Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

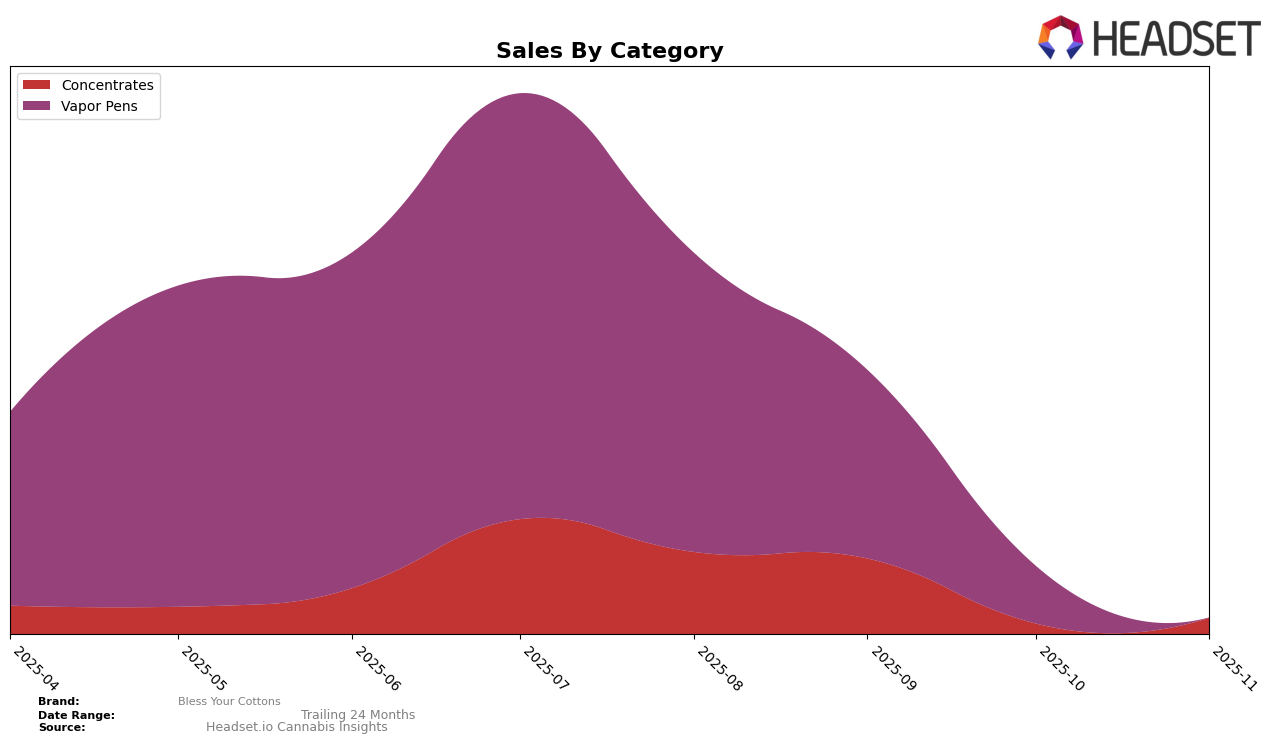

Bless Your Cottons, a cannabis brand known for its diverse product offerings, has shown varied performance across different categories and states. In the Concentrates category in New Jersey, the brand maintained a steady position at rank 11 from August to September 2025, before experiencing a decline to rank 21 in October. However, it demonstrated a slight recovery in November, improving to rank 19. This fluctuation suggests a competitive market landscape in New Jersey, where maintaining a top rank requires consistent performance and possibly strategic adjustments. The sales figures reflect this trend, with a notable decrease between September and October, followed by a modest increase in November, indicating potential market challenges or seasonal variations impacting consumer demand.

In contrast, Bless Your Cottons faced challenges in the Vapor Pens category in New Jersey. Starting at rank 26 in August, the brand slipped to rank 27 in September and further dropped out of the top 30 by October, reaching rank 45. The downward trajectory continued into November, landing at rank 64. This decline highlights significant competitive pressures or shifts in consumer preferences within the Vapor Pens market segment. The sales figures corroborate this trend, with a sharp decline from August to November. The absence of a top 30 ranking in October and November indicates that the brand may need to reassess its strategy in this category to regain its footing and improve its market position.

Competitive Landscape

Bless Your Cottons, a notable player in the New Jersey concentrates market, experienced significant fluctuations in its competitive standing from August to November 2025. Initially holding a strong position at rank 11 in both August and September, the brand saw a decline to rank 21 in October, before slightly recovering to rank 19 in November. This volatility in rank is mirrored in its sales performance, which dropped from a high in August to nearly half by October, before a modest recovery in November. In comparison, Drool maintained a more stable presence, consistently ranking within the top 20, while Breakwater surged into the rankings in November at position 17, indicating a potential threat to Bless Your Cottons' market share. Meanwhile, URBNJ and Space Ranger showed fluctuating ranks, with Space Ranger notably improving its position by November. These dynamics suggest that Bless Your Cottons faces increasing competition and must strategize to regain its earlier market position and sales momentum.

Notable Products

In November 2025, the top-performing product for Bless Your Cottons was Rainbow Guava Live Rosin (1g) in the Concentrates category, rising to the number one spot with notable sales of 204 units. Electric Rainbow Live Rosin (1g) debuted strongly in second place, while Ground Scores Live Rosin (1g), which previously ranked third in September, returned to the third position. Guava Glitch Distillate Cartridge (1g) maintained steady sales, holding onto fourth place in the Vapor Pens category. Rainbow Wooks Live Rosin (1g) entered the rankings at fifth place, showing a competitive performance among Concentrates. This month saw significant shifts, with Rainbow Guava Live Rosin climbing from third to first, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.