Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

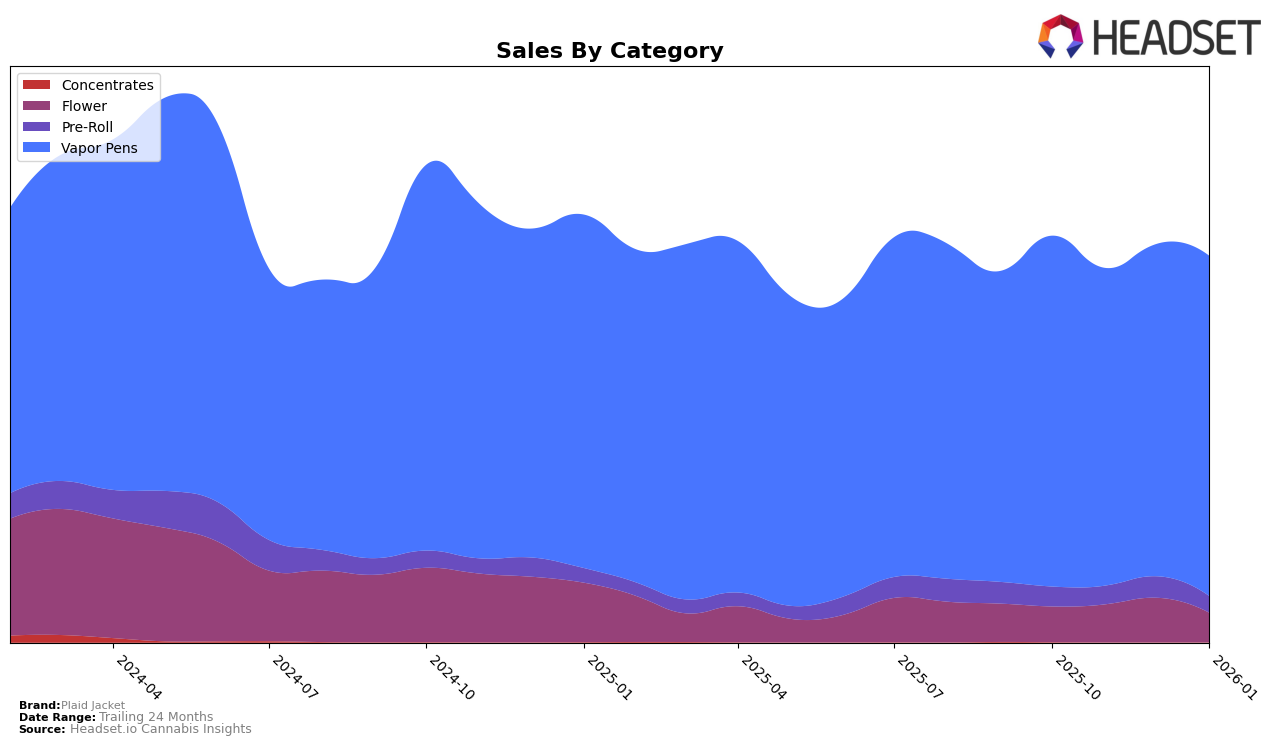

Plaid Jacket's performance across various categories in Washington reveals intriguing dynamics. In the Flower category, the brand showed a notable fluctuation. Starting at a rank of 47 in October 2025, it improved to 40 by December, only to drop to 58 by January 2026. This indicates a volatile presence in the Flower market, which might suggest either a highly competitive landscape or internal challenges. Meanwhile, in the Pre-Roll category, Plaid Jacket's ranking remained outside the top 30, peaking at 46 in December 2025, suggesting a need for strategic adjustments to strengthen its market position.

Conversely, Plaid Jacket's performance in the Vapor Pens category is commendable, consistently maintaining a top 6 position throughout the months analyzed. This stability, with minor fluctuations between the 5th and 6th ranks, highlights a strong foothold in this category in Washington. The brand's ability to sustain such high rankings in Vapor Pens, despite the competitive pressures, could be indicative of a robust product offering or effective market strategies. While specific sales figures are not extensively detailed, the brand's directional movement across these categories offers a glimpse into its diverse market engagement.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Plaid Jacket has experienced notable fluctuations in its market rank, impacting its sales trajectory. From October 2025 to January 2026, Plaid Jacket's rank shifted from 5th to 6th, then back to 5th, indicating a dynamic competitive environment. This fluctuation is particularly significant when compared to competitors like Phat Panda, which consistently held a top position, and Full Spec, which maintained a stable 4th rank. Meanwhile, Micro Bar saw a decline from 4th to 6th, highlighting opportunities for Plaid Jacket to capitalize on shifts in consumer preferences. Despite these rank changes, Plaid Jacket's sales remained relatively stable, with a slight dip in November 2025, followed by a recovery in January 2026. This suggests that while rank fluctuations can impact market perception, Plaid Jacket's brand loyalty and product quality continue to support its sales performance in a competitive market.

Notable Products

In January 2026, Plaid Jacket's top-performing product was the Super Boof Cured Resin Cartridge (1g) from the Vapor Pens category, maintaining its number one rank from October 2025 with sales increasing slightly to 4304 units. The Super Boof Cured Resin Disposable (1g) debuted impressively at the second position with notable sales of 2690 units. Dirty White Girls BHO Live Resin Cartridge (1g) showed a strong upward movement, climbing from fifth place in December 2025 to third in January 2026. Singapore Sling Cured Resin Cartridge (1g) and Blueberry Cherry Melted Diamonds + HTE Disposable (1g) rounded out the top five, with Singapore Sling entering the rankings at fourth. This month saw a notable shift in rankings, with new entries making significant impacts in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.