Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

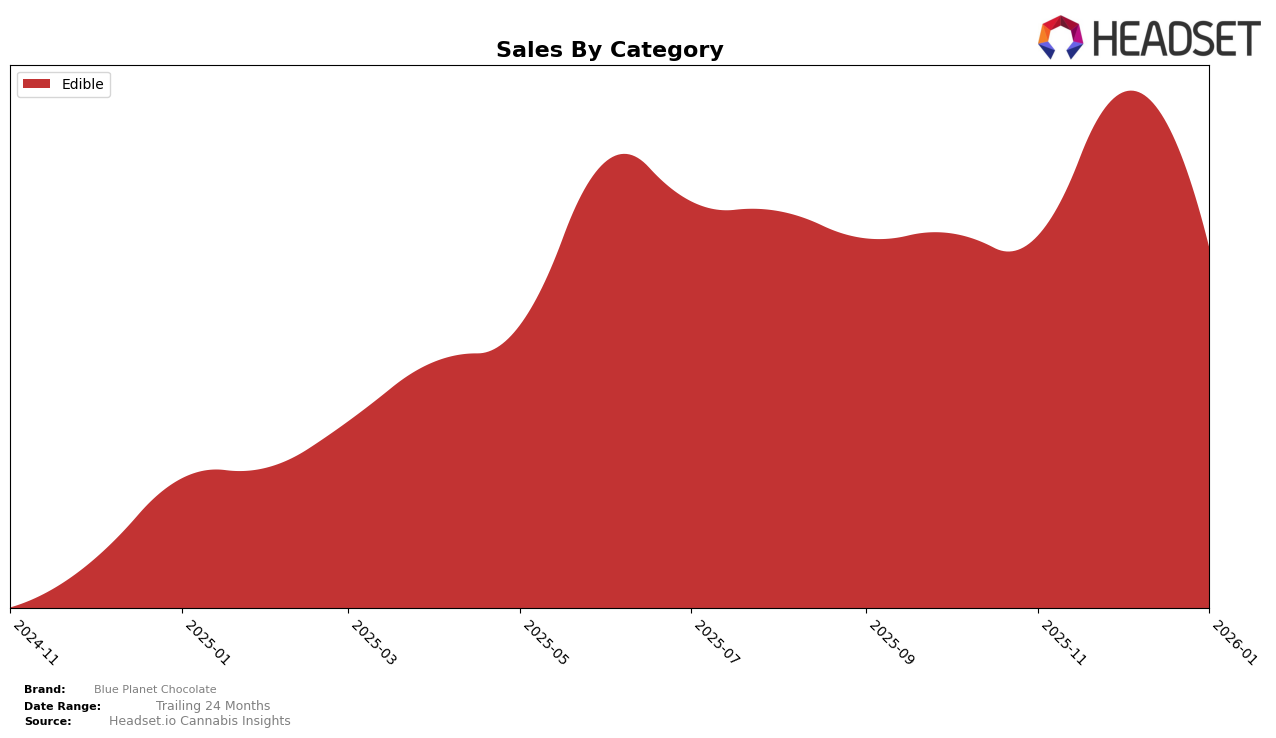

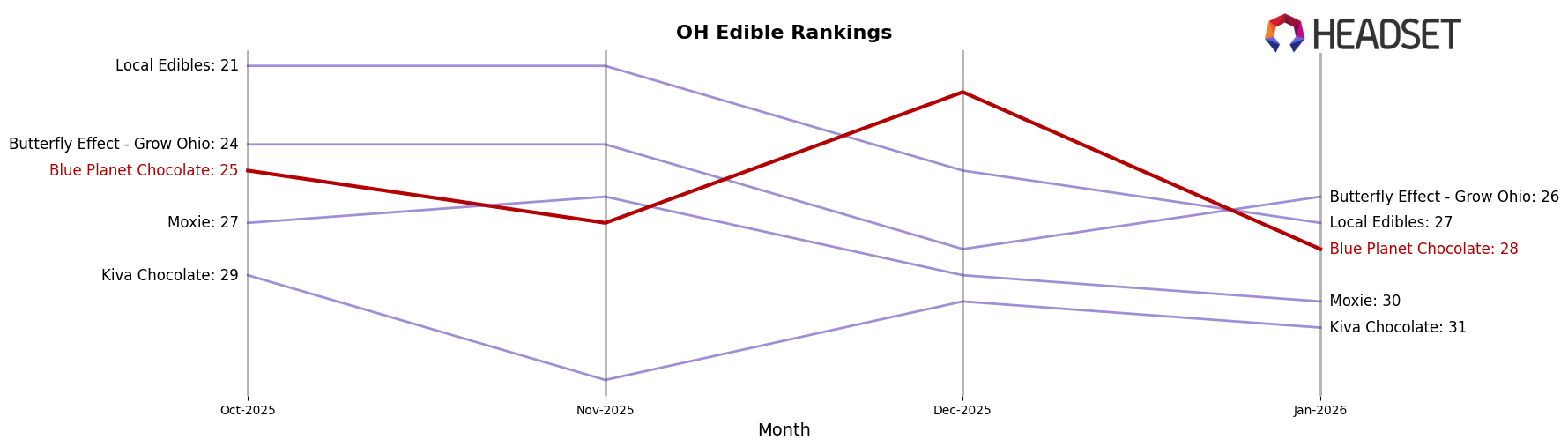

Blue Planet Chocolate's performance in the Edible category across various states has shown interesting dynamics over the past few months. In Ohio, the brand maintained a presence within the top 30 rankings, albeit with some fluctuations. Starting at rank 25 in October 2025, it slipped slightly to 27 in November, climbed to 22 in December, and then fell back to 28 in January 2026. This indicates a volatile yet persistent presence in the Ohio market. The sales in December 2025 were notably higher compared to other months, suggesting a potential seasonal boost or successful promotional efforts during that period.

For Blue Planet Chocolate, remaining within the top 30 in Ohio consistently is a positive sign, although the drop in January 2026 might warrant attention to maintain competitiveness. The brand's ability to climb back to a higher rank in December 2025 indicates potential strategies that could be replicated or enhanced. However, the absence of rankings in other states or provinces suggests that Blue Planet Chocolate has room for expansion or improvement in market penetration outside of Ohio. This could be an area of focus for the brand to explore new opportunities and diversify its market reach.

```Competitive Landscape

In the competitive landscape of the edible cannabis market in Ohio, Blue Planet Chocolate has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. While Blue Planet Chocolate saw a significant boost in December 2025, climbing to the 22nd rank, it faced challenges