Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Boutiq's performance in the Pre-Roll category has shown varied results across different states. In Arizona, the brand maintained a consistent presence in the top 30, albeit with some fluctuations. Starting at rank 24 in October 2025, Boutiq experienced slight downward movement, reaching rank 29 in December before improving to rank 26 in January 2026. This indicates a relatively stable market presence, though not without challenges. In contrast, the Pre-Roll category in California shows that Boutiq was not ranked in the top 30 until December 2025, where it entered at rank 79 and then slipped to rank 84 in January 2026. The absence from the top 30 in earlier months suggests a more competitive or challenging market environment in California for this category.

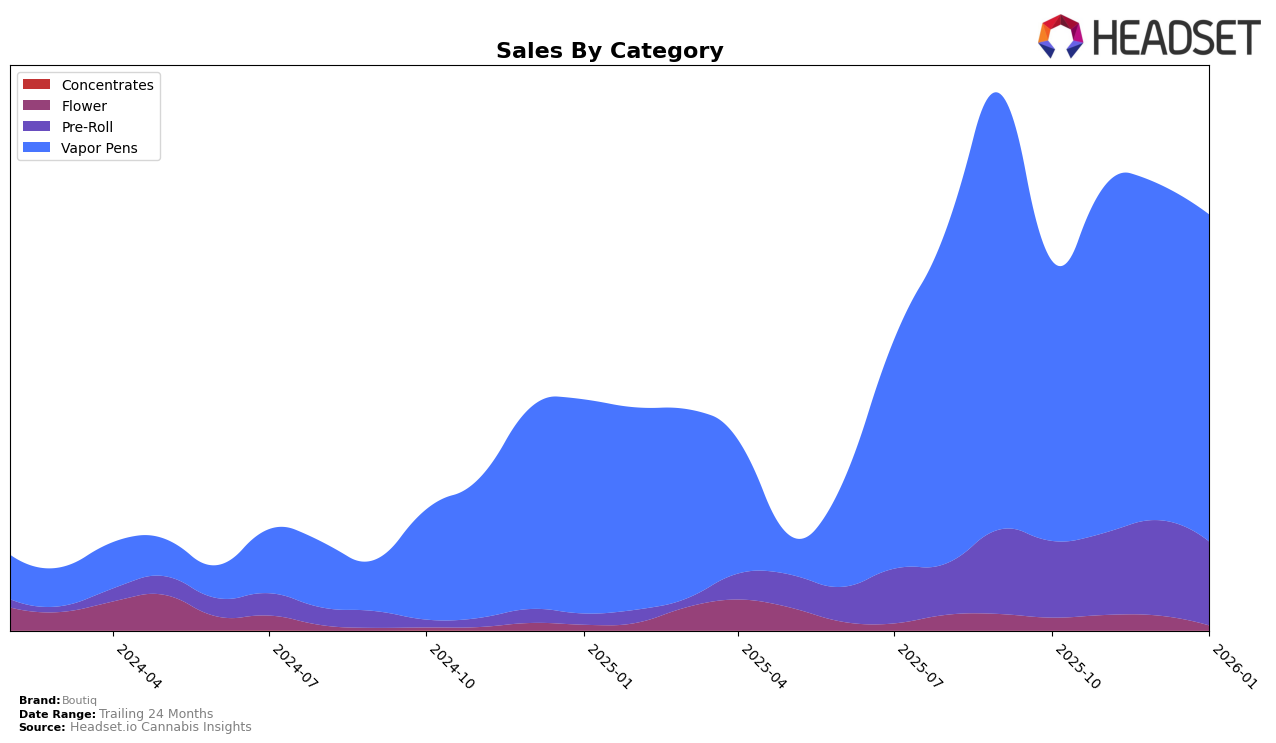

In the Vapor Pens category, Boutiq has demonstrated more consistent performance across several regions. In California, the brand improved its ranking from 59 in October 2025 to 45 by January 2026, indicating a positive trend and growing acceptance among consumers. Meanwhile, in New York, Boutiq maintained a steady presence, hovering around the mid-30s in ranking throughout the observed period, which suggests stability in consumer preference. In Ontario, however, the brand experienced a slight dip from rank 34 in December 2025 to rank 37 in January 2026, which could point to increased competition or shifting consumer tastes. Interestingly, in Massachusetts, Boutiq was only ranked in November 2025 at position 79, highlighting a potential challenge in gaining traction in this market.

Competitive Landscape

In the competitive landscape of vapor pens in California, Boutiq has demonstrated a notable upward trajectory in its rankings from October 2025 to January 2026. Initially ranked at 59th in October, Boutiq made significant strides, climbing to 45th by January. This upward movement suggests a positive reception in the market, likely driven by strategic initiatives or product offerings that resonated well with consumers. In contrast, brands like Kushy Punch and DomPen maintained relatively stable but lower rankings, with Kushy Punch moving from 50th to 47th and DomPen from 57th to 48th over the same period. Meanwhile, Timeless and Connected Cannabis Co. consistently outperformed Boutiq in terms of rank, holding positions in the low 40s, with Connected Cannabis Co. peaking at 39th in December. Despite this, Boutiq's sales figures reflect a robust growth pattern, particularly from October to November, where a substantial increase is evident, although it slightly tapered off by January. This indicates that while Boutiq is gaining ground, it still faces stiff competition from these established brands, necessitating continued innovation and marketing efforts to further enhance its market position.

Notable Products

In January 2026, the top-performing product for Boutiq was the Switch 95 - Sour Slush x Rainbow Belts Digital Diamonds Disposable (1g) in the Vapor Pens category, maintaining its position as the number one ranked product for four consecutive months despite a slight decrease in sales to 1857 units. The Switch 95 - Strawberry Jam x French Toast Digital Diamonds Disposable (1g) climbed back to the second position after a brief dip in December, with sales reaching 1159 units. The Switch 95 - Freshly Squeezed OJ x Red Delish Digital Diamonds Disposable 2-Pack (1g) improved its rank from fifth in December to third in January. Meanwhile, the Switch - Papaya x Mango Melon Liquid Live Diamonds Dual Tank Disposable (1g) debuted at the second spot with notable sales of 1159 units. Lastly, the Switch - Warhead x Blue Crack Liquid Live Diamonds Dual Tank Disposable (1g) dropped from second in December to fourth in January, reflecting a decrease in sales to 887 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.