Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

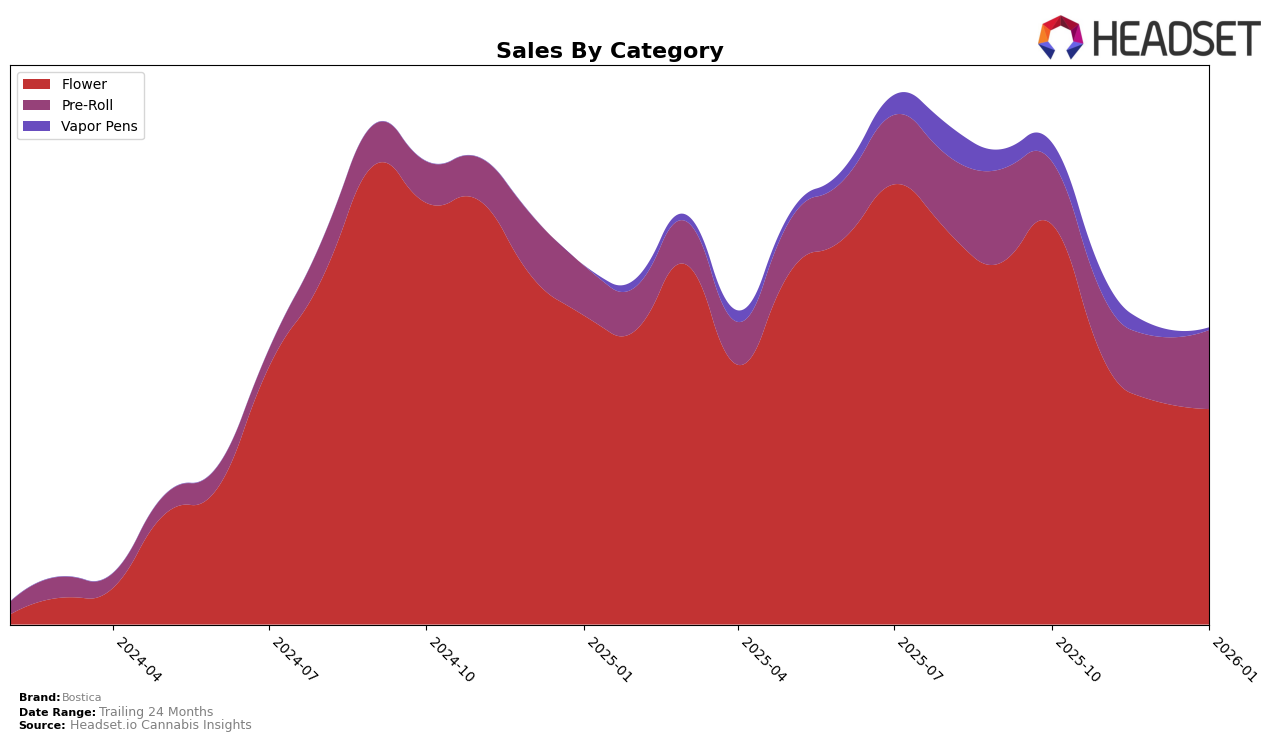

Bostica's performance in Massachusetts reveals some interesting dynamics across various product categories. In the Flower category, Bostica has experienced a steady decline in rankings from October 2025 through January 2026, dropping from 12th to 23rd. This downward trend is mirrored by a decrease in sales, which indicates potential challenges in maintaining market share in this competitive category. Conversely, the Pre-Roll category shows a more positive trajectory. Starting at a rank of 55 in October 2025, Bostica improved its position to 31 by January 2026, with sales increasing during this period. This suggests that their Pre-Roll offerings are gaining traction among consumers in Massachusetts, possibly due to product innovation or effective marketing strategies.

The Vapor Pens category presents a different scenario for Bostica in Massachusetts. Although they managed to climb from 79th to 73rd place between October and November 2025, the brand's position slipped to 92nd in December, and they did not make it into the top 30 by January 2026. This could imply significant challenges in maintaining consumer interest or facing stiff competition from other brands in this segment. The absence from the top 30 in January is notable and suggests a need for strategic adjustments to regain market presence. Overall, while Bostica has seen some successes, particularly in the Pre-Roll category, there are clear areas where the brand could focus on improvement to bolster its standing in the Massachusetts market.

Competitive Landscape

In the competitive landscape of the flower category in Massachusetts, Bostica has experienced notable fluctuations in its rank and sales over the past few months. Starting from a strong position at rank 12 in October 2025, Bostica's rank slipped to 23 by January 2026, indicating increased competition and possibly a decline in consumer preference. This downward trend contrasts with brands like In House, which maintained a relatively stable presence within the top 20, despite a slight drop from rank 15 in November to 21 in January. Meanwhile, Commcan showed resilience by improving its rank from 28 in October to 24 in January, suggesting a positive reception in the market. Additionally, Legends demonstrated significant growth, climbing from rank 49 in October to 25 by December, maintaining this position into January. These dynamics highlight the competitive pressures Bostica faces, underscoring the need for strategic adjustments to regain its earlier market position and capitalize on sales opportunities.

Notable Products

In January 2026, Bostica's top-performing product was Drip 3.5g in the Flower category, maintaining the number one rank consecutively from October 2025 through January 2026, with sales of 8,641 units. Purple Milk 3.5g, also in the Flower category, secured the second position, consistent with its rank from December 2025. Drip Pre-Roll 2-Pack 1g emerged as a new entry in the rankings, claiming the third spot in January 2026. Another newcomer, Jet Fuel G6 Pre-Roll 1g, achieved fourth place, while Godfather OG 3.5g rounded out the top five. These changes highlight a shift in consumer preferences towards pre-rolls alongside the continued success of established flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.