Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

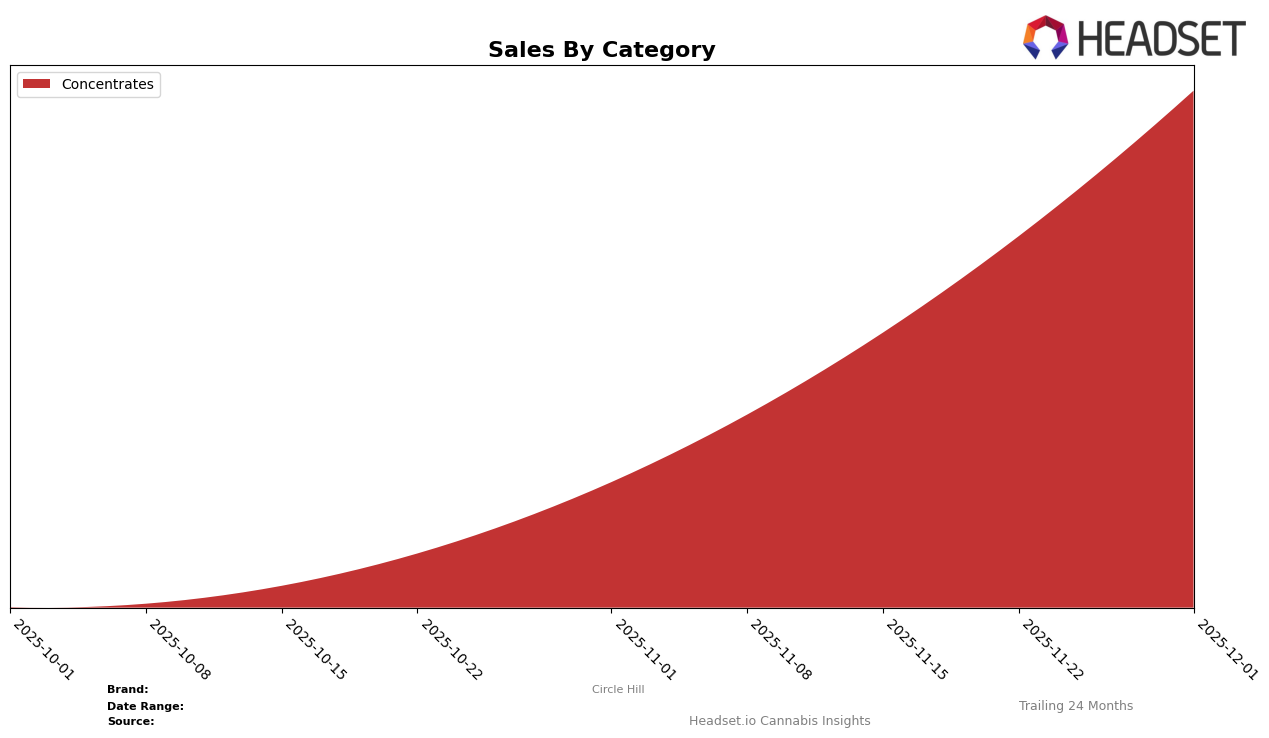

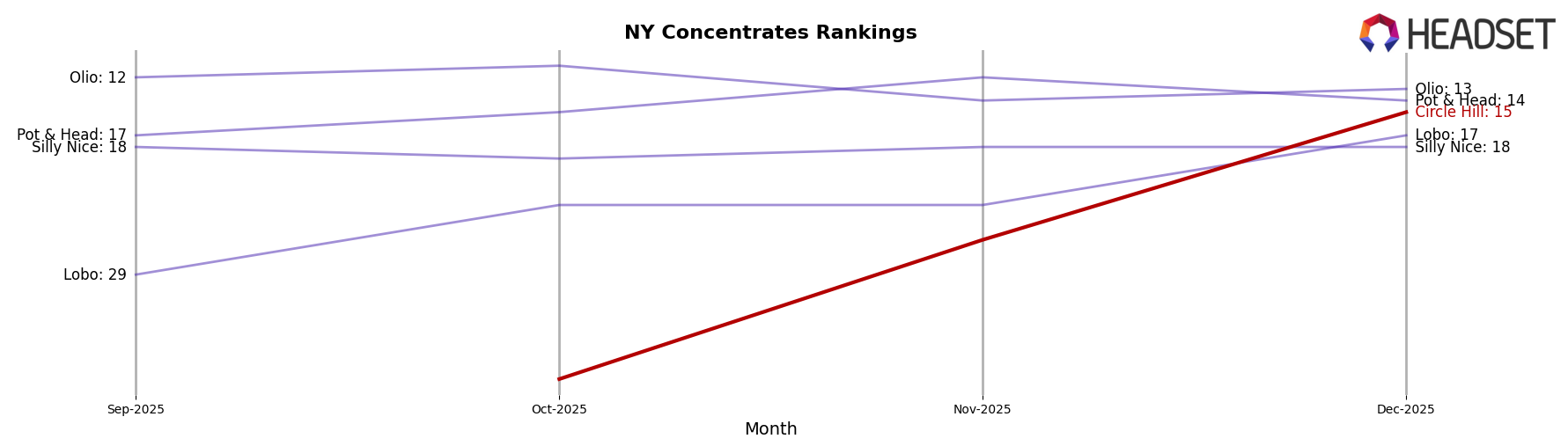

Circle Hill has demonstrated notable growth in the Concentrates category in New York. Starting from not being in the top 30 brands in September 2025, Circle Hill showed a significant upward trajectory by climbing to the 38th position in October and then making a substantial leap to the 26th spot in November. By December, the brand had further improved its standing, reaching the 15th position. This positive trend in rankings indicates a strong market presence and increasing consumer interest in Circle Hill's products. The brand's performance in New York is noteworthy, especially considering the competitive nature of the Concentrates category.

The sales figures for Circle Hill in New York also reflect this upward momentum. From October to December, the brand experienced a substantial increase in sales, with December's sales reaching 72,542, a significant rise from October's 10,083. This growth is a clear indicator of Circle Hill's successful strategies in capturing market share and enhancing brand visibility in the state. The absence of Circle Hill in the top 30 rankings in September highlights the brand's rapid ascent in the following months, underscoring its potential to become a major player in the Concentrates category in New York.

Competitive Landscape

