Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

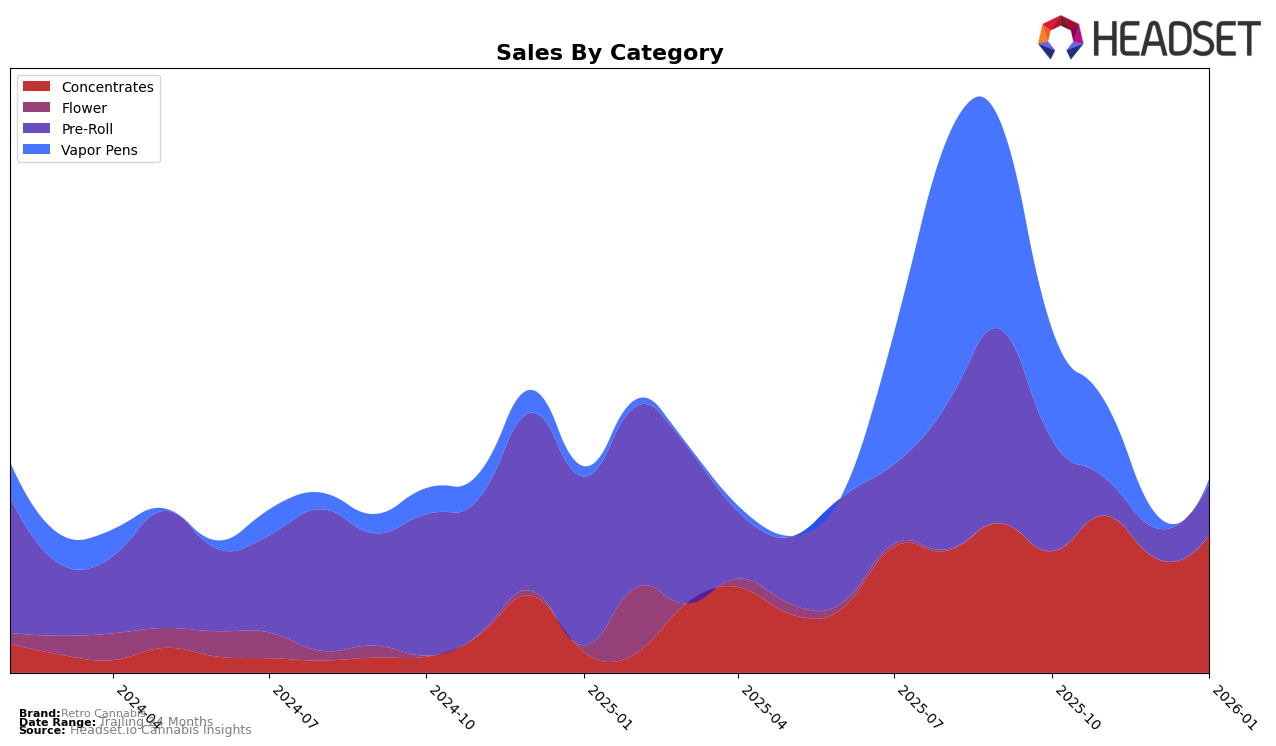

Retro Cannabis has shown notable performance in the Concentrates category within Saskatchewan. Over the months from October 2025 to January 2026, the brand has consistently maintained a presence in the top 15, peaking at 9th place in December 2025. This consistent ranking, despite a slight dip back to 10th in January, indicates a solid market presence and a steady consumer base. The sales figures reflect a peak in November 2025, with a subsequent slight decline, suggesting potential seasonal variations or competitive pressures. However, their ability to bounce back to a higher ranking in December is a positive indicator of their resilience in this category.

In contrast, the Vapor Pens category presents a different challenge for Retro Cannabis in Saskatchewan. While they managed to secure the 29th spot in October 2025, their absence from the top 30 in the following months suggests a struggle to maintain a competitive edge in this segment. This drop-off could be attributed to increased competition or shifting consumer preferences, which may require strategic adjustments to regain market share. The initial sales figures in this category were promising, but the subsequent decline indicates that maintaining visibility and consumer interest is crucial for future success.

