Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

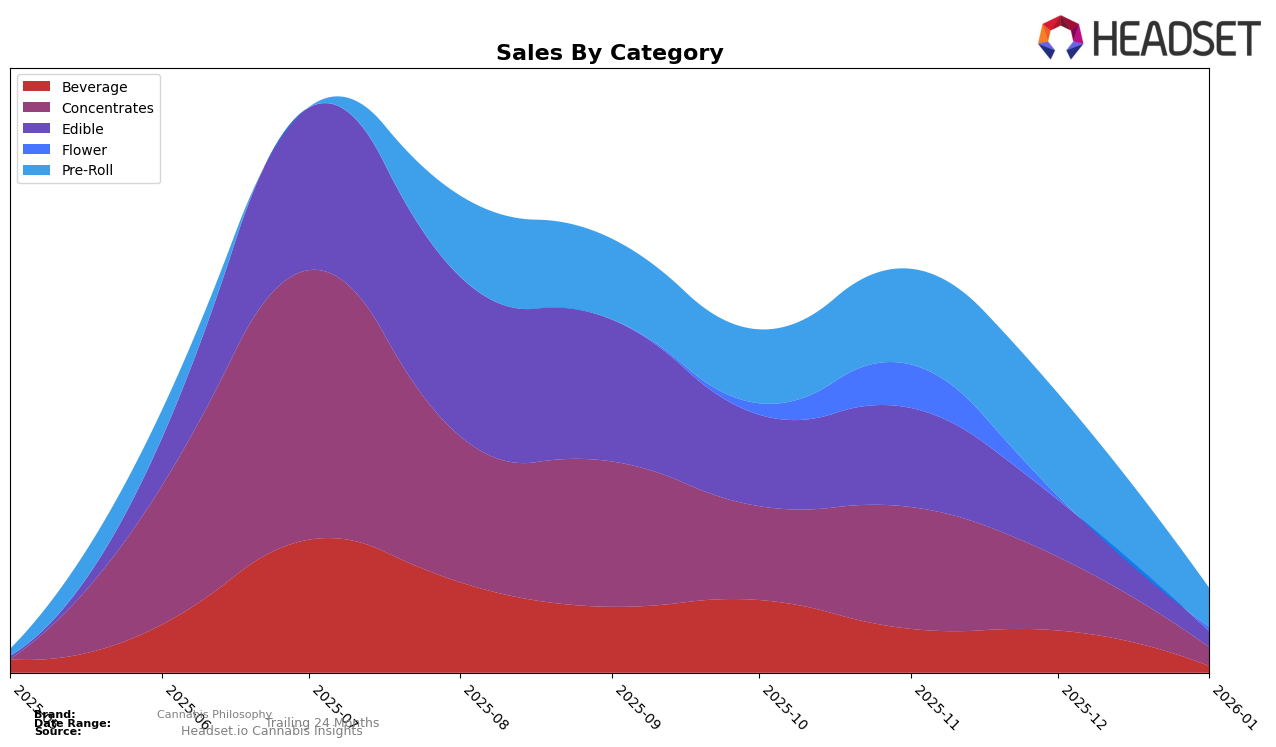

In the state of New Jersey, Cannabis Philosophy has shown variable performance across different product categories. In the Concentrates category, the brand was ranked 34th in both October and November of 2025, but it failed to maintain a position in the top 30 in subsequent months. This drop out of the top rankings could indicate increased competition or a shift in consumer preferences. Meanwhile, the Edible category saw a slight upward movement from 60th to 58th place from October to November, suggesting a modest improvement in market presence, although still not breaking into the top 30. These rankings highlight areas where the brand could focus its efforts to improve visibility and sales performance.

For Pre-Rolls, Cannabis Philosophy entered the top 100 in New Jersey in November 2025, debuting at 89th place and slightly dropping to 92nd place by December. While this category shows the brand's entry into a competitive space, maintaining and improving its position will be crucial for sustained growth. Despite not making it into the top 30, the incremental sales increase from November to December suggests a growing consumer interest. The data implies that while Cannabis Philosophy is making strides in some categories, there is room for strategic improvements to enhance its market standing across the board.

Competitive Landscape

In the New Jersey concentrates market, Cannabis Philosophy has faced significant challenges in maintaining its competitive position. Over the last quarter of 2025, Cannabis Philosophy consistently ranked 34th, indicating a struggle to break into the top 30. In contrast, Lobo and North Lake Supply have shown more dynamic movement, with Lobo improving its rank from 29th to 27th by December 2025, and North Lake Supply making a notable leap from 33rd to 23rd in the same period. This upward trajectory for competitors suggests they are capturing more market share, potentially at the expense of Cannabis Philosophy, whose absence from the rankings in December 2025 and January 2026 highlights a critical need for strategic adjustments to regain visibility and sales momentum in this competitive landscape.

Notable Products

In January 2026, the Brownie Bites 10-Pack (100mg) from the Edible category emerged as the top-performing product for Cannabis Philosophy, climbing from second place in December 2025 to first place with notable sales of 59 units. The Sour Diesel Infused Pre-Roll 10-Pack (3.5g) made a strong entry, securing the second position in its debut month. The Road Trip Infused Pre-Roll 10-Pack (3.5g) followed closely in third place, showing a promising start. Secret Meeting Hash Cube (1g) and Secret Meetings Hashish Cube (1g) both held the third rank, though they experienced a drop from their previous higher positions in earlier months. Overall, January marked significant reshuffling in product rankings for Cannabis Philosophy, with new entries making a notable impact.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.