Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

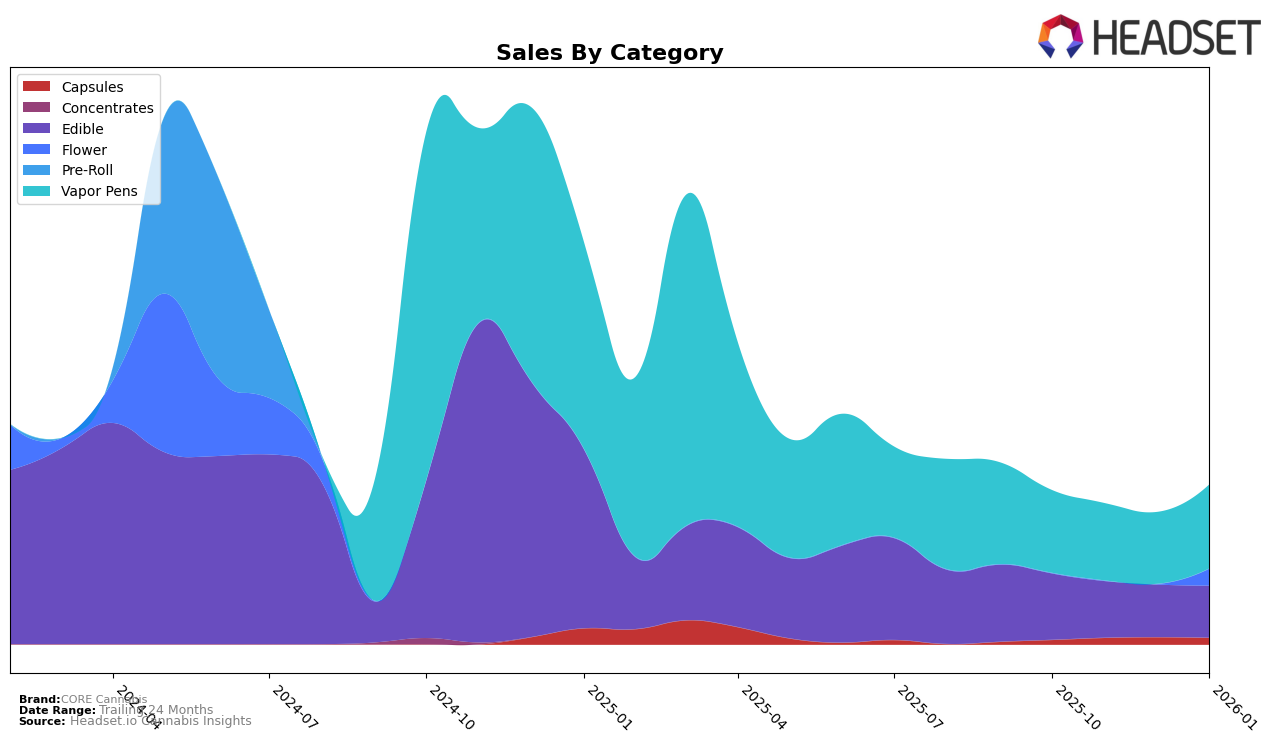

In the state of Missouri, CORE Cannabis has shown varied performance across different product categories. In the Edible category, the brand has consistently ranked outside the top 30, with rankings hovering around the 50th position from October 2025 to January 2026. Despite this, there is a slight improvement in their ranking from 50th in December 2025 to 49th in January 2026, although sales figures have seen a downward trend over the months. This suggests that while there may be a marginal increase in their market presence, overall consumer demand for their edibles remains a challenge.

Conversely, in the Vapor Pens category, CORE Cannabis has demonstrated a more positive trajectory. Although still ranked outside the top 30, their position improved from 73rd in December 2025 to 68th in January 2026. This improvement is supported by an increase in sales from December to January, indicating a growing interest in their vapor pen offerings. The brand's ability to climb the rankings in this category, despite not breaking into the top 30, suggests potential for future growth if they continue to capitalize on consumer preferences and enhance their product offerings in this segment.

Competitive Landscape

In the competitive landscape of Vapor Pens in Missouri, CORE Cannabis has shown a steady presence, although it remains outside the top 20 brands. Over the observed months, CORE Cannabis has experienced a slight improvement in rank, moving from 72nd in October 2025 to 68th in January 2026. This upward trend, albeit modest, suggests a potential for growth amidst a competitive market. Brands like Flower by Edie Parker and Fuzed have demonstrated higher sales figures, with Fuzed notably maintaining a stronger position despite a significant drop from 42nd to 72nd rank by January 2026. Meanwhile, Covert Extraction and goodnight have consistently ranked lower than CORE Cannabis, indicating that CORE Cannabis is positioned competitively within its tier. The data suggests that while CORE Cannabis is not yet among the top players, its consistent sales and slight rank improvement could be leveraged to capture more market share in the future.

Notable Products

In January 2026, the top-performing product for CORE Cannabis was Chill - CBD/THC 1:1 Blueberry Gummies 20-Pack, which maintained its December 2025 rank at number one with sales of 530 units. Sleep - Grape Gummies 20-Pack held its position at second place, although its sales decreased from the previous month. Active - Peach Mango Chews 20-Pack retained the third position, continuing its decline in sales since October 2025. New to the rankings, Peanut Butter Breath (3.5g) entered at fourth place, marking its debut on the list. Green Apple Down Distillate Disposable (0.5g) dropped to fifth place, showing a slight increase in sales compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.