Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

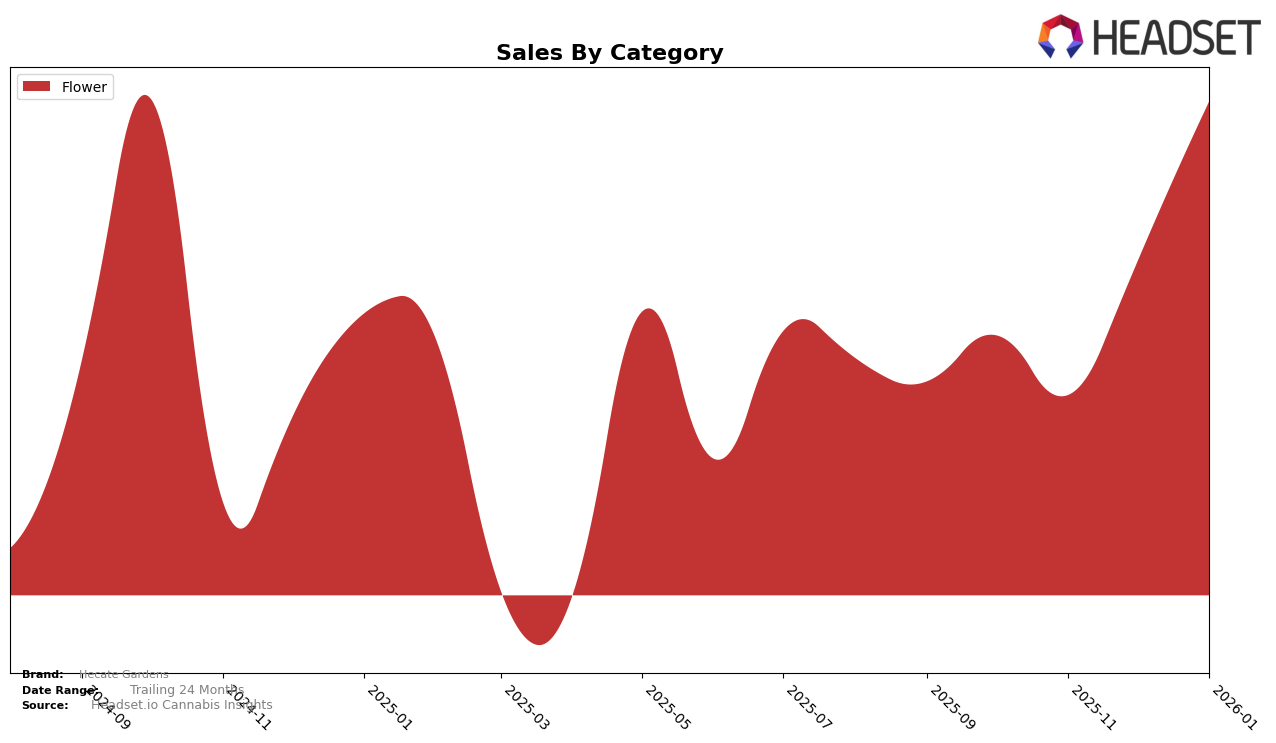

Hecate Gardens has demonstrated a noteworthy upward trajectory in the Oregon market within the Flower category. Beginning in October 2025, the brand was positioned at rank 38, but by January 2026, it had impressively climbed to rank 14. This significant movement indicates a growing consumer preference and possibly effective strategic changes within the company. Despite not being in the top 30 for October and November, the brand's jump to rank 28 in December suggests a turning point, further solidified by its continued ascent in January. The brand's sales figures reflect this positive trend, with a notable increase from November to January, hinting at successful market penetration strategies or product offerings that resonated well with consumers.

While Hecate Gardens' performance in Oregon is promising, it's important to consider how the brand might replicate this success in other states or provinces. The absence of rankings in the top 30 for October and November could have been a cause for concern, but the subsequent rise suggests resilience and adaptability. As the brand continues to grow, understanding the factors behind its success in Oregon could provide insights for expansion into new markets or categories. Observing how Hecate Gardens manages its product offerings and marketing strategies in the coming months will be crucial for stakeholders interested in the brand's long-term growth and sustainability.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Hecate Gardens has shown a notable upward trajectory in rankings, moving from 38th in October 2025 to an impressive 14th by January 2026. This positive trend suggests a significant improvement in market presence and consumer preference. In contrast, Eugreen Farms experienced fluctuations, peaking at 7th in November 2025 but dropping to 12th by January 2026. Meanwhile, Mother Magnolia Medicinals saw a remarkable climb from 67th to 15th over the same period, indicating a strong competitive push. Focus North consistently improved its position, reaching 13th by January 2026, while House Party showed a recovery from a dip in November to rank 16th in January. These dynamics highlight Hecate Gardens' strategic advancements in the market, as it outpaces several competitors in both rank and sales momentum.

Notable Products

In January 2026, Oregon Lime Diesel (1g) emerged as the top-performing product for Hecate Gardens, climbing to the number one rank with sales of 7401 units, a significant increase from its second-place position in October 2025. Golden Gunchest (Bulk) maintained a strong presence, holding steady in the second position after leading in December 2025. Marionberry Cobbler (1g) debuted impressively at the third rank, showing strong sales momentum. Sun Kissed Orange (1g) experienced a slight drop, moving from second in December 2025 to fourth in January 2026. Candy Kush (1g) entered the rankings in fifth place, indicating a new contender in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.