Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

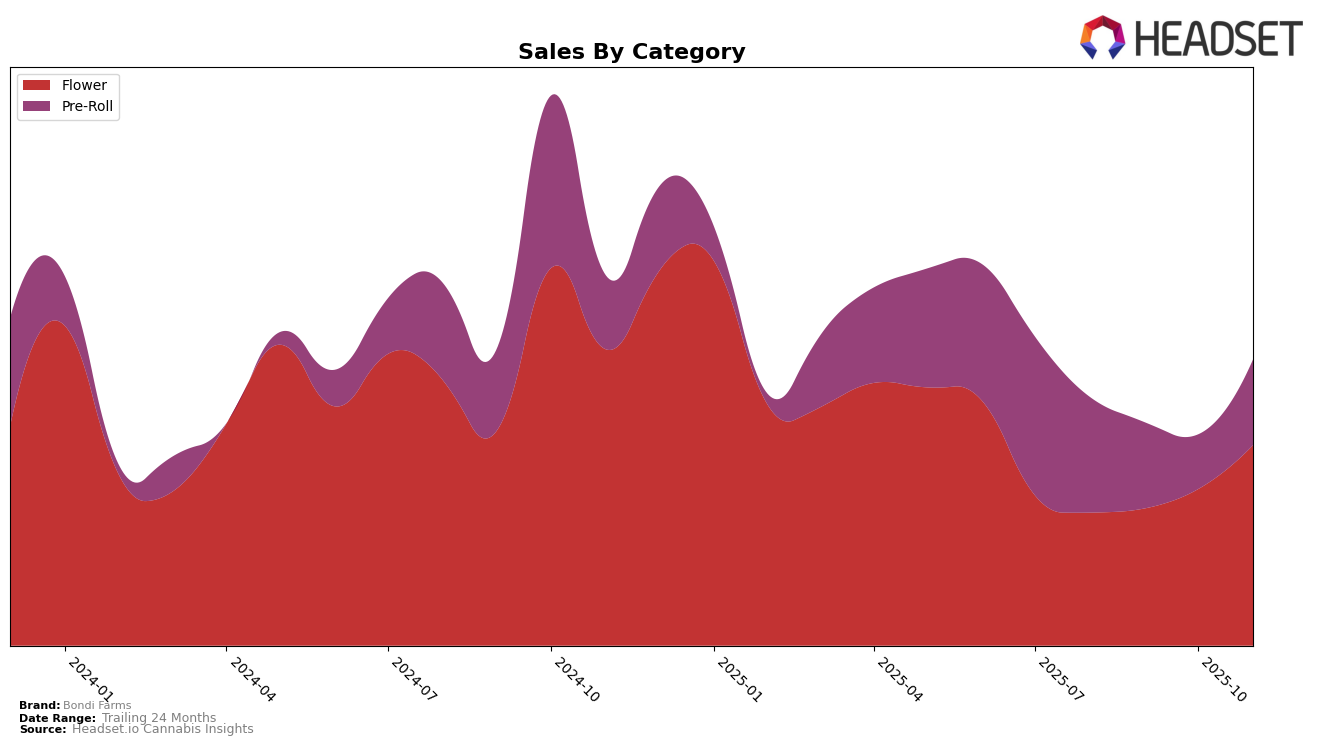

Bondi Farms has shown a consistent upward trajectory in the Washington market, particularly within the Flower category. Over the past four months, their ranking has improved steadily from 45th in August to 36th by November. This upward movement is accompanied by a noticeable increase in sales, indicating a growing consumer preference for their products. However, it's important to highlight that Bondi Farms has not yet broken into the top 30 brands in this category, suggesting there is still room for growth and increased market penetration.

In contrast, Bondi Farms' performance in the Pre-Roll category in Washington has been more variable. Despite a brief dip in October, where they fell to 33rd place, they managed to regain their 30th position by November. This fluctuation in ranking could suggest a competitive landscape or shifts in consumer preferences within the Pre-Roll segment. The fact that they are on the cusp of falling out of the top 30 indicates potential challenges in maintaining a steady market position. Their ability to sustain and improve this ranking will be crucial for their long-term success in this category.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Bondi Farms has demonstrated a consistent upward trajectory in its rankings, moving from 45th in August 2025 to 36th by November 2025. This improvement is indicative of a positive sales trend, with Bondi Farms experiencing a steady increase in sales over the months. In contrast, Smokey Point Productions (SPP) has seen a decline in both rank and sales, dropping from 23rd to 34th, suggesting a potential loss of market share. Meanwhile, Freddy's Fuego (WA) has shown a notable recovery, climbing from 50th to 37th, closely trailing Bondi Farms by November. Cookies has experienced fluctuations, ultimately falling to 38th, while Snickle Fritz has made a significant leap to 35th. These shifts highlight Bondi Farms' growing competitiveness and potential to capture further market share in the Flower category.

Notable Products

In November 2025, the top-performing product from Bondi Farms was Obama Kush Pre-Roll 2-Pack (1g) in the Pre-Roll category, climbing to the number one spot with sales of 2356. This marks a significant improvement from October 2025, where it was ranked second. Super Lemon Haze Preroll 2-Pack (1g), which previously held the top position for three consecutive months, fell to second place. Super Silver Lemon Haze Pre-Roll 2-Pack (1g) maintained a strong presence, advancing from fourth in October to third in November. Candyland Pre-Roll 2-Pack (1g) consistently stayed in the fourth position, while Cherry Dosidos Pre-Roll 2-Pack (1g) returned to the ranking at fifth place after being unranked in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.