Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

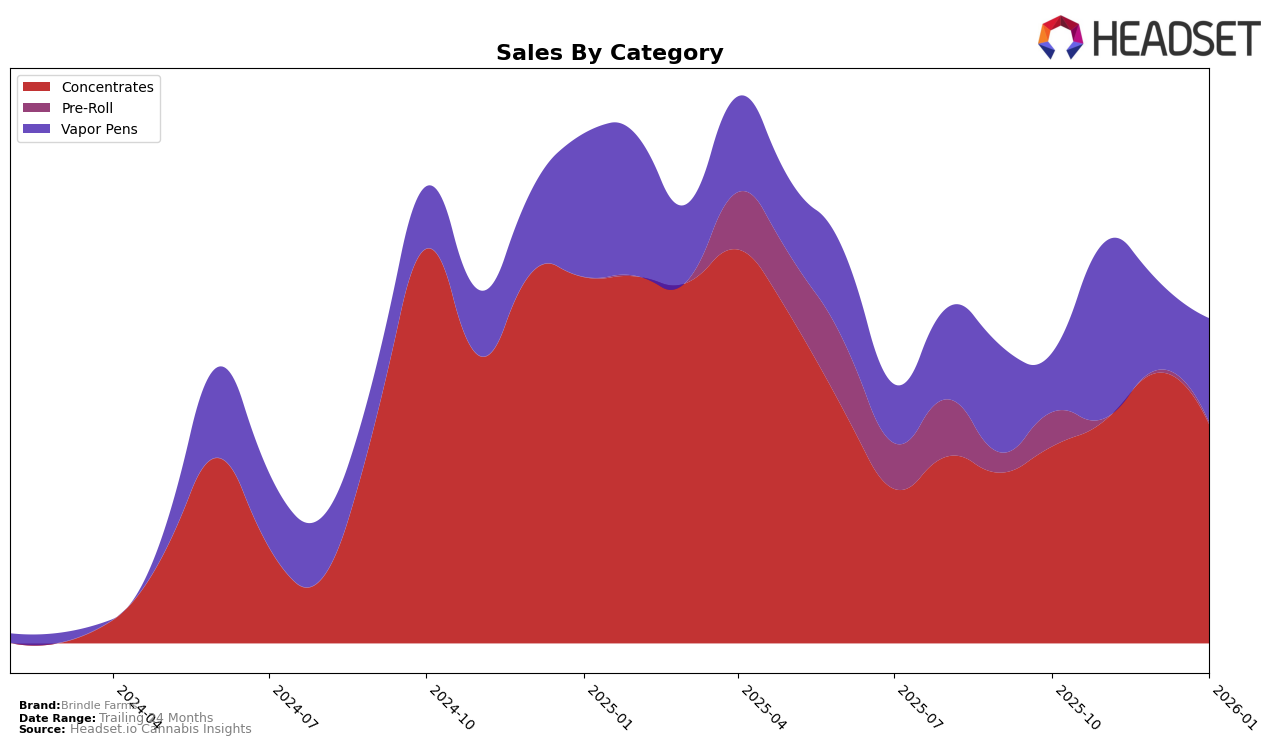

Brindle Farms has shown a noteworthy performance in the Concentrates category within British Columbia. The brand maintained a strong presence, starting with a first-place ranking in October 2025 and gradually moving to fifth place by January 2026. Despite this slight decline in rank, the sales figures indicate a significant upward trend, peaking in December 2025. This suggests that while competition may have increased, Brindle Farms has managed to sustain consumer interest and demand for its concentrates. In contrast, their presence in the Pre-Roll category was fleeting, with a ranking in October 2025 but absent from the top 30 in subsequent months, indicating a potential area for growth or a shift in strategy.

In the Vapor Pens category, Brindle Farms experienced fluctuating rankings in British Columbia. Starting at 45th place in October 2025, the brand improved to 31st in November before experiencing a slight dip in December and January. This movement suggests a volatile yet resilient market presence, as the brand managed to recover and improve its position toward the end of the period. The sales data supports this narrative, with a notable increase in November 2025, indicating a successful campaign or product launch that month. The absence of top 30 rankings in multiple categories highlights areas where Brindle Farms could focus on strengthening its market position.