in maintaining this momentum, dropping to 28th by January 2026. This volatility is set against the backdrop of competitors like Local Edibles, which consistently held a higher rank, maintaining a position within the top 25 throughout the period. Meanwhile, Butterfly Effect - Grow Ohio also showed resilience, ending January 2026 at the 26th rank, slightly ahead of Blue Planet Chocolate. Brands like Moxie and Kiva Chocolate remained outside the top 20, indicating a competitive edge for Blue Planet Chocolate in certain months. The data suggests that while Blue Planet Chocolate has the potential to surge ahead, consistent strategies are needed to stabilize and improve its market position amidst strong competition.

Notable Products

In January 2026, the Milk Chocolate Bar High Dose 20-Pack (550mg) emerged as the top-performing product for Blue Planet Chocolate, climbing from the second position in December 2025 to first place with sales reaching 350 units. The Peanut Butter Creams Milk Chocolate Bites 4-Pack (100mg) secured the second rank, slightly down from its third position the previous month, with consistent sales figures. The Milk Chocolate Malt Balls 10-Pack (100mg) showed a notable improvement, moving to third place from a previous unranked position in December. The Dark Chocolate Bar 20-Pack (100mg) experienced a slight drop, moving from fifth to fourth place, while the Coffee Toffee Latte Milk Chocolate Bar 20-Pack (220mg) rounded out the top five, having previously been unranked. Overall, the rankings indicate a strong preference for high-dose chocolate products in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.