Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

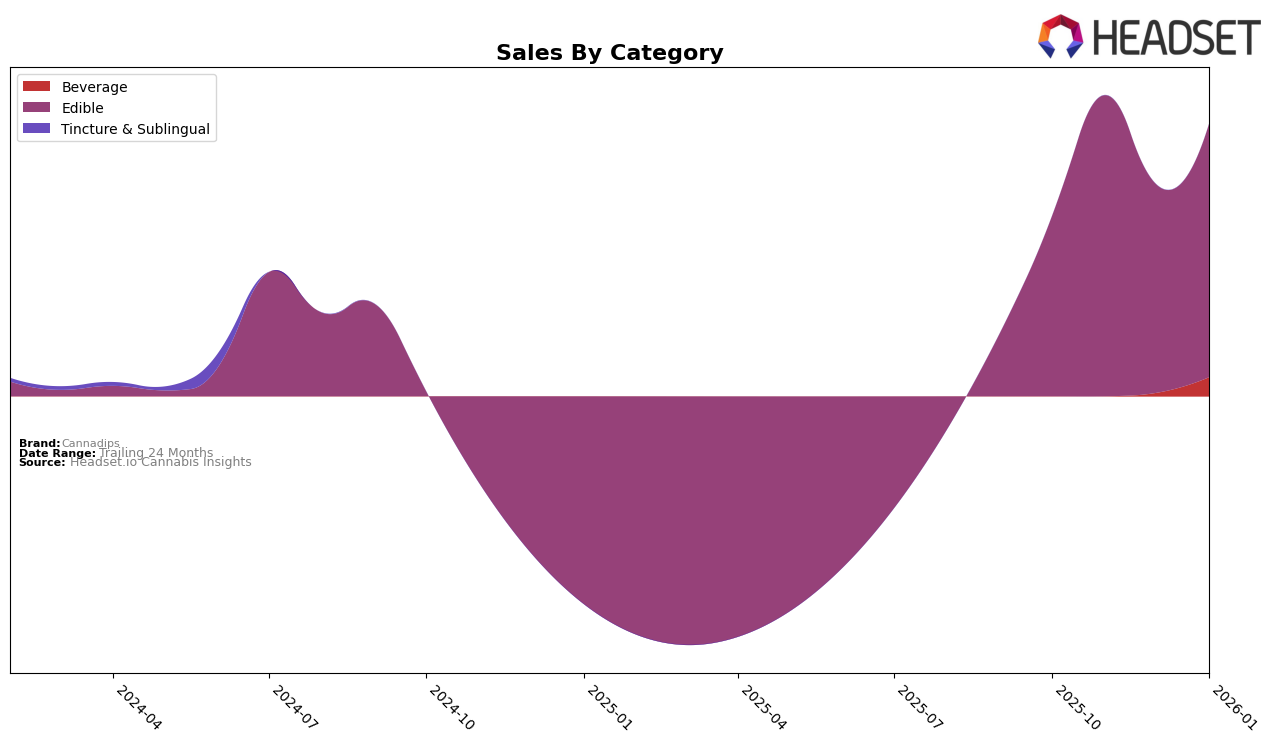

In the state of Missouri, Cannadips has experienced some challenges in the Edible category. Notably, the brand did not rank in the top 30 in October 2025, with a position of 61 in November 2025, and subsequently fell off the rankings again in December 2025 and January 2026. This movement suggests a struggle to maintain a competitive edge in Missouri's market, where consumer preferences may be shifting or competition is intensifying. Such fluctuations indicate areas where Cannadips might need to focus their efforts to regain market presence.

The absence of Cannadips from the top rankings in multiple months highlights potential areas for strategic improvement. While specific sales figures for December 2025 and January 2026 are not provided, the directional movement in rankings suggests a downward trend that could be concerning for stakeholders. It is essential to consider how these movements compare with other states or provinces where Cannadips operates, as performance can vary widely based on local market dynamics. Understanding and addressing these differences can be crucial for the brand's overall growth and success.

Competitive Landscape

In the Missouri edible cannabis market, Cannadips has experienced fluctuating rankings, notably missing from the top 20 in both October 2025 and January 2026. This absence highlights a competitive pressure from brands like Vlasic Labs and Bubby's Baked, which also didn't rank in January 2026, indicating a potential market shift or seasonal demand changes. Meanwhile, Spinello Cannabis Co. and CORE Cannabis have maintained more consistent rankings, with Spinello Cannabis Co. showing a strong upward sales trend, peaking in December 2025. CORE Cannabis, despite a slight decline in sales, remains a formidable competitor with a stable ranking. These dynamics suggest that Cannadips may need to strategize on enhancing its market presence and sales to compete effectively against these consistently performing brands.

Notable Products

In January 2026, Blue Razz Pouch 15-Pack (375mg) maintained its position as the top-performing product for Cannadips, with sales reaching 106 units. Mint Pouch 15-Pack (375mg) climbed to the second spot from its third position in December 2025, showcasing a consistent rise in popularity. Watermelon Pouches 15-Pack (375mg) experienced a drop to third place after leading in November 2025, indicating a shift in consumer preference. Peach Pouches 15-Pack (375mg) held steady at fourth place, showing little change in its ranking over the past months. Notably, Rest CBN Orange Creamsicle Pouches 15-Pack (375mg CBN) entered the rankings in December 2025 and maintained its fifth position into January 2026, suggesting a growing interest in this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.