Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

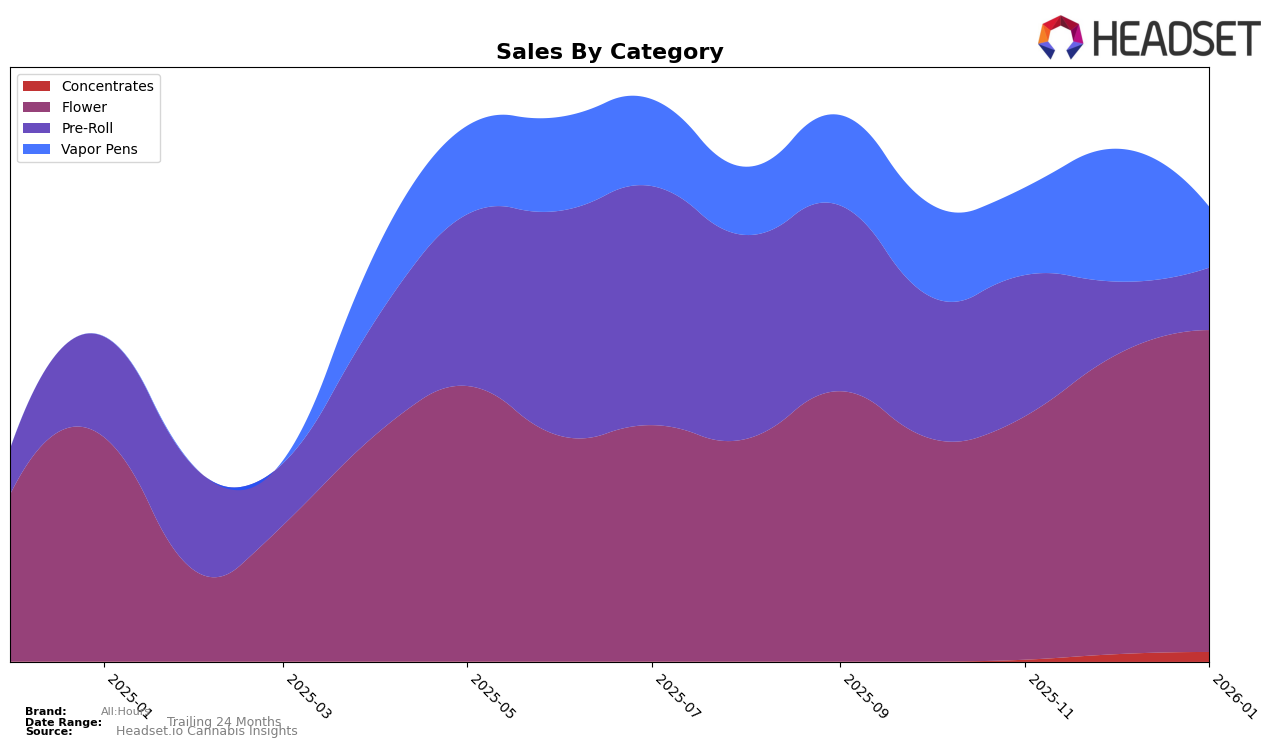

All:Hours has shown a varied performance across different cannabis product categories in Connecticut. In the Flower category, the brand has maintained a strong presence, consistently ranking within the top 10 from October 2025 to January 2026, with a notable improvement from 9th to 7th place. This upward movement aligns with a steady increase in sales, indicating a growing consumer preference for their Flower products. Conversely, the Pre-Roll category has seen a decline in rankings, dropping from 5th place in November 2025 to 12th by January 2026, reflecting a significant decrease in sales over the same period. This contrast suggests that while their Flower products are gaining traction, Pre-Rolls might require strategic adjustments to regain market position.

In the Vapor Pens category, All:Hours experienced fluctuations, starting at 11th place in October 2025, briefly improving in December, but then dropping to 16th in January 2026. This volatility might indicate inconsistent consumer interest or competitive pressures within the market. Interestingly, in the Concentrates category, All:Hours made a significant breakthrough in January 2026, securing the 5th position, despite not being ranked in the top 30 in the previous months. This sudden rise could be attributed to a strategic push or a new product launch that resonated well with consumers. The brand's performance across these categories suggests a dynamic presence in Connecticut, with specific areas of strength and others that might benefit from targeted marketing efforts or product innovation.

Competitive Landscape

In the competitive landscape of the Flower category in Connecticut, All:Hours has shown a promising upward trajectory in terms of rank and sales. From October 2025 to January 2026, All:Hours improved its rank from 9th to 7th, indicating a positive reception in the market. This advancement is notable when compared to other brands such as Affinity Grow, which experienced a decline from 4th to 8th place, and Theraplant, which maintained a strong position but showed slight fluctuations. Meanwhile, Comffy improved its rank from 8th to 6th, surpassing All:Hours by a narrow margin, while Awssom made significant strides from 17th to 9th place. Despite these shifts, All:Hours' consistent sales growth, culminating in a notable increase from November to January, underscores its strengthening presence and competitive edge in the Connecticut Flower market.

Notable Products

In January 2026, the top-performing product from All:Hours was the Trop Cherry Honey Bananas Rosin Infused Shorties Pre-Roll 4-Pack, which secured the number one rank with sales of 2247 units. The part:timers - Trop Cherry Honey Bananas Smalls maintained its second position from December 2025, with a slight decrease in sales to 1679 units. Over:Timers - Mule Fuel climbed back to the third spot, mirroring its position from November 2025, achieving sales of 1482 units. Part:Timers - Mule Fuel Smalls dropped from third to fourth place in January, reflecting a notable decline in sales to 931 units. Rounding out the top five was Air Hdz Hash Infused, which entered the rankings for the first time, capturing the fifth position with sales of 925 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.