Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

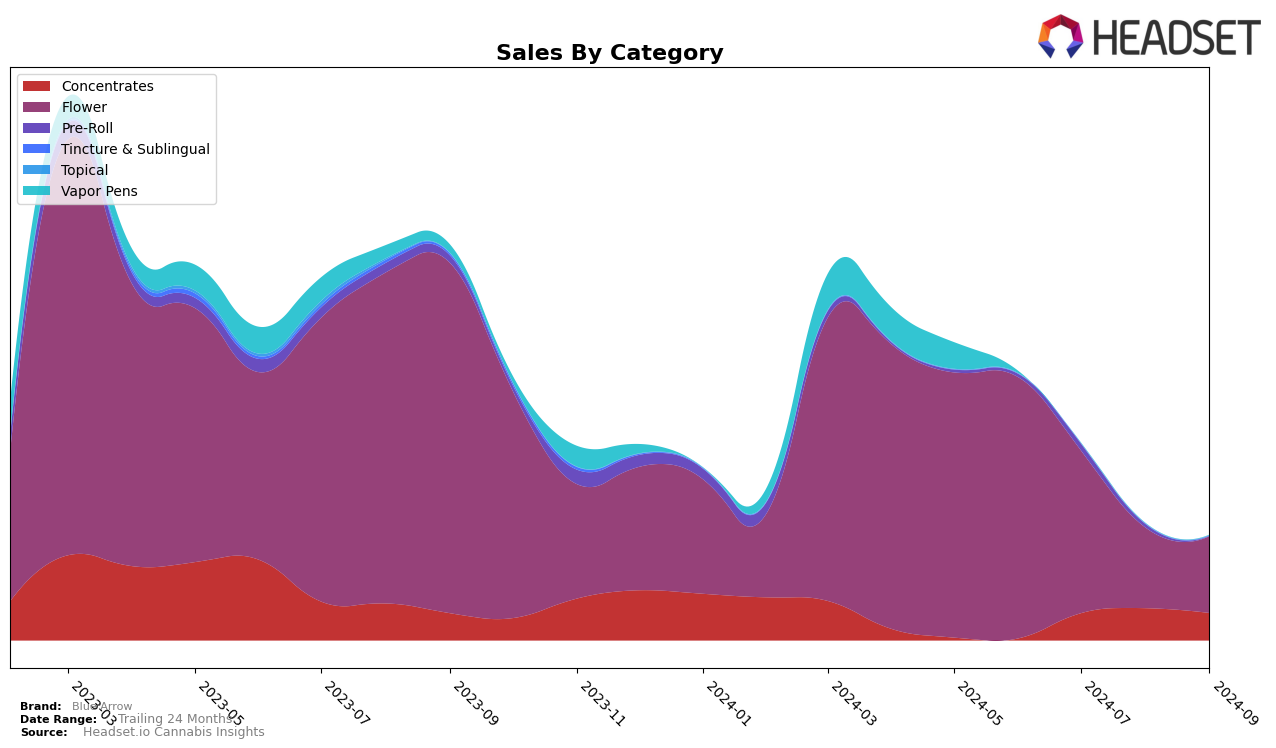

Blue Arrow has shown notable performance shifts across various categories and states, particularly in Missouri. In the Concentrates category, the brand has been making steady progress, moving up the ranks from 24th in July 2024 to 20th by September 2024, indicating a positive reception and growing market presence. This upward trend is supported by a significant increase in sales from June to July, although there was a slight dip in August. Conversely, the Flower category has seen a decline in Blue Arrow's rank, dropping from 20th in June to 37th by September, which could suggest increasing competition or shifting consumer preferences in this segment.

The Pre-Roll category presents a different scenario for Blue Arrow in Missouri, where the brand did not make it into the top 30 rankings for any month, peaking at 62nd in July. This absence from the top ranks could be a cause for concern or an opportunity for strategic realignment. The lack of consistent rank presence in this category may suggest either a need for increased marketing efforts or product innovation to capture consumer interest. Overall, while Blue Arrow is making strides in some areas, there are clearly opportunities for growth and improvement in others, particularly in the Pre-Roll sector.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Blue Arrow has experienced a notable decline in both rank and sales over the past few months. Starting from a strong position at rank 20 in June 2024, Blue Arrow has slipped to rank 37 by September 2024. This downward trend is accompanied by a significant drop in sales, from a high in June to lower figures by September. In contrast, Willie's Reserve has shown a positive trajectory, climbing from rank 38 in June to 34 in September, with a steady increase in sales. Meanwhile, Cookies has seen a dramatic fall from rank 24 in June to 35 in September, with sales plummeting significantly, suggesting a potential opportunity for Blue Arrow to reclaim market share if they can address the factors contributing to their decline. Additionally, Farmer G and The Solid have maintained relatively stable positions, indicating a consistent performance that Blue Arrow might aim to emulate to stabilize their market presence.

Notable Products

In September 2024, the top-performing product from Blue Arrow was Loma Prieta (3.5g) in the Flower category, maintaining its number one rank from August, with a notable sales figure of 1787 units. Kush Cake Live Budder (1g) emerged as a new entry in the Concentrates category, securing the second position. Tropicana Cherries (3.5g) ranked third in the Flower category, while Glitter Bomb (3.5g) followed closely in fourth place, both being new entries for September. Kush Cake Live Crumble (1g) experienced a slight drop, moving from third place in August to fifth in September. Overall, the rankings indicate a strong preference for flower products, with Loma Prieta consistently leading the sales for Blue Arrow.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.