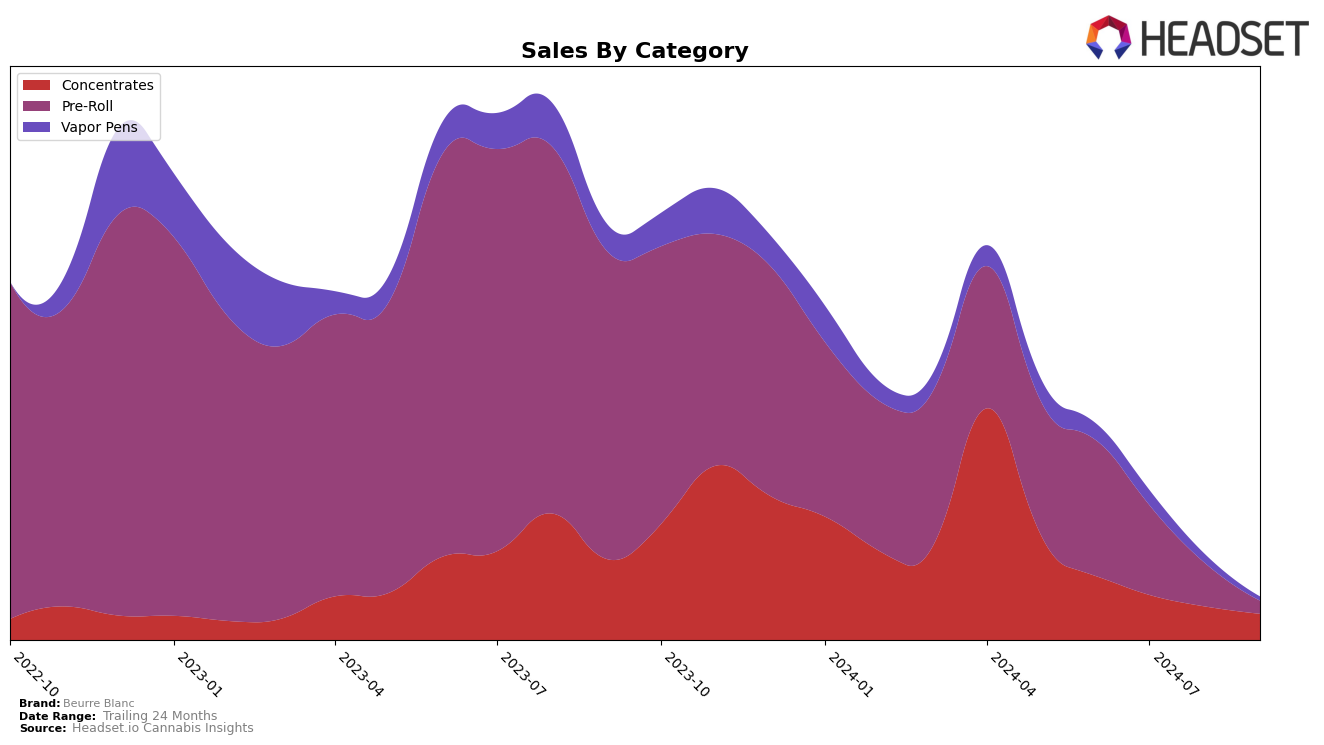

Beurre Blanc's performance in the Canadian cannabis market has shown notable shifts across various provinces and product categories. In British Columbia, their presence in the Concentrates category has been declining steadily, with rankings slipping from 17th in June 2024 to 30th by September 2024. This downward trend is mirrored in their sales figures, which saw a significant reduction from June to September, indicating a need for strategic adjustments in this market. In contrast, Ontario presents a mixed picture. Beurre Blanc's Concentrates category did not make the top 30 in September, marking a potential area for concern despite a brief improvement in July. However, the brand's absence from the top 30 in the Pre-Roll category after June suggests a potential opportunity for growth if addressed appropriately.

Examining Beurre Blanc's category performance, the Concentrates segment in British Columbia has been experiencing a consistent decline in both ranking and sales, which could reflect increased competition or changing consumer preferences. Meanwhile, in Ontario, the brand's fluctuating position in the Concentrates category highlights the competitive nature of the market, with brief improvements not sustained over the following months. The Pre-Roll category in Ontario, where the brand was ranked 90th in June, shows no subsequent rankings, indicating that Beurre Blanc has not maintained a significant presence in this category. This could either suggest an area ripe for development or a strategic decision to focus resources elsewhere. These insights into Beurre Blanc's market dynamics across provinces and categories provide a snapshot of the challenges and opportunities the brand faces in the evolving cannabis landscape.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, Beurre Blanc has experienced a notable decline in both rank and sales over the past few months. Starting from a strong position at 17th in June 2024, Beurre Blanc's rank slipped to 28th in July and August, and further down to 30th by September. This downward trend is mirrored in its sales figures, which have consistently decreased each month. In contrast, Good Buds has maintained a relatively stable position, ranking 27th in July, 26th in August, and 27th in September, suggesting a more consistent market presence. Meanwhile, Even Cannabis Company has shown slight improvement, moving from 32nd in August to 31st in September, indicating potential growth. The absence of Dabble Extracts and Delta 9 Cannabis from the top 20 rankings during this period highlights the competitive challenges within the market. These dynamics suggest that Beurre Blanc may need to reassess its strategies to regain its competitive edge in the concentrates market in British Columbia.

Notable Products

In September 2024, the top-performing product from Beurre Blanc was Diamants Pressés 45-189um Solventless Pressed Diamonds (1g) in the Concentrates category, climbing to the number one rank from the third position in the previous months. This product achieved a notable sales figure of 198 units. Solventless Pressed Diamonds (1g) also made a significant entry, securing the second position in the Concentrates category. Roulé Infusé Water Hash Infused Pre-Roll (1g), previously holding the top rank consistently, dropped to third place in the Pre-Roll category. Meanwhile, Ceramic Tip Water Hash Infused Pre-Roll 3-Pack (1.5g) and Ceramic Tip LA Kush Cake Water Hash Infused Pre-Roll (1g) were ranked fourth and fifth, respectively, with the latter experiencing a slight decline from its second position in August 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.