Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

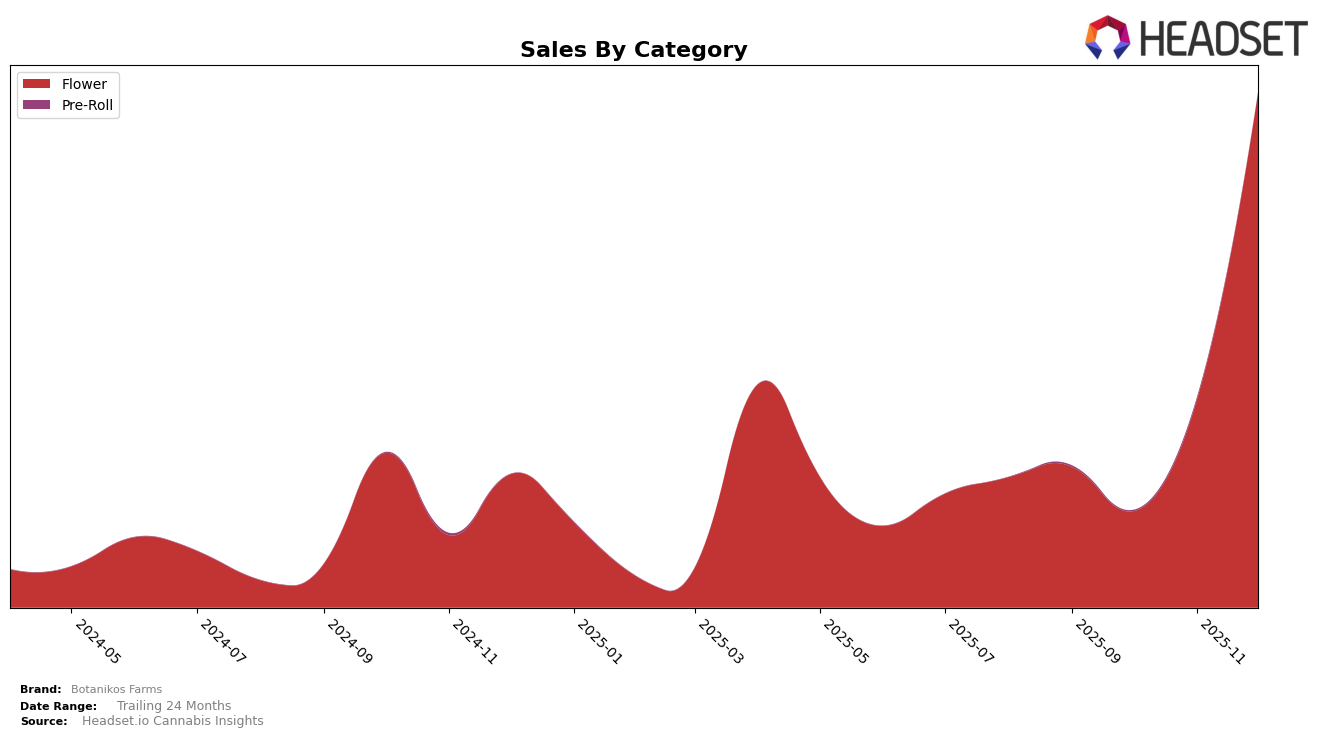

In the state of Oregon, Botanikos Farms has shown a notable improvement in its performance within the Flower category over the last few months of 2025. Starting from a rank of 77 in September, the brand's position improved significantly to 16 by December. This upward trajectory indicates a strong recovery and increasing consumer preference for their products in this category. Notably, the brand was not within the top 30 in September and October, which suggests that the latter months saw a strategic shift or market conditions that favored Botanikos Farms, allowing them to climb the ranks rapidly. The substantial increase in sales from October to December further supports this positive trend.

While Botanikos Farms has made impressive strides in Oregon, the absence of rankings in other states or provinces suggests that their influence might be limited to this region, or they have not yet broken into the top 30 in other markets. This could be seen as both a challenge and an opportunity for the brand, as expanding their footprint beyond Oregon could offer significant growth potential. The brand's success in Oregon might serve as a blueprint for similar strategies in other states, provided they can replicate the factors that contributed to their recent achievements. Understanding the dynamics that led to their success in Oregon could be crucial for Botanikos Farms as they consider broader market expansion.

Competitive Landscape

In the Oregon flower category, Botanikos Farms has experienced a remarkable upward trajectory in its market position from September to December 2025. Initially ranked 77th in September, Botanikos Farms surged to 16th place by December, showcasing a significant improvement in rank and indicating a strong growth in consumer demand. This positive shift is notable when compared to competitors like William's Wonder Farms, which saw a decline from 14th to 18th, and Emerald Fields Cannabis, which dropped from 9th to 14th. Meanwhile, Focus North improved its rank from 23rd to 15th, and Hecate Gardens made a significant leap from 31st to 17th. Despite these competitors' movements, Botanikos Farms' rise is particularly impressive given its initial lower rank, suggesting a successful strategy in capturing market share and increasing sales, which could be attributed to effective marketing, product quality, or distribution enhancements.

Notable Products

In December 2025, the top-performing product from Botanikos Farms was Grape Gummiez B-Buds (1g), which ranked first in sales with an impressive figure of 2418 units sold. Maui Lobster B-Buds (1g) followed as the second-best seller, marking its debut in the rankings. Randy Marsh (1g) secured the third position, demonstrating strong market entry. Maui Lobster 5 (1g), which previously held the top spot in November, dropped to fourth place. Space Jam (1g) rounded out the top five, slipping from its second-place ranking in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.