Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

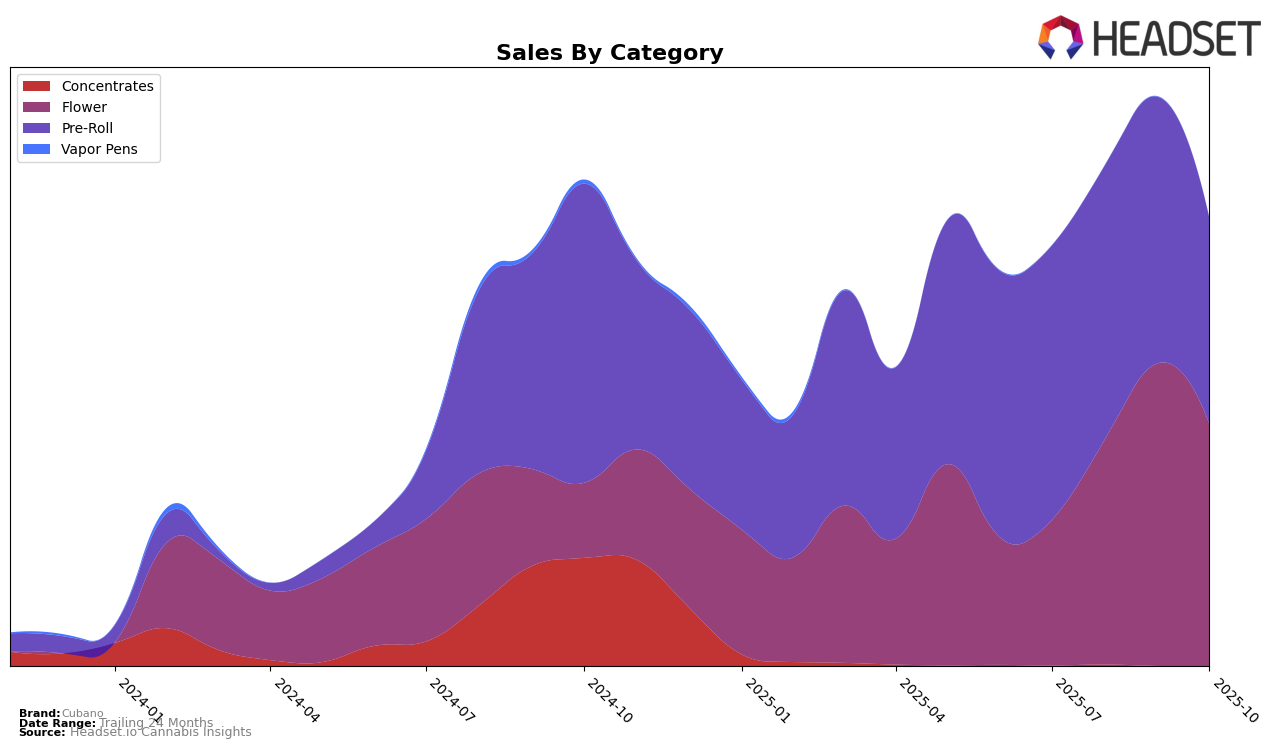

In Missouri, Cubano has shown a notable performance trajectory in the Flower category, improving its rank from 55 in July 2025 to 41 by October 2025. This steady climb indicates a positive reception and increasing consumer interest in their Flower products, despite a decline in sales from September to October. Conversely, in the Pre-Roll category, Cubano's ranking experienced a slight decline, moving from 23 in July to 28 by October. This suggests some challenges in maintaining their competitive edge in the Pre-Roll segment, which could be attributed to fluctuating consumer preferences or increased competition within the state.

While Cubano's presence in Missouri's Flower category did not break into the top 30, the consistent upward movement in rankings highlights a potential for future growth. In the Pre-Roll category, their presence within the top 30 throughout the months suggests a stable foothold, although the drop to the 28th position in October might signal a need for strategic adjustments. The contrasting performances across these categories underscore the dynamic nature of the cannabis market in Missouri, where consumer trends and competitive forces are constantly evolving.

Competitive Landscape

In the competitive landscape of the flower category in Missouri, Cubano has shown a promising upward trajectory in brand rank from July to October 2025. Starting from a rank of 55 in July, Cubano climbed to 41 by September and maintained this position in October, indicating a positive reception and growing market presence. This improvement in rank is noteworthy when compared to competitors like Cloud Cover (C3), which consistently held a higher rank but showed a gradual decline in sales from August to October. Meanwhile, Belushi's Farm experienced fluctuating ranks and a noticeable drop in sales, suggesting potential challenges in maintaining market share. The Solid maintained a stable rank throughout the months, but their sales saw a dip in September, contrasting with Cubano's upward sales trend. Interestingly, Vertical (MO) experienced a significant drop in rank from 23 in August to 42 in October, which aligns with their steep decline in sales, highlighting a potential opportunity for Cubano to capture more market share as Vertical (MO) struggles. Overall, Cubano's consistent rise in rank and sales amidst the varying performances of its competitors suggests a strengthening position in the Missouri flower market.

Notable Products

In October 2025, the top-performing product for Cubano was Cherry Gar-See-Ya Distillate Infused Pre-Ground Shake (3.5g) in the Flower category, securing the number one position with sales of 1305 units. Ethos Apex (3.5g) followed closely in the second rank, maintaining strong performance in the same category. Redneck Wedding Pre-Roll (1g) ranked third, showing a solid presence in the Pre-Roll category. Notably, French Royale Pre-Roll (0.5g) dropped to fourth from its previous first position in July 2025, reflecting a decline in sales. Cigarillo - French Royale Blunt (1g) slipped from second in August and September to fifth in October, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.