Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

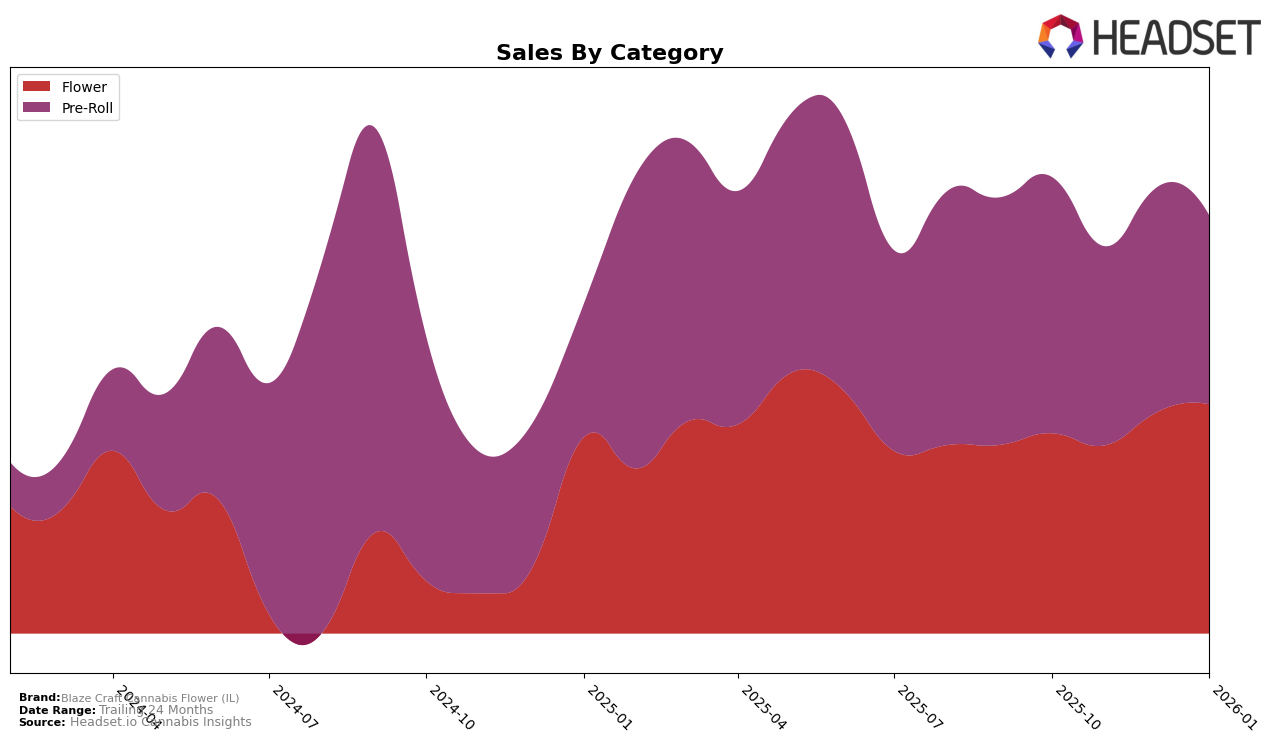

Blaze Craft Cannabis Flower (IL) has shown a consistent presence in the Illinois market, particularly in the flower category. Although it did not break into the top 30 rankings in October 2025, the brand made gradual progress, climbing to the 31st position by December 2025 and maintaining a steady 32nd rank in January 2026. This upward movement is indicative of a growing acceptance and demand for their flower products, despite the competitive nature of the market. Notably, sales figures saw a significant increase from November to December, suggesting a successful holiday season push or a possible introduction of new product lines that resonated well with consumers.

In the pre-roll category, Blaze Craft Cannabis Flower (IL) has maintained a stronger foothold, consistently ranking within the top 11 brands in Illinois. Starting at the 9th position in October 2025, the brand experienced a slight dip to 11th by January 2026. This slight decline in ranking, alongside a decrease in sales from December to January, could point to increased competition or changing consumer preferences. However, the brand's ability to remain within the top tier suggests a solid consumer base and brand loyalty. The fluctuations in sales and rankings hint at dynamic market conditions, which could provide opportunities for strategic adjustments to regain higher positions in the coming months.

Competitive Landscape

In the competitive landscape of the Illinois cannabis flower market, Blaze Craft Cannabis Flower (IL) has experienced a steady presence in the rankings, maintaining a position within the top 35 from October 2025 to January 2026. Despite facing strong competition, Blaze Craft Cannabis Flower (IL) managed to improve its rank from 33rd in October 2025 to 32nd by January 2026. This upward trend is indicative of their resilience and growing market acceptance. In comparison, Khalifa Kush showed a consistent improvement, climbing from 34th to 31st, while Galaxy (CA) experienced fluctuations, peaking at 27th in November and December before dropping to 30th in January. Seed & Strain Cannabis Co. saw a decline from 31st to 35th, and Mini Budz showed significant volatility, dropping to 42nd in December but rebounding to 34th in January. Blaze Craft Cannabis Flower (IL)'s ability to maintain and slightly improve its rank amidst these shifts highlights its competitive edge and potential for growth in the Illinois flower category.

Notable Products

In January 2026, Blaze Craft Cannabis Flower (IL) saw Blue Gruntz Pre-Roll (1g) maintaining its top position from December 2025, leading the sales in the Pre-Roll category with a notable figure of 2,995 units sold. Peanut Butter Cherry Pie Pre-Roll (1g) climbed back to the second position after slipping to fourth in December, indicating a resurgence in popularity. Blue Unicorn Poop Pre-Roll (1g) dropped to third place from its previous second position, suggesting a slight decline in demand. Boof Meat Pre-Roll (1g) entered the rankings in fourth place, showing a promising debut. Gastronaut Pre-Roll (1g) completed the top five, indicating a steady entry into the competitive market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.