Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

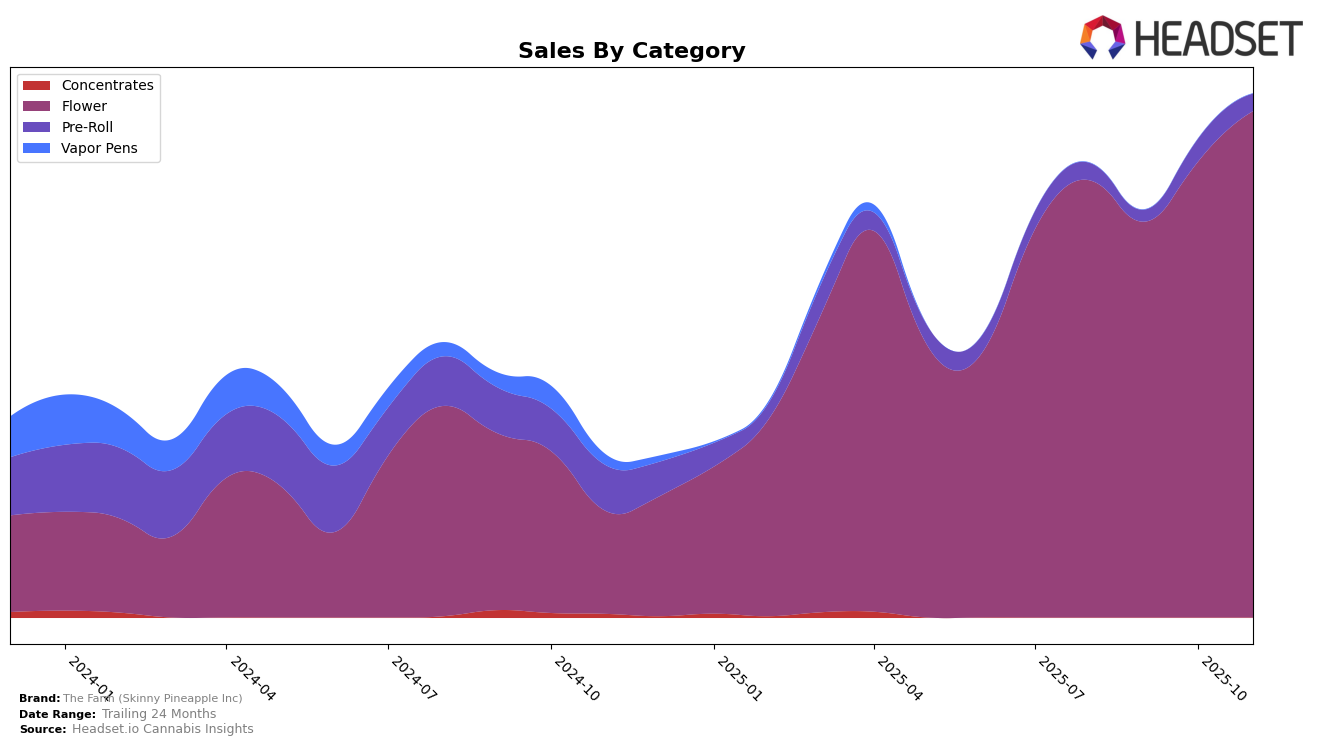

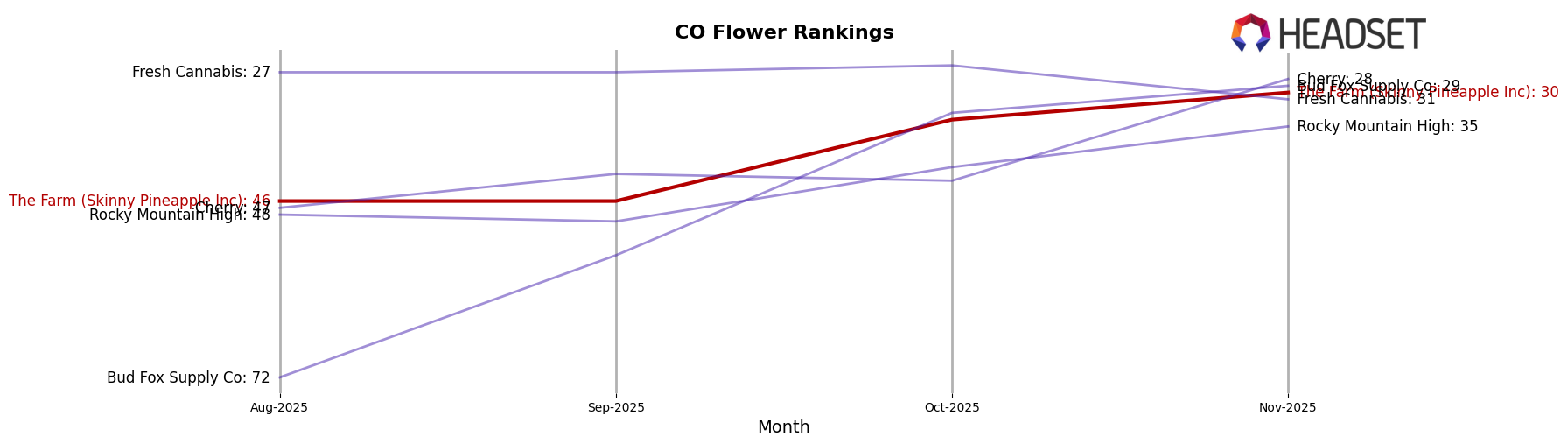

The performance of The Farm (Skinny Pineapple Inc) in the Colorado market has shown notable improvements in the Flower category over the months leading up to November 2025. Starting from a rank of 46 in both August and September, the brand managed to climb to the 30th position by November. This upward trajectory is supported by a consistent increase in sales, culminating in a notable jump in November. The ability to break into the top 30 indicates a strengthening presence in the Colorado Flower market, which could suggest effective strategies in product quality or distribution channels.

However, the Pre-Roll category paints a different picture for The Farm (Skinny Pineapple Inc) in Colorado. The brand did not rank within the top 30 until October, where it appeared at the 76th position, indicating a potential struggle to compete in this segment. The absence of a ranking in earlier months suggests that the brand was not a significant player in the Pre-Roll market during that period. This disparity between categories highlights an area for potential growth and improvement, especially if the brand aims to replicate its success in the Flower category across other product lines.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, The Farm (Skinny Pineapple Inc) has shown a promising upward trend in rankings, moving from 46th place in August 2025 to 30th place by November 2025. This improvement is indicative of a positive shift in sales, which increased from $198,421 in August to $229,985 in November. Notably, Bud Fox Supply Co has also demonstrated a significant rise, surpassing The Farm by moving from 72nd to 29th place, with sales climbing to $243,886 in November. Meanwhile, Rocky Mountain High and Cherry have shown varied performance, with Cherry making a notable leap to 28th place in November. Despite these competitive pressures, The Farm's consistent sales growth and improved ranking suggest a strengthening market position, although it remains crucial to monitor competitors like Bud Fox Supply Co, which has rapidly closed the gap in both rank and sales.

Notable Products

In November 2025, the top-performing product from The Farm (Skinny Pineapple Inc) was Gas Attack (14g), which secured the number one rank with sales of 719 units. Zonkey (14g) followed closely as the second-best seller. Penny's Pie (14g) improved its standing significantly, climbing to third place from its previous ranking of fourth in September 2025. Both Gas Attack (3.5g) and Grape Cream Cake (14g) shared the fourth position, showcasing consistent performance. This demonstrates a notable shift in product popularity, with Penny's Pie (14g) gaining traction over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.