Competitive Landscape

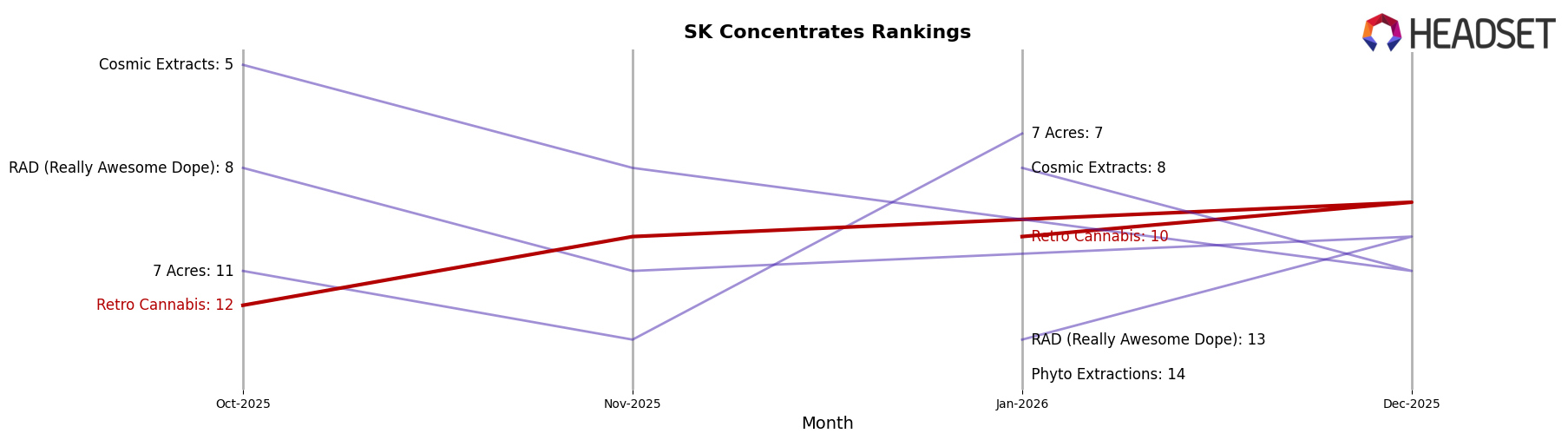

In the Saskatchewan concentrates market, Retro Cannabis has shown a steady performance with a slight improvement in rank from 12th in October 2025 to 10th in November 2025, maintaining a consistent presence in the top 10 through January 2026. This upward trend is notable compared to competitors like RAD (Really Awesome Dope), which experienced a decline from 8th to 13th over the same period. Meanwhile, 7 Acres saw fluctuations, dropping out of the top 20 in December 2025 but rebounding to 7th in January 2026. Cosmic Extracts also showed variability, peaking at 5th in October 2025 before falling to 11th in December, then recovering to 8th in January. Retro Cannabis's stable ranking amidst these shifts suggests a resilient market position, although it still trails behind the sales figures of top competitors like Cosmic Extracts. This analysis highlights the importance of strategic positioning and market adaptability for Retro Cannabis to enhance its competitive edge.

Notable Products

In January 2026, the top-performing product from Retro Cannabis was Ghost Train Haze Cherry Co2 Oil Syringe, maintaining its number one rank from the previous three months despite a slight dip in sales to 533 units. Potent Pete Infused Pre-Roll 3-Pack rose to the second position, showing a significant recovery with sales increasing to 204 units from a low of 106 in November 2025. Honey Oil Infused Hash climbed to the third position, marking its highest rank over the past months with sales reaching 134 units. I Got 5 On It Pre-Roll 5-Pack improved to fourth place, bouncing back from its fifth position in December 2025. R2 Full Spectrum Honey Oil Syringe entered the rankings for the first time at fifth place, indicating a new entry to watch in the coming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.