Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

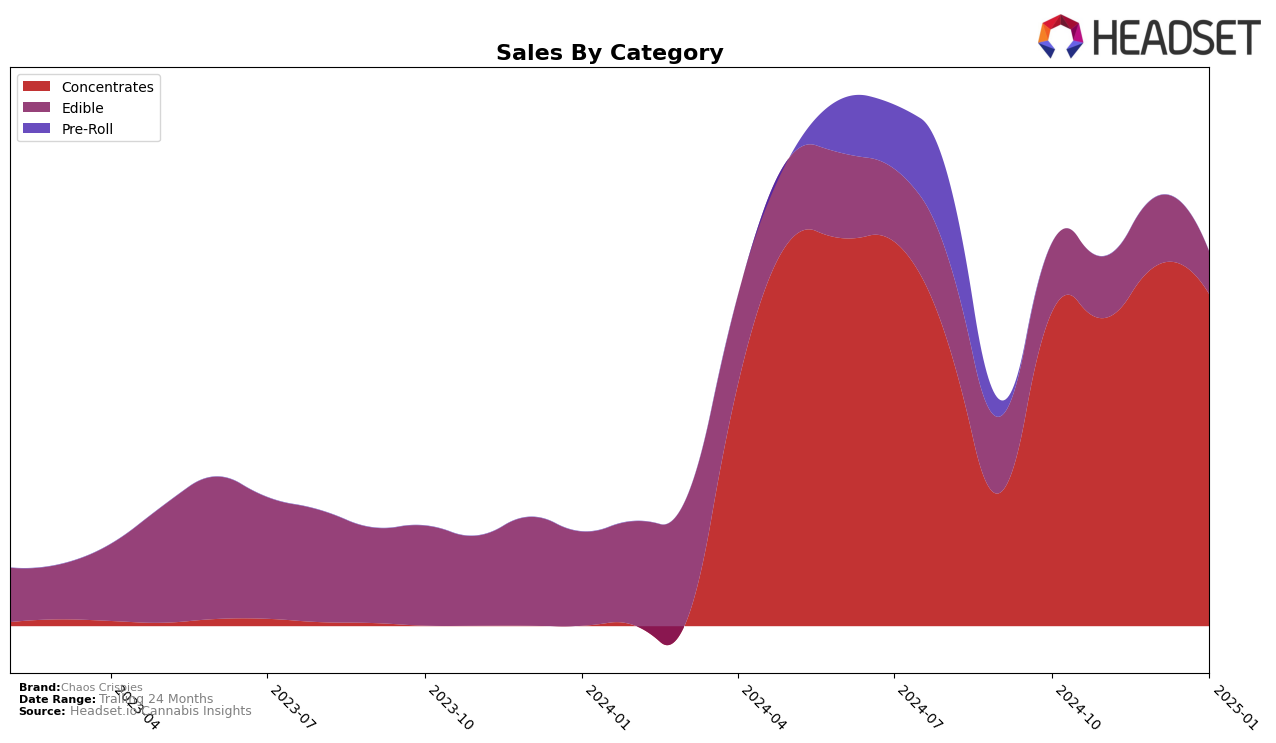

Chaos Crispies has shown a notable performance in the Concentrates category in Colorado. Starting from a rank of 22 in October 2024, the brand improved its position to 17 by December 2024, before slightly declining to 18 in January 2025. This upward trend in the last quarter of 2024, despite a small dip in January, indicates a strong market presence and potential growth in this category. The sales figures support this positive trajectory, with December 2024 witnessing the highest sales of the period, suggesting an effective strategy in place for the Concentrates market.

In contrast, Chaos Crispies' performance in the Edible category in Colorado has been less impressive. The brand failed to break into the top 30 rankings throughout the months analyzed, maintaining a position around the mid-30s. This consistent ranking outside the top 30 highlights a potential area for improvement, as they face stiff competition in the Edibles market. The sales figures reflect this challenge, with a noticeable drop in January 2025. Addressing this could be crucial for Chaos Crispies to bolster their overall market performance in Colorado.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Chaos Crispies has shown a promising upward trajectory in brand ranking, moving from 22nd in October 2024 to 17th by December 2024, before slightly dipping to 18th in January 2025. This positive trend indicates a strengthening market presence, with sales peaking in December 2024 at $124,301. However, the brand faces stiff competition from established players like Dablogic, which consistently maintained a higher rank, albeit with a sales decline from October to January. Meanwhile, Olio held steady in the top 20, but experienced a notable sales drop in January 2025, potentially offering an opportunity for Chaos Crispies to capture market share. Additionally, Seed and Smith (LBW Consulting) and Colorado's Best Dabs (CBD) are also key competitors, with the former showing a consistent rank improvement, which could pose a challenge to Chaos Crispies' growth ambitions. Overall, while Chaos Crispies is on an upward trend, maintaining momentum amidst these competitive pressures will be crucial for continued success.

Notable Products

In January 2025, Chaos Crispies' top-performing product was MAC Wax (1g) in the Concentrates category, climbing from second place in December 2024 to first place with sales reaching 3,855 units. Crescendo Wax (1g) also showed a significant improvement, moving from fourth to second place with 3,651 units sold. Divine Kush Breath Sugar Wax (1g) entered the rankings for the first time in January, securing the third position. Gelato Cake Wax (1g), which was the top product in December, dropped to fourth place in January. Diesel Cream Wax (1g) debuted in the rankings at fifth place, rounding out the list of top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.