Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

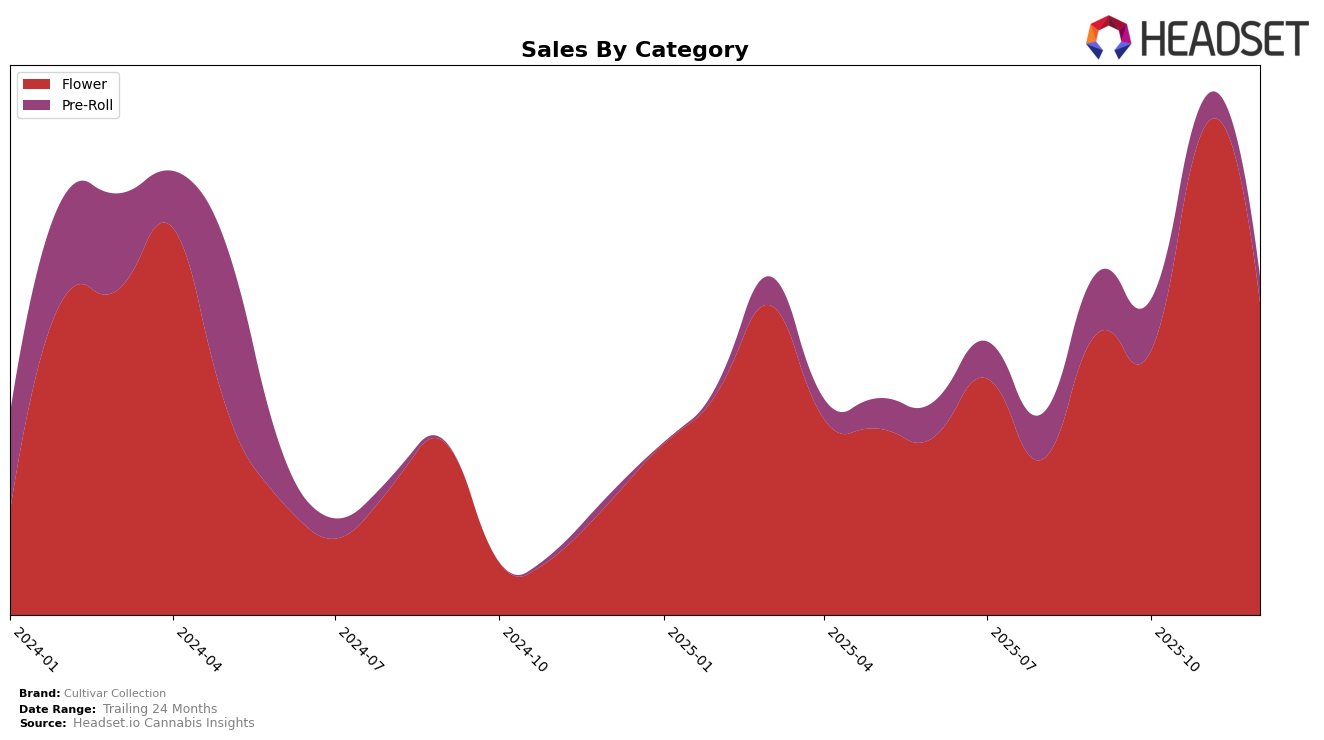

In the state of Maryland, Cultivar Collection has shown notable fluctuations in the Flower category rankings over the last few months of 2025. Starting at a rank of 32 in September, the brand climbed to 23 in November, before settling at 27 in December. This upward movement in November coincided with a significant increase in sales, suggesting a successful period for the brand. However, the decline in December indicates a potential challenge in maintaining that momentum. Such changes in ranking highlight the competitive nature of the Flower category in Maryland, where brands must consistently innovate and adapt to consumer preferences to remain prominent.

Conversely, the Pre-Roll category in Maryland presents a different scenario for Cultivar Collection. The brand started at rank 29 in September and slipped to 36 by November and December, indicating a downward trend. The consistent position at 36 towards the end of the year suggests that the brand may be struggling to compete effectively in this category. The sales figures reflect this challenge, as there was a noticeable decline from September to December. This persistent lower ranking in the Pre-Roll category could be a signal for the brand to reassess its strategies and offerings to better align with market demands and improve its competitive standing.

Competitive Landscape

In the Maryland flower category, Cultivar Collection has demonstrated a fluctuating performance in the latter months of 2025, with notable changes in rank and sales. Starting from a rank of 32 in September, Cultivar Collection improved to 23 in November, before settling at 27 in December. This improvement in rank coincides with a significant sales increase in November, suggesting a successful marketing or product strategy during that period. Despite this, Cultivar Collection remains behind competitors like Legend, which consistently maintained a higher rank, peaking at 21 in October, and The Essence, which, despite a drop in rank from 15 in September to 26 in December, still outperformed Cultivar Collection in sales. Meanwhile, Happy Eddie and Phas3 also present competitive challenges, with Happy Eddie closely trailing Cultivar Collection in December. These dynamics highlight the competitive pressure on Cultivar Collection to maintain its upward trajectory in both rank and sales in a highly competitive market.

Notable Products

In December 2025, the top-performing product from Cultivar Collection was Kush Lato (3.5g), which reached the number one rank in sales for the month. It was followed closely by Pink Certz (3.5g), which secured the second position. Sour OG Chem Pre-Roll (1g) maintained a steady performance, ranking third in December. Notably, Kush Lato (3.5g) experienced a significant rise from its second-place position in November, while Pink Certz (3.5g) also improved its ranking from third to second. The Sour OG Chem Pre-Roll (1g) remained consistent in its third-place ranking, with a notable sales figure of 960 units in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.