Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

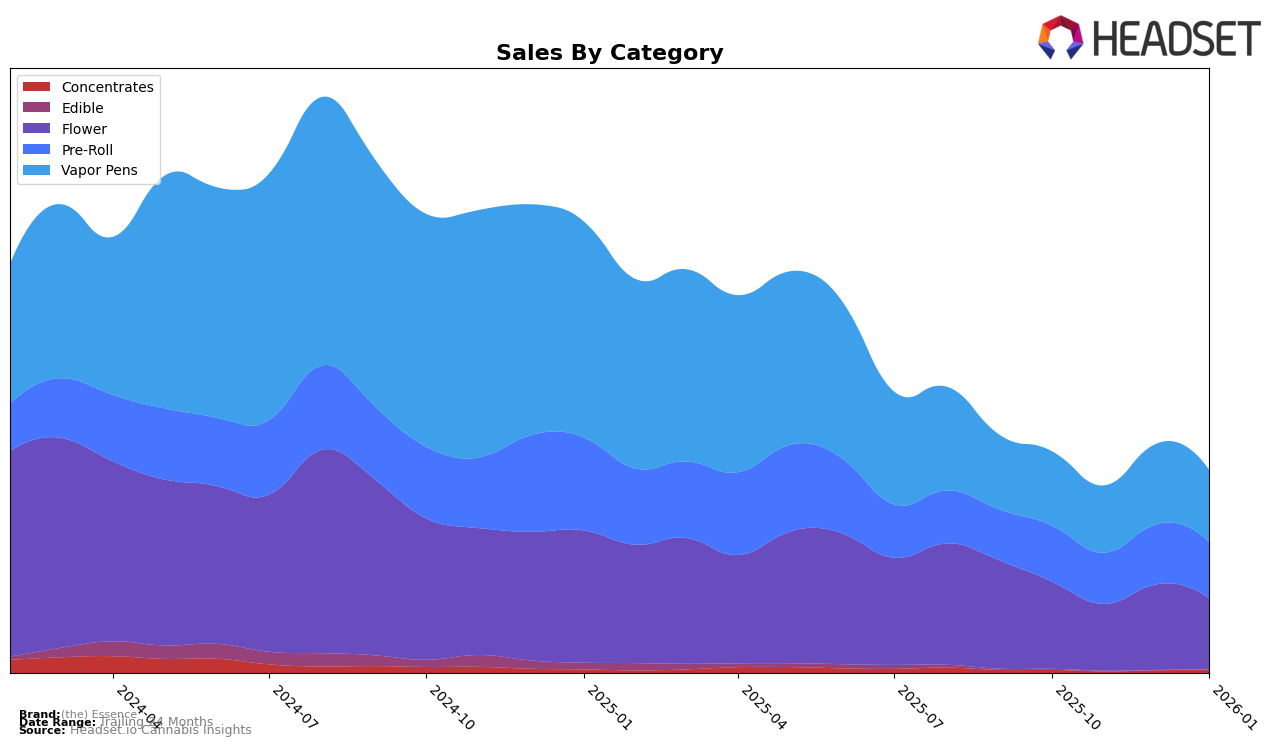

The performance of (the) Essence across various states and categories reveals some interesting trends. In Connecticut, the brand made a notable entry into the Vapor Pens category, securing the 13th position in December 2025 and improving to 11th by January 2026. This upward movement indicates a growing acceptance and popularity of their vapor pens in this state. Meanwhile, in Illinois, (the) Essence maintained consistent rankings in the Flower category, hovering around the mid-40s, which suggests a stable but not dominant presence. However, their Pre-Roll products in Illinois showed strong performance, consistently ranking within the top 15, and even reaching the 11th position in November 2025, reflecting a robust consumer preference for their pre-rolls in this state.

In Maryland, the brand experienced a decline in the Flower category, dropping from 19th in October 2025 to 36th by January 2026, suggesting possible challenges in this segment. The Pre-Roll category also saw a similar downward trend, with the brand falling out of the top 30 by January 2026, which could be a cause for concern. In contrast, in Ohio, (the) Essence showed remarkable performance in the Pre-Roll category, achieving the top rank by January 2026, showcasing their dominance in this segment. Their Vapor Pens also demonstrated steady improvement, moving from 23rd to 21st over the same period, indicating a gradual increase in consumer interest. This varied performance across states and categories highlights the brand's strengths and areas for potential growth.

Competitive Landscape

In the Illinois Vapor Pens category, (the) Essence experienced a slight decline in rank from October 2025 to January 2026, moving from 7th to 9th place. Despite this drop, (the) Essence maintained relatively stable sales figures, suggesting a resilient customer base. Notably, Cresco Labs consistently held a higher rank, maintaining the 7th position from November 2025 through January 2026, which may indicate stronger brand loyalty or market strategies that resonate well with consumers. Meanwhile, Bloom showed a positive trend, climbing from 11th to 8th place over the same period, potentially capturing market share from (the) Essence. Daze Off and Fernway demonstrated fluctuations in their rankings, which could suggest volatility in their market strategies or consumer preferences. These dynamics highlight the competitive pressures (the) Essence faces, emphasizing the need for strategic adjustments to regain a stronger foothold in the market.

Notable Products

In January 2026, the top-performing product for (the) Essence was Martian Mellows Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 6264 units. The Hyphen - Strawberry Cough Distillate Cartridge (1g) maintained its strong performance in the Vapor Pens category, holding the second position with a slight increase in sales from December. J's - Brr Berry Pre-Roll 5-Pack (2.5g) and J's - Green Gelato Pre-Roll 5-Pack (2.5g) secured the third and fourth ranks, respectively, within the Pre-Roll category. J's - Rotten Teeth Pre-Roll (1g) retained its fifth position, showing consistent demand. Notably, while Hyphen - Strawberry Cough Distillate Cartridge (1g) saw a rise from its previous third place in December, Martian Mellows Pre-Roll (1g) emerged as a new leader for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.