Competitive Landscape

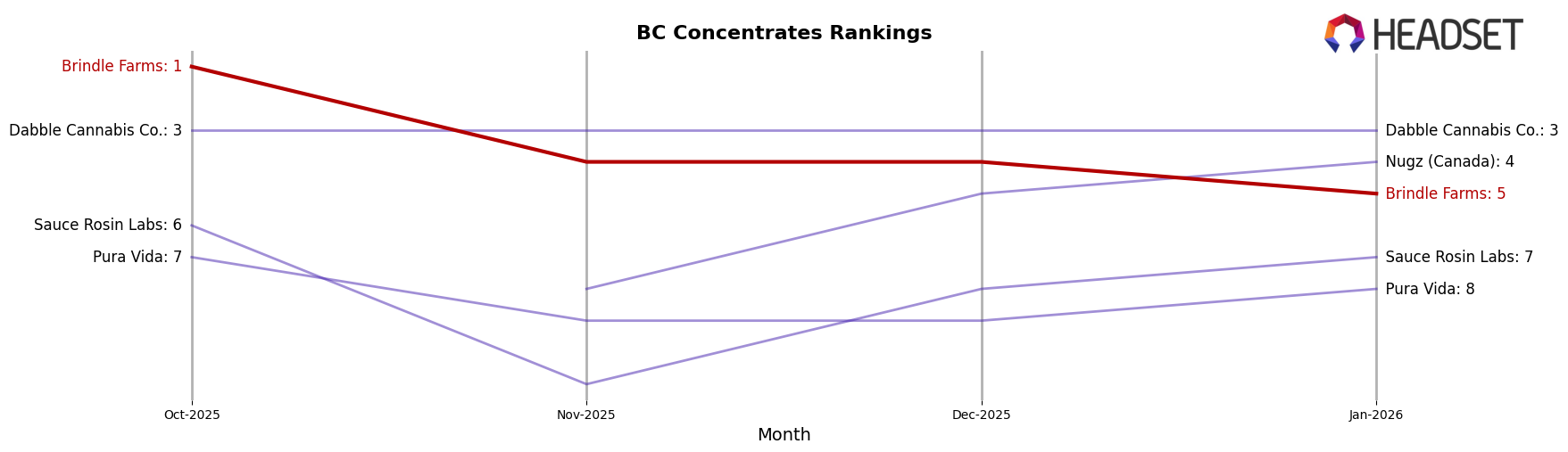

In the competitive landscape of concentrates in British Columbia, Brindle Farms has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially leading the category in October 2025, Brindle Farms saw a decline in rank, moving to 4th place by November and December, and further slipping to 5th in January 2026. This shift is particularly significant given the consistent performance of Dabble Cannabis Co., which maintained a steady 3rd place throughout the period. Meanwhile, Nugz (Canada) showed a strong upward trajectory, climbing from outside the top 20 to 8th in November and reaching 4th by December, eventually surpassing Brindle Farms to secure 4th place in January. The competitive pressure from these brands, alongside the fluctuating ranks of Pura Vida and Sauce Rosin Labs, underscores the dynamic nature of the concentrates market in British Columbia, highlighting the need for strategic adjustments by Brindle Farms to reclaim its leading position.

Notable Products

In January 2026, Brindle Farms' top-performing product was The Hive Live Rosin Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales of 440 units. Rainbow Guava Live Rosin (1g) secured the second position in the Concentrates category, making a notable debut in the rankings. The Hive Live Rosin (1g) dropped to third place in the Concentrates category, despite previously holding the top spot in December 2025. Rainbow Guava Percy Rosin (1g) entered the rankings at fourth place, also in the Concentrates category. Sour Animal Pure Live Rosin Cartridge (1g) maintained its position at fifth place in the Vapor Pens category, consistent with its previous appearance in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.