Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

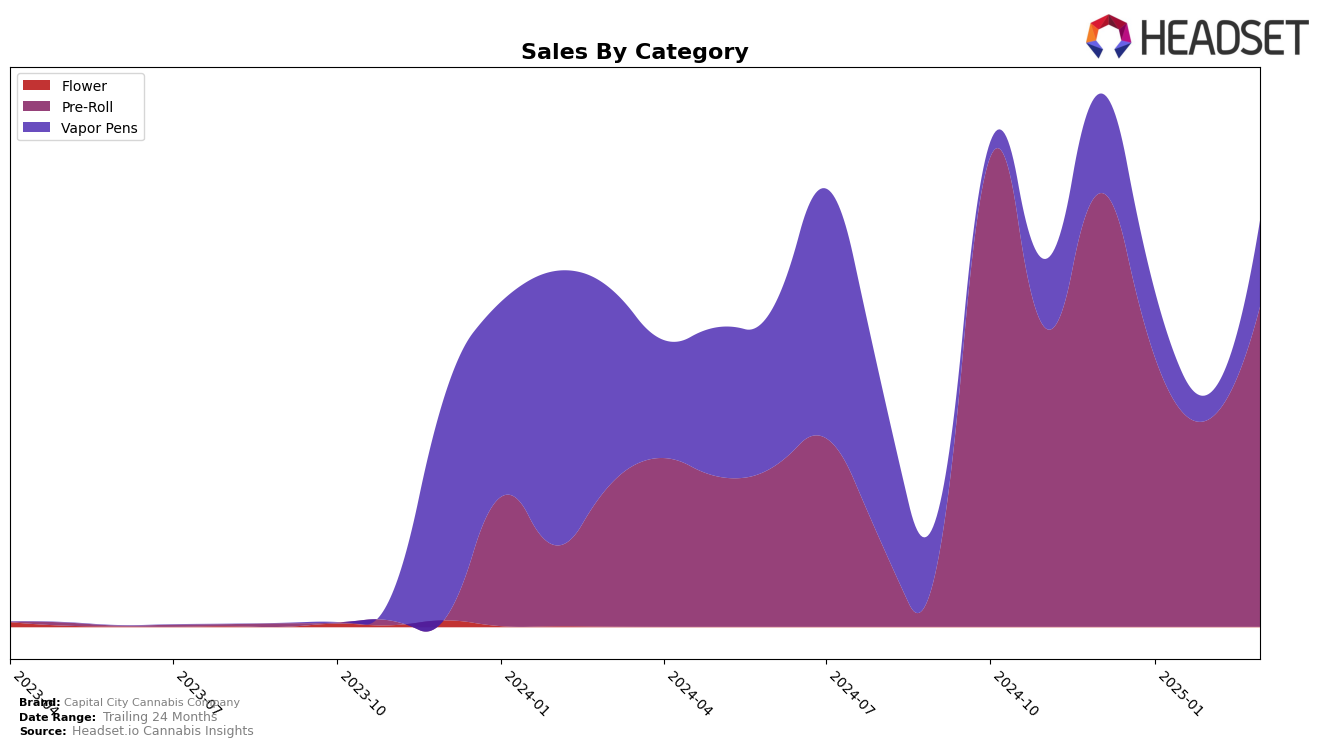

Capital City Cannabis Company has shown a dynamic performance across different categories in Missouri. In the Pre-Roll category, the brand maintained a presence in the top 30 throughout the first quarter of 2025. Notably, there was a dip in February, where they ranked 27th, but they quickly rebounded to 22nd in March. This fluctuation might be indicative of a strategic adjustment or market response that paid off. The sales figures reflect this volatility, with March sales significantly higher than those in February, suggesting a recovery or successful promotional efforts. In contrast, their performance in the Vapor Pens category did not see them break into the top 30, highlighting a potential area for growth or increased competition in that segment.

Despite not making it into the top 30 for Vapor Pens in Missouri, the brand's sales data indicates a noteworthy uptick from February to March. This suggests a positive trend, even if the category ranking does not yet reflect it. The data reveals a significant increase in sales from February to March, which could point to a successful marketing campaign or a shift in consumer preferences. This performance might encourage the brand to focus on strengthening its presence in the Vapor Pens category to improve its ranking. Observing these movements, it is clear that while Capital City Cannabis Company has its strengths, there are also opportunities for growth and expansion in certain areas.

Competitive Landscape

In the competitive landscape of the Missouri Pre-Roll category, Capital City Cannabis Company experienced notable fluctuations in rank and sales over the first quarter of 2025. Starting at 18th place in December 2024, the brand dropped out of the top 20 in January and February, before climbing back to 22nd in March. This volatility contrasts with competitors like TWAX, which consistently maintained a higher rank, peaking at 19th in February and showing a steady increase in sales. Meanwhile, Safe Bet and Robust also demonstrated upward trends, with Safe Bet reaching 20th in February and Robust climbing to 21st the same month. Notably, Pocket J's made a significant leap from 42nd in December to 21st in March, indicating a strong upward trajectory. These dynamics suggest that while Capital City Cannabis Company faces challenges in maintaining a stable position, there is potential for recovery and growth in a competitive market.

Notable Products

In March 2025, Strawberry Cough Infused Pre-Roll 5-Pack (3.5g) reclaimed its top position as the leading product for Capital City Cannabis Company, with sales reaching 726 units. Following closely, Grape Ape Infused Pre-Roll 5-Pack (3.5g) secured the second position, showing a significant rise from its previous absence in February. Wedding Cake Infused Pre-Roll 5-Pack (3.5g) took the third spot, maintaining a strong presence despite a drop from its earlier second position in January. Blue Dream Infused Pre-Roll (1.5g) ranked fourth, slightly declining from its third position in February. Watermelon Kush Infused Pre-Roll (1.5g) entered the top five for the first time, marking a notable debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.