Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

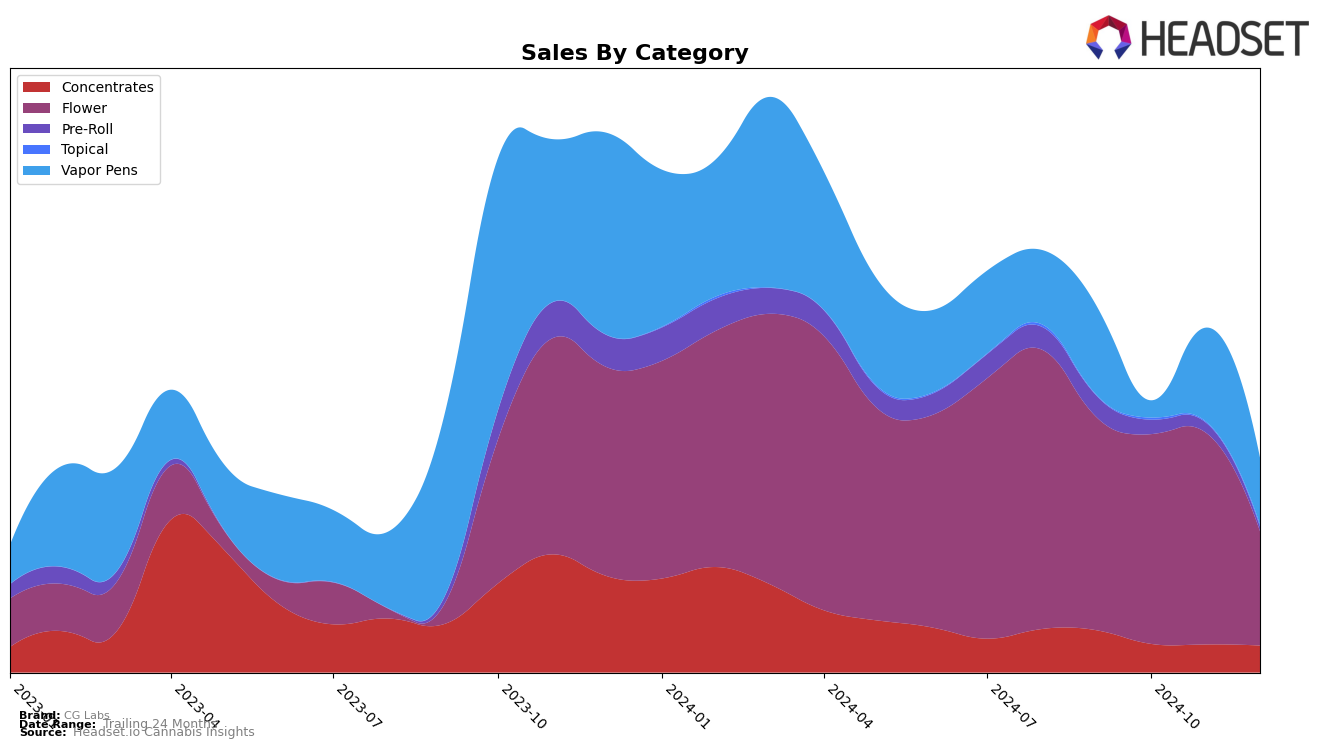

In examining the performance of CG Labs across different cannabis categories within Colorado, there are notable shifts to consider. In the Concentrates category, CG Labs has shown a fluctuating presence, moving from a rank of 54 in September to 51 in December. Despite a downward trend in sales, this slight improvement in ranking suggests a competitive edge over other brands that may have experienced more significant declines. In contrast, the Flower category witnessed a notable drop from rank 44 in November to 60 in December, indicating a potential challenge in maintaining market share. The absence from the top 30 in the Pre-Roll category after September highlights an area where CG Labs may need to strategize for better visibility and market penetration.

Turning to the Vapor Pens category, CG Labs experienced a mixed performance in Colorado. After disappearing from the rankings in October, the brand re-emerged at rank 66 in November and slightly declined to 67 in December. This suggests a modest recovery but also points to the volatility and competitive nature of the Vapor Pens market. The sales figures corroborate this, showing a decrease from September to December, though the brand managed to maintain a presence in the rankings. These dynamics indicate that while CG Labs has areas of strength, particularly in maintaining a presence in certain categories, there are also significant challenges that could impact their overall market strategy moving forward.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, CG Labs experienced notable shifts in its ranking and sales performance from September to December 2024. While CG Labs maintained a stable position at rank 49 in September and October, it saw an improvement to rank 44 in November before dropping to rank 60 in December. This decline in December coincided with a significant decrease in sales, suggesting potential challenges in market positioning or seasonal demand fluctuations. In contrast, Rare Dankness showed a remarkable upward trend, moving from rank 74 in September to rank 52 in December, with a corresponding increase in sales. Similarly, NOBO improved its rank from 66 in September to 57 in December, despite missing data for October, indicating a strong recovery. Meanwhile, Green Treets entered the top 20 in November at rank 86 and improved to rank 79 in December, showcasing a positive trajectory. These movements highlight the dynamic nature of the market, where competitors are gaining ground, potentially impacting CG Labs' market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In December 2024, the top-performing product from CG Labs was NY Mayhem Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with a notable sales figure of 1315 units. Banger Rang Live Resin Cartridge (1g) also showed strong performance, climbing from fourth place in November to second place in December with improved sales. Ice Cream Cake Distillate Cartridge (1g) experienced a drop from first place in November to third place in December, indicating a decrease in sales momentum. Sprinklez Pre-Roll (1g) maintained a consistent position, ranking fourth in December after being third in November. Mandarin Sunset Distillate Cartridge (1g) entered the rankings in December, achieving fifth place, suggesting a new interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.