Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

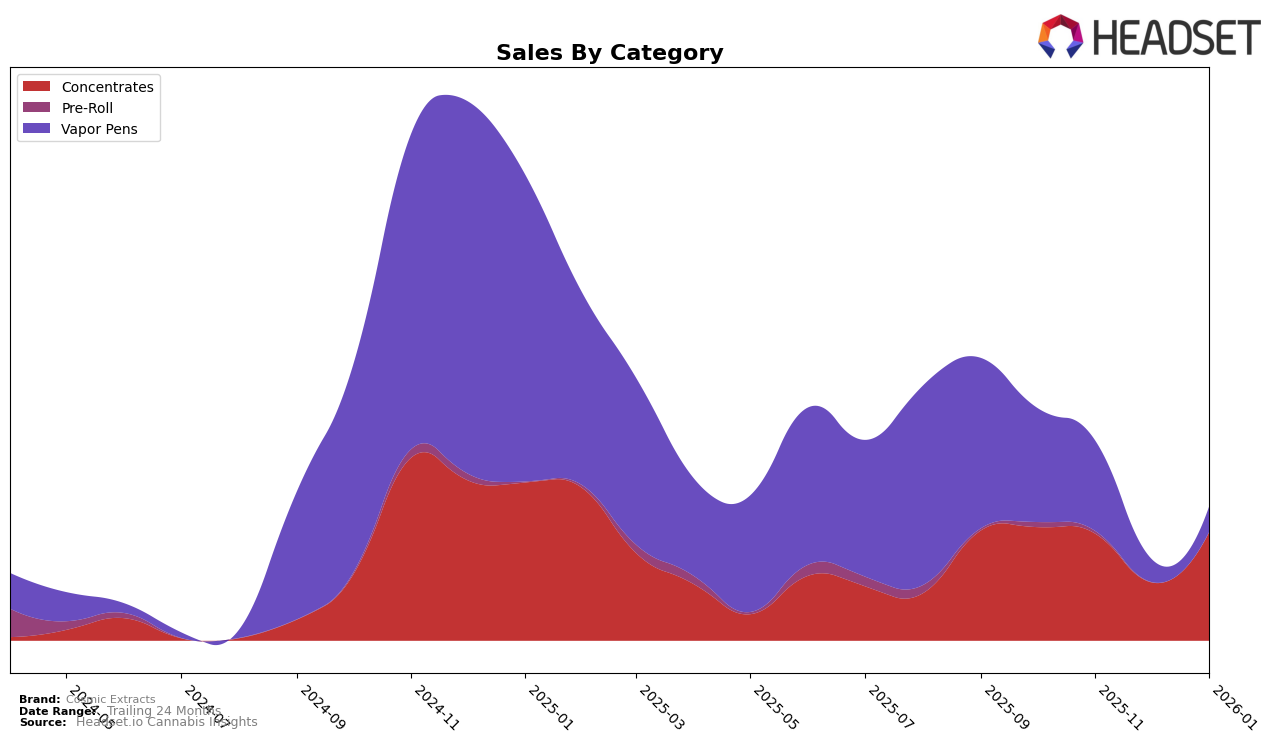

In the province of Saskatchewan, Cosmic Extracts has demonstrated a notable performance in the Concentrates category. Starting from a strong 5th place in October 2025, their ranking dipped to 11th by December, before recovering slightly to 8th in January 2026. This fluctuation in ranking indicates some volatility in their market position, though the recovery in January suggests a potential positive trend. Despite the drop in sales from October to December, the rebound in January highlights their resilience in the market. However, the absence of Cosmic Extracts in the top 30 rankings for the Vapor Pens category after November could be a point of concern, as it suggests a significant decline in their competitive standing in this segment.

Analyzing their performance across these categories provides insights into the brand's strategic positioning in Saskatchewan. The Concentrates category seems to be a stronger area for Cosmic Extracts, where they maintain a presence within the top 15 brands, despite some fluctuations. In contrast, their inability to maintain a top 30 position in the Vapor Pens category post-November could indicate either a shift in consumer preferences or increased competition. This disparity between categories suggests that while Cosmic Extracts has a foothold in certain segments, there may be a need to reassess strategies in others to regain and sustain a competitive edge.

Competitive Landscape

In the Saskatchewan concentrates market, Cosmic Extracts experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially ranked 5th in October, Cosmic Extracts saw a decline to 8th in November and further to 11th in December, before recovering to 8th place in January. This volatility is contrasted by competitors such as Western Cannabis, which maintained a relatively stable position, peaking at 3rd in October and maintaining a top 10 presence throughout the period. Meanwhile, RAD (Really Awesome Dope) showed a downward trend, dropping from 8th to 13th by January. Cosmic Extracts' sales mirrored its ranking changes, with a significant dip in December, but a rebound in January suggests potential for recovery. The data indicates that while Cosmic Extracts faces stiff competition, particularly from brands like Western Cannabis, its ability to regain rank demonstrates resilience and potential for growth in the coming months.

Notable Products

In January 2026, Cereal Milk Live Rosin (1g) maintained its top position in the Concentrates category with a notable sales figure of 598 units, demonstrating a strong performance compared to previous months. Stoned Fruit Live Rosin Cartridge (1g) ranked second in the Vapor Pens category, holding steady from its December 2025 position. Cherry Distillate Cartridge (1g) remained consistent at third place in the Vapor Pens category, showing a slight improvement from its fifth-place ranking in December 2025. Grapefruit Live Rosin (1g) experienced a drop to fourth place in the Concentrates category, despite being second in December 2025. Goldie Knox Live Rosin (1g) secured fifth place in January 2026, maintaining its December 2025 ranking in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.