In the competitive landscape of New York's concentrates category, Circle Hill has demonstrated a remarkable upward trajectory in recent months. While the brand was not ranked in the top 20 in September 2025, it made a significant leap to 38th in October, 26th in November, and achieved an impressive 15th place by December. This upward movement is indicative of a strong growth trend in sales, as Circle Hill's sales figures have more than doubled from October to December. In comparison, Olio maintained a relatively stable position, fluctuating slightly but remaining within the top 15, while Lobo showed a notable rise from 29th to 17th, suggesting an increase in market presence. Silly Nice and Pot & Head also maintained consistent rankings, with Pot & Head peaking at 12th in November. Circle Hill's rapid ascent suggests a successful strategy that could potentially disrupt the current market leaders if the trend continues.

Notable Products

In December 2025, the top-performing product from Circle Hill was Rainbow Pushpop #4 Live Rosin (1g) in the Concentrates category, maintaining its number one rank from November with sales reaching 270 units. Dulce De Uva Live Rosin (1g) held the second position, consistent with its rank the previous month, reflecting strong consumer preference. Dulce De Uva Live Rosin (2g) improved its standing to third place, up from fourth in November, indicating a growing interest in larger quantities. Meanwhile, Rainbow Push Pop #4 Live Rosin (2g) slipped to fourth place from third, despite maintaining a steady sales volume. Dulce De Uva Live Resin Hash (1g) remained in fifth place, showing stability in its sales performance over the past three months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.