Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

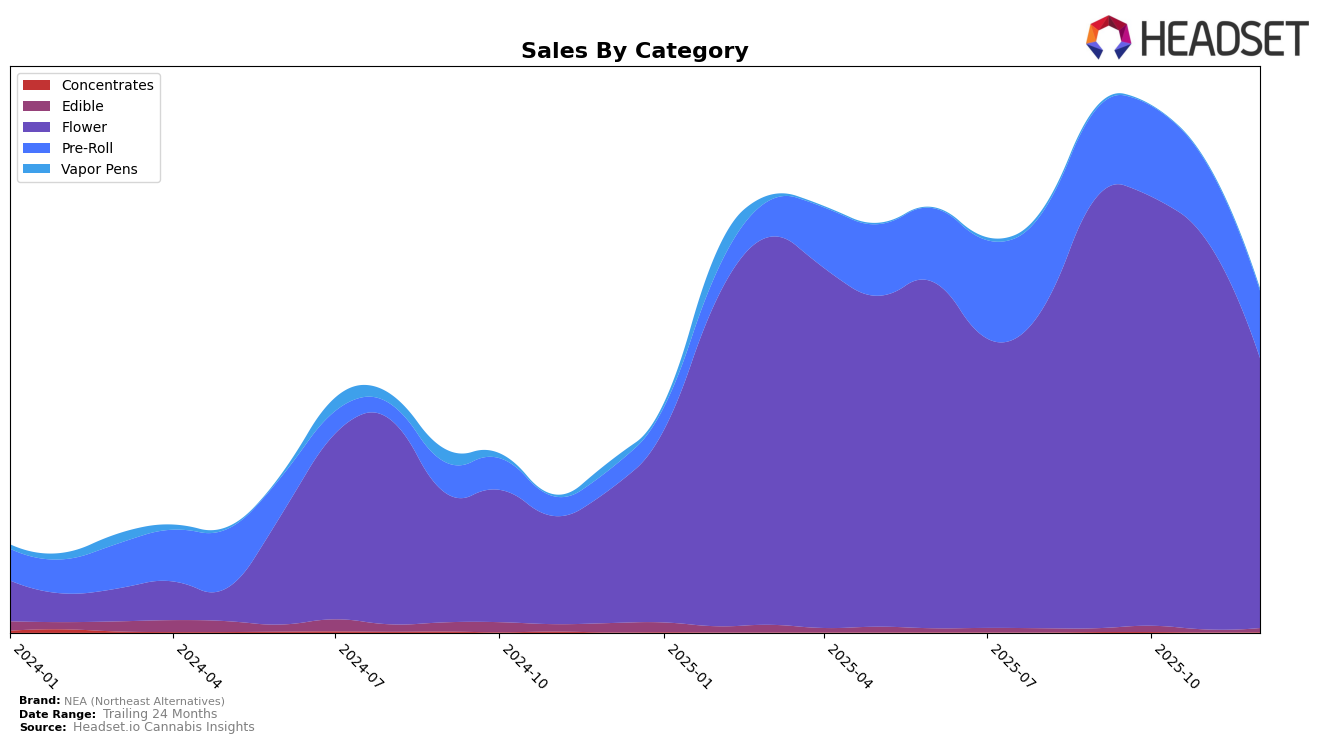

NEA (Northeast Alternatives) has shown varied performance across different categories in Massachusetts. In the Flower category, NEA experienced a steady decline in its ranking from 14th place in September 2025 to 26th by December 2025. This downward trend is mirrored by a decrease in sales over the same period, with December sales hitting a notable low. This movement may suggest a need for strategic adjustments in their Flower offerings to regain a stronger market position. Conversely, in the Pre-Roll category, NEA did not make it into the top 30 rankings for the months analyzed, indicating a potential area for growth or reevaluation of their market strategy.

Although NEA's presence in the Pre-Roll category in Massachusetts didn't rank within the top 30, the brand's sales figures suggest there is still a consumer base for their products. Despite not being a top contender, their sales figures in this category were relatively stable, albeit with a slight decline towards the end of the year. This pattern might indicate a loyal customer segment that could be leveraged with targeted marketing or product improvement strategies. The lack of top 30 rankings in Pre-Rolls, however, highlights an opportunity for NEA to innovate and potentially capture a larger share of the market.

Competitive Landscape

In the competitive Massachusetts flower market, NEA (Northeast Alternatives) has experienced a notable decline in its rankings over the last quarter of 2025, dropping from 14th place in September to 26th by December. This downward trend in rank is mirrored by a significant decrease in sales, suggesting a potential loss of market share. In contrast, competitors such as Nature's Heritage and Legends have shown upward momentum, with Nature's Heritage climbing from 35th to 24th and Legends making a substantial leap from 57th to 25th during the same period. Meanwhile, Garcia Hand Picked and Cheech & Chong's maintained relatively stable positions, indicating consistent performance. The shifting dynamics in this competitive landscape highlight the need for NEA to reassess its strategies to regain its standing and bolster sales in the Massachusetts flower category.

Notable Products

In December 2025, NEA (Northeast Alternatives) saw Mandarin Cookies (3.5g) top the sales chart in the Flower category, achieving the number one rank with sales of 1880 units. Hooch (3.5g) followed closely behind in second place, while White 99 (3.5g) secured the third spot. Notably, Banana Land Pre-Roll (1g) experienced a drop in ranking from second in November to fourth in December, with sales of 1295 units. Zweet Inzanity (3.5g) also appeared in the top five, declining from its previous third position in September to fifth in December. These shifts indicate a dynamic change in consumer preferences within the Flower and Pre-Roll categories over the months leading up to December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.