Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

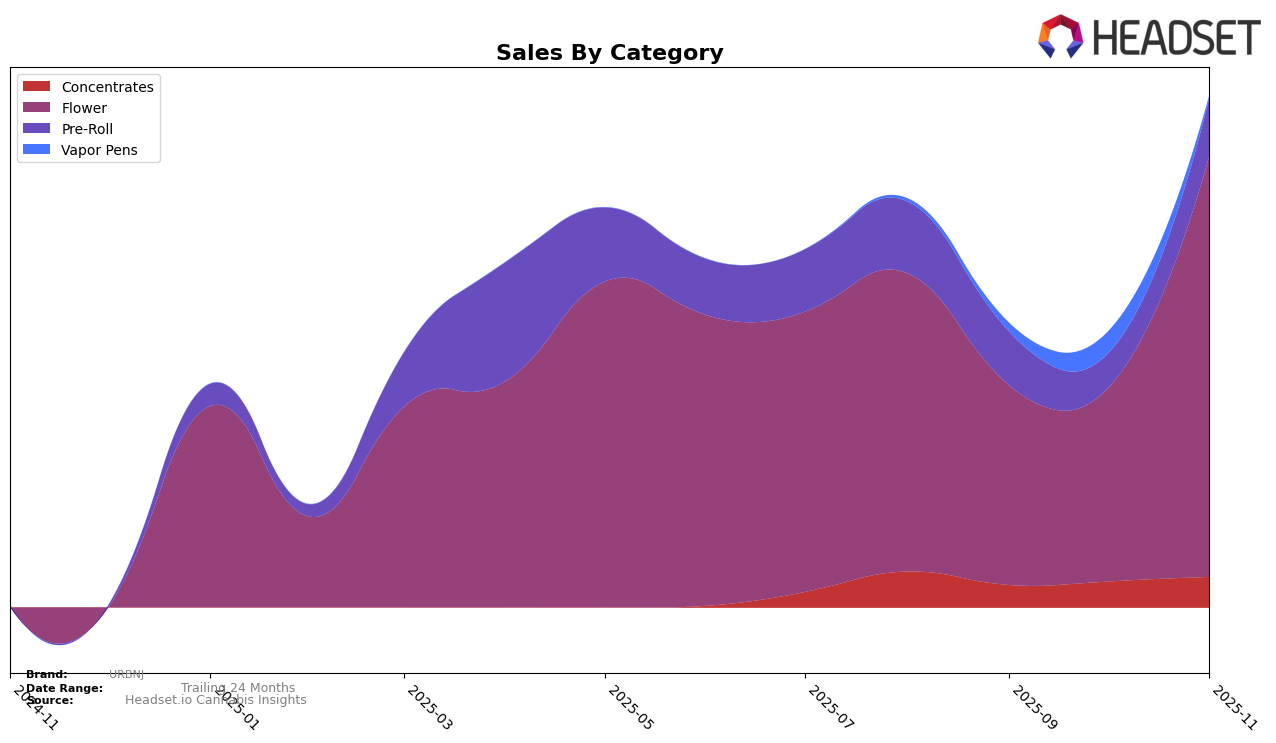

URBNJ has shown varied performance across different categories in New Jersey. In the Concentrates category, the brand has consistently maintained a presence in the top 30, with a slight improvement from a rank of 27 in September 2025 to 23 in November 2025. This upward trend is accompanied by a positive increase in sales during the same period. However, in the Flower category, URBNJ has struggled to break into the top 30, only reaching a rank of 33 in November 2025. Despite this, a significant spike in sales was recorded in November, indicating a potential for further growth if this trend continues.

In the Pre-Roll category, URBNJ has faced challenges, consistently ranking outside the top 40, with a peak rank of 48 in both August and November 2025. This suggests that while there is some demand, it is not as strong as in other categories. Interestingly, in the Vapor Pens category, URBNJ did not appear in the top 30 until October 2025, when it ranked 72. This could be interpreted as a slow entry into the market, but it also highlights an area with room for potential growth. Overall, the mixed performance across categories suggests that while URBNJ has strengths, particularly in Concentrates, there are opportunities for improvement in other areas.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, URBNJ has shown a notable improvement in its rank from 44th in September 2025 to 33rd in November 2025, indicating a positive trend in its market position. This upward movement suggests a recovery in sales, particularly when compared to competitors like Goodies, which experienced a decline from 26th to 32nd over the same period. Meanwhile, Savvy maintained a relatively stable position, slightly improving from 33rd to 31st, while The Botanist and Another State hovered around the mid-30s. Despite URBNJ's lower sales figures in September and October, the brand's resurgence in November suggests strategic adjustments that could be capitalizing on market dynamics, positioning it favorably against its competitors.

Notable Products

In November 2025, Sour Zkittlez Pre-Roll (1g) emerged as the top-performing product for URBNJ, achieving the number one rank with sales of 579 units. KY Jealous #4 (1g) followed closely as the second best-seller, while Orange Malt (1g) secured the third position. Garlicane Pre-Roll (1g) and Orange Malt Ground (7g) rounded out the top five, ranking fourth and fifth respectively. Notably, Sour Zkittlez Pre-Roll (1g) and KY Jealous #4 (1g) both made significant leaps to top ranks from previous months where they were not listed in the top five. This indicates a strong upward trend for these products within the URBNJ lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.