Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

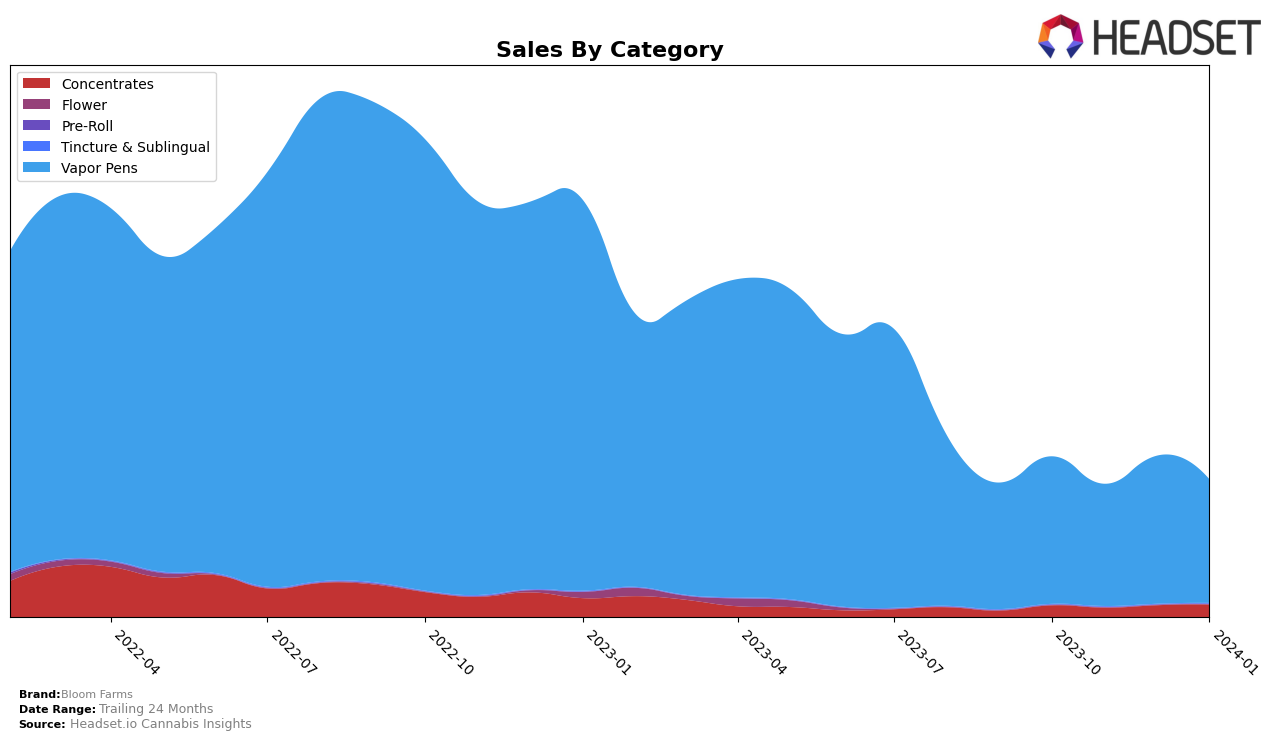

In California, Bloom Farms has shown an interesting trend in the Vapor Pens category, initially ranking 54th in October 2023 but experiencing fluctuations in the subsequent months, with a slight improvement in January 2024 to the 62nd position. This indicates a volatile market presence in California, yet the brand has managed to maintain a spot within the top 100, highlighting its resilience amidst competitive pressures. However, in the Concentrates category, the brand faced challenges, not making it into the top 20 until December 2023, where it finally appeared in the 100th position and improved to 93rd by January 2024. This late entry into the rankings could suggest a strategic pivot or an improvement in market penetration efforts, with December 2023 sales figures showing a promising increase to $21,307.

Contrastingly, in Nevada and Washington, Bloom Farms' performance varied significantly across categories and states. In Nevada, the brand struggled to maintain a consistent position within the top 100 for Vapor Pens, with rankings fluctuating from 81st in October 2023 to 76th by January 2024. This demonstrates a struggle to capture a significant market share in Nevada's competitive landscape. Meanwhile, in Washington, Bloom Farms found success in the Tincture & Sublingual category, securing a spot within the top 10 from October 2023 to January 2024, albeit with a missing rank in December. This indicates a strong consumer preference and brand loyalty in Washington for their Tincture & Sublingual products, contrasting sharply with their challenges in Nevada and the late bloom in California's Concentrates market.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in California, Bloom Farms has experienced fluctuations in its market position, indicating a dynamic and challenging environment. From October 2023 to January 2024, Bloom Farms saw a decline in rank from 54th to 62nd, suggesting a struggle to maintain its market share amidst stiff competition. Notably, Care By Design showed a remarkable improvement, moving from a rank of 73rd in October to 58th by January 2024, surpassing Bloom Farms in the process. This rise was accompanied by a significant increase in sales, highlighting Care By Design's growing influence in the market. Conversely, 710 Labs and Platinum Vape experienced a downward trend in both rank and sales, indicating potential opportunities for Bloom Farms to capitalize on. Jungle Boys, despite a brief rise in November, also faced challenges, ending up close to Bloom Farms in the rankings by January 2024. These shifts underscore the volatile nature of the Vapor Pens market in California, where brand dynamics can change rapidly, affecting sales and market positions significantly.

Notable Products

In January 2024, Bloom Farms' top product was the Maui Wowie Classic Live Resin Cartridge (1g) within the Vapor Pens category, maintaining its December 2023 first-place ranking with impressive sales of 1600 units. Following closely behind, the Pineapple Express Live Resin Cartridge (1g) secured the second spot, a position it held since December after being the top seller in the preceding two months. The Skywalker Live Resin Cartridge (1g) claimed the third rank, consistently showing modest sales improvement and maintaining its position from December. The Pineapple Express Live Resin Disposable (0.5g) experienced a slight drop, moving from third in December to fourth in January, indicating a shift in consumer preference within the same category. Notably, the Girl Scout Cookies High Potency Oil Cartridge (1g) made its debut in the rankings at fifth place, showcasing Bloom Farms' ability to introduce new products successfully into the competitive market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.