Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

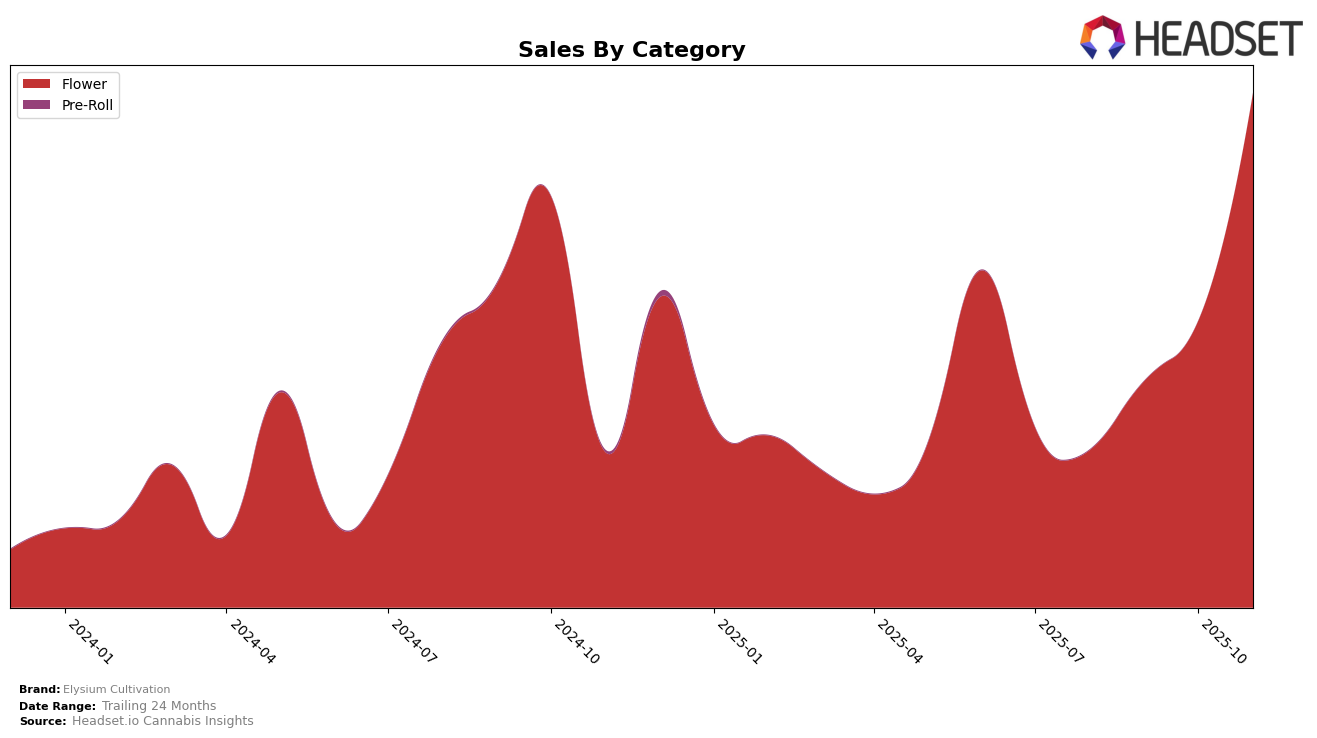

Elysium Cultivation has shown significant progress in the Michigan market, particularly in the Flower category. Over the months from August to November 2025, the brand has ascended from a rank of 97 to 23, indicating a strong upward trajectory. This improvement is reflected in their sales figures, which nearly tripled from August to November. The brand's ability to climb into the top 30 by November suggests a successful strategy in product offerings or market penetration, which could be a point of interest for stakeholders analyzing competitive movements in the cannabis industry. Such a leap in ranking within a few months is noteworthy and positions Elysium Cultivation as a brand to watch in the Michigan market.

While Elysium Cultivation's performance in Michigan is impressive, it is important to note that the brand does not appear in the top 30 rankings for other states and categories during this period. This absence could be interpreted as an area for potential growth or a strategic decision to focus efforts within Michigan. The lack of presence in other markets might suggest opportunities for expansion or indicate challenges that the brand faces outside its primary market. Observers and potential investors might consider these dynamics when evaluating the brand's overall market strategy and future potential.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Elysium Cultivation has shown remarkable progress in recent months. Starting from a rank of 97 in August 2025, Elysium Cultivation climbed to an impressive 23 by November 2025, indicating a significant upward trajectory in market presence and consumer preference. This rise in rank is particularly noteworthy when compared to competitors like High Supply / Supply, which saw fluctuations, ending at rank 22 in November after a brief ascent to 16 in October. Similarly, Muha Meds experienced a more volatile ranking, finishing at 21 in November. Meanwhile, Carbon and Pure Options both saw a decline in their rankings, ending at 25 and 24, respectively. This competitive shift suggests that Elysium Cultivation's strategic initiatives are resonating well with consumers, potentially leading to increased sales and market share in the near future.

Notable Products

In November 2025, Gastropop (7g) emerged as the top-performing product for Elysium Cultivation, achieving the number one rank with notable sales of 2945 units. Pineapple Tart (14g) followed closely behind in second place, showing strong performance in the Flower category. LA Pop Rocks (3.5g) ranked third, experiencing a slight drop from its consistent second position in September and October. Thin Mint x Jealousy (3.5g) climbed to fourth place after not being ranked in the previous months, indicating a significant rise in popularity. Sherb Cream Pie (Bulk) completed the top five, marking its debut in the rankings for the specified month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.