Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

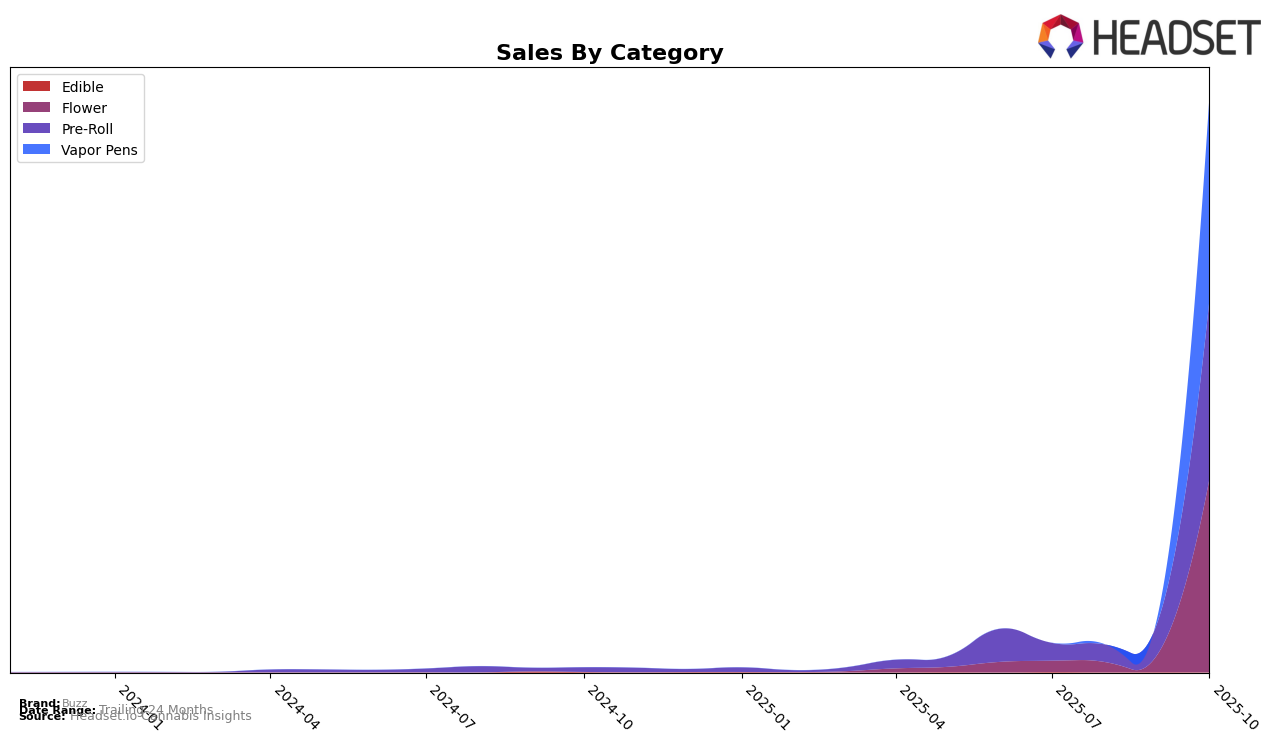

In the province of British Columbia, Buzz has demonstrated remarkable growth across several categories. Notably, in the Flower category, Buzz made a significant leap from not being in the top 30 in July to securing the 16th position by October 2025. This upward trend is indicative of their strengthening market presence and possibly an effective strategy in product offerings or distribution. The Pre-Roll category also saw Buzz climb from the 100th position in August to a commendable 21st position in October, showcasing a strong recovery and growing consumer preference. Such movements highlight Buzz's ability to capture market share rapidly, although the absence from the top 30 in July suggests there was considerable ground to cover initially.

Buzz's performance in the Vapor Pens category in British Columbia is particularly noteworthy. The brand was not ranked in the top 30 in July and August but surged to the 7th position by October. This dramatic improvement suggests a successful entry or rebranding strategy that resonated well with consumers. The significant sales increase in this category, reaching over 450,000 units by October, underscores the effectiveness of Buzz's approach. While these gains are impressive, the initial lack of presence in the rankings indicates that Buzz had to overcome challenges to establish its foothold, which it seems to have done quite effectively in recent months.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Buzz has made a significant leap in its market presence. After not ranking in the top 20 for July and August 2025, Buzz surged to the 7th position by October 2025, indicating a substantial increase in sales and brand recognition. This upward trajectory contrasts with brands like Spinach, which saw a decline from 3rd to 5th place, and DEBUNK, which dropped from 4th to 8th. Meanwhile, Wildcard Extracts experienced a notable rise from 18th to 6th place, showcasing a competitive environment where Buzz's rapid ascent highlights its potential to capture more market share. The dynamic shifts in rankings suggest that Buzz's strategic initiatives are resonating well with consumers, positioning it as a formidable contender in the vapor pen category.

Notable Products

In October 2025, Dutch Folds Pre-Roll 3-Pack (1.5g) emerged as the top-performing product for Buzz, climbing from fourth place in September to first place with sales reaching 7,747 units. Berry Pop Distillate Cartridge (1g) made a significant entrance into the rankings, securing the second position. Tutti Pop Distillate Cartridge (1g) followed closely, debuting at third place. Mac OG Pre-Roll (1g) entered the rankings at fourth place, while Cones Pre-Roll (1g), which was previously the top product in July, dropped to fifth place in October. This shift highlights the growing popularity of vapor pens within the Buzz product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.