Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

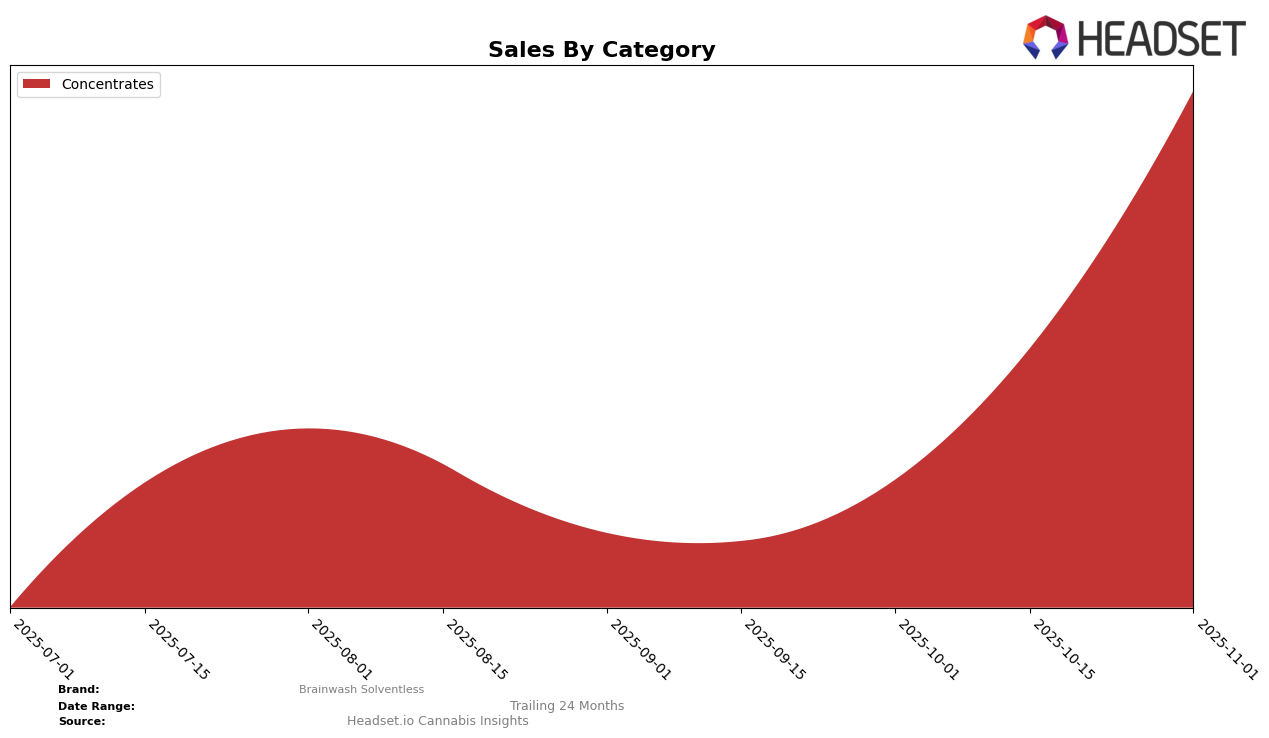

Brainwash Solventless has shown a significant upward trajectory in the Michigan concentrates market over the past few months. After struggling to break into the top 30 rankings in August through October 2025, the brand made a notable leap to the 30th position in November. This improvement suggests a strategic shift or a successful marketing push that has resonated well with consumers in the state. The brand's sales in November were particularly strong, indicating a growing consumer base and effective distribution strategies. However, the previous months' rankings outside the top 30 underscore the challenges Brainwash Solventless faced in gaining traction earlier in the year.

Despite the challenges in Michigan, Brainwash Solventless's breakthrough into the top 30 in November is a positive indicator of its potential in the concentrates category. The brand's ability to improve its ranking from 88th in October to 30th in November highlights a significant competitive gain. This upward movement could be attributed to increased brand awareness or changes in consumer preferences favoring solventless products. The lack of top 30 presence in the preceding months might have been a wake-up call for the brand to innovate or enhance its market strategies, which seems to have paid off by November. Further monitoring will be essential to determine if this trend continues or if it was a temporary spike.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Brainwash Solventless has demonstrated a remarkable turnaround in recent months. After struggling to maintain a presence in the top 20, with ranks of 73, 97, and 88 in August, September, and October 2025 respectively, Brainwash Solventless surged to a rank of 30 in November 2025. This significant improvement in rank is indicative of a strategic shift or successful marketing efforts that have resonated with consumers. In comparison, Peninsula Cannabis has shown a steady climb from rank 56 in August to 29 in November, while Shatter House Extracts also improved from 40 to 28 over the same period, suggesting a competitive market environment. Meanwhile, Rise (MI) and Mischief have experienced more volatility, with fluctuating ranks that reflect varying consumer preferences. Brainwash Solventless's leap in rank, coupled with a significant increase in sales from October to November, positions it as a brand to watch, potentially capturing market share from its competitors.

Notable Products

In November 2025, Papaya Rosin (2g) emerged as the top-performing product for Brainwash Solventless, with sales reaching 369 units. Strawguava Live Hash Rosin (1g) also secured the number one spot, sharing the rank with Papaya Rosin, marking a significant rise from its fourth position in October. Biscotti Pippen Live Rosin (2g), Black Maple Rosin (2g), and Double Baked Cake Rosin (2g) all tied for the second position, each demonstrating strong sales performance. Notably, these products did not have a ranking in the months leading up to November, indicating a fresh surge in popularity. The Concentrates category dominated the top ranks, showcasing a growing consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.