Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

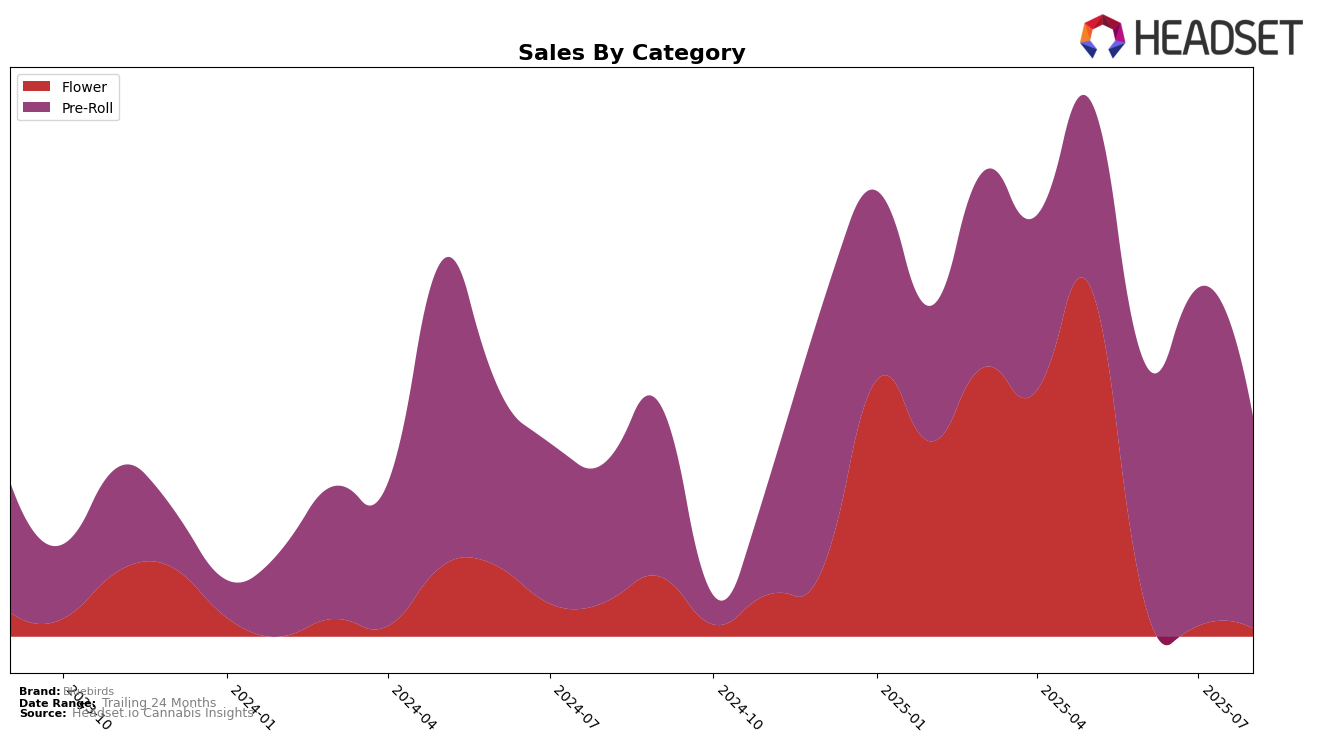

In the state of Nevada, Bluebirds has shown varied performance across different cannabis categories. In the Flower category, Bluebirds did not make it into the top 30 rankings from May through August 2025, indicating a challenging market presence in this category. Their ranking was 43rd in May and dropped significantly to 98th in June, with no subsequent rankings available, suggesting a decline or stagnation in this segment. This could be seen as a negative trend, as maintaining a presence in the top 30 is often indicative of competitive strength and consumer preference.

Conversely, Bluebirds has demonstrated a more robust performance in the Pre-Roll category within Nevada. The brand improved its standing from 27th in May to 12th in July, before settling at 23rd in August. This upward trajectory, particularly the peak in July, highlights a growing consumer interest and possibly strategic adjustments by Bluebirds that resonated well with the market. While the August ranking shows a slight dip, the consistent presence in the top 30 suggests a relatively strong foothold in the Pre-Roll category, contrasting sharply with their Flower category performance.

Competitive Landscape

In the competitive landscape of the Nevada pre-roll category, Bluebirds has demonstrated notable fluctuations in its market position over the summer of 2025. Starting from a rank of 27 in May, Bluebirds climbed to 12 by July, showcasing a significant upward trend in sales momentum. However, by August, it slipped to rank 23, indicating a potential volatility or market challenge. In comparison, The Grower Circle experienced a similar pattern, peaking at rank 11 in June before dropping out of the top 20 by August. Meanwhile, Pheno Exotic showed a steady improvement, moving from rank 41 in May to 22 by August, suggesting a growing market presence. Tyson 2.0 maintained a relatively stable position around the mid-20s, while Spiked Flamingo showed a slight decline. These dynamics highlight the competitive pressures and opportunities for Bluebirds to leverage its mid-summer momentum and address the factors contributing to its August decline.

Notable Products

In August 2025, Gush Mints Pre-Roll (1g) emerged as the top-performing product for Bluebirds, leading the sales with a notable figure of 3078 units sold. Following closely, Wedding Cake Pre-Roll (1g) secured the second position while Guava Pre-Roll 3-Pack (3g) ranked third. Cookies Pre-Roll 3-Pack (3g) and Amoretto Sour Pre-Roll (1g) took the fourth and fifth spots respectively. This month marked the first time these products were ranked, indicating a strong market entry for Bluebirds' pre-roll category. The rankings suggest a growing preference for single and multi-pack pre-rolls among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.