Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

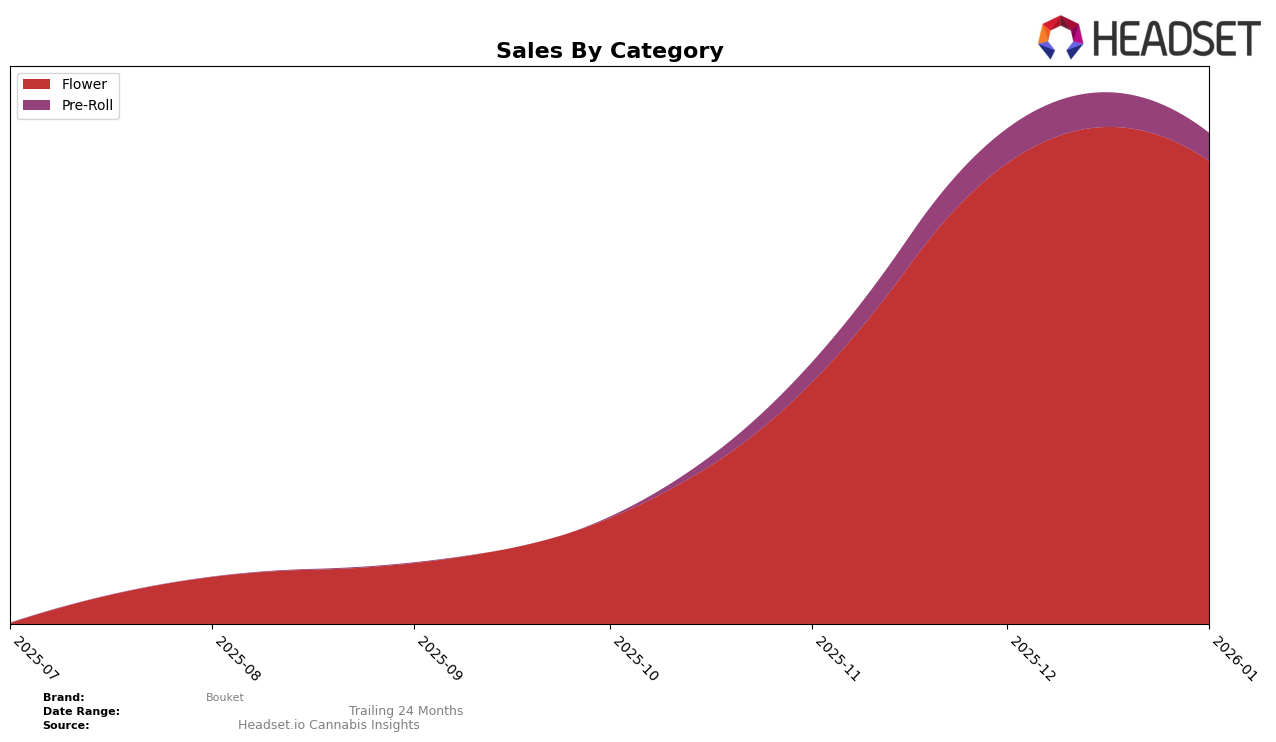

Bouket has shown notable progress in the New York cannabis market, particularly in the Flower category. Starting from October 2025, Bouket was ranked 81st, but by January 2026, it had climbed to the 25th position. This upward trajectory is indicative of a strong growth trend, with sales more than quadrupling from October to December 2025. The consistent improvement in rankings suggests that Bouket is gaining traction and possibly increasing its market share in New York's competitive Flower category.

However, Bouket's absence from the top 30 brands in certain months could be seen as a challenge in maintaining momentum. While they have made significant gains in New York, the data does not provide insights into their performance in other states or categories, where their presence might be less pronounced or entirely absent. This could indicate a need for Bouket to expand its reach or strengthen its presence in other markets to diversify its portfolio and reduce dependency on a single state or category.

```Competitive Landscape

In the competitive landscape of the New York Flower category, Bouket has demonstrated a remarkable upward trajectory in terms of rank and sales. Starting from a rank of 81 in October 2025, Bouket surged to 25 by January 2026, showcasing a significant improvement in market positioning. This ascent is noteworthy when compared to competitors such as 1937, which fluctuated between ranks 22 and 42, and Good Green, which maintained a relatively stable position around the mid-20s. Meanwhile, Knack and Left Coast experienced more volatility, with Knack peaking at rank 25 and Left Coast reaching as low as 38. Bouket's sales growth aligns with its improved rank, indicating a robust market acceptance and strategic positioning that outpaces several of its competitors, making it a brand to watch in the New York Flower market.

Notable Products

In January 2026, Paztelito (4g) maintained its position as the top-selling product for Bouket, achieving the highest sales figure of 1781 units. GMO Punch (4g) rose from fourth place in December 2025 to secure the second position, demonstrating a significant increase in sales from 912 to 1630 units. Honeymoon Diesel (4g) remained steady in third place, while Honeymoon Diesel Smalls (7g) entered the rankings for the first time at fourth. Blue Nerdz (4g) also made its debut in the rankings, coming in fifth. This shift in rankings highlights Paztelito's consistent popularity and the growing demand for GMO Punch.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.