Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

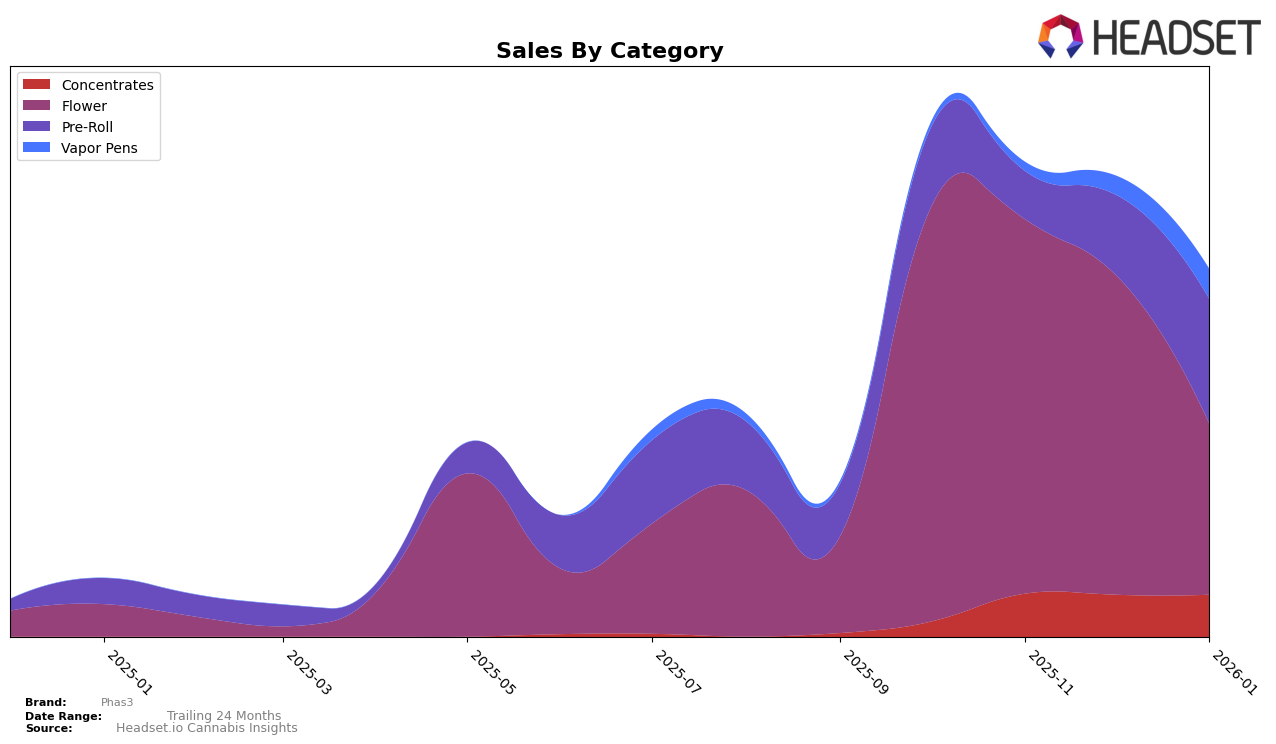

Phas3 has demonstrated notable performance shifts across various categories in Maryland. In the Concentrates category, Phas3 has shown a consistent upward trend, moving from a rank of 28 in October 2025 to 20 by January 2026, indicating a strengthening market presence. On the other hand, the Flower category has seen a decline, with Phas3 dropping out of the top 30 by January 2026, signifying potential challenges or increased competition in that segment. This divergence in performance across categories suggests strategic opportunities for Phas3 to capitalize on its strengths in Concentrates while reassessing its approach in the Flower market.

The Pre-Roll category presents an interesting case for Phas3, where the brand has rebounded from a rank of 36 in November 2025 to 20 by January 2026, showcasing a significant recovery and potential growth trajectory. Conversely, in the Vapor Pens category, Phas3 did not make it into the top 30 until December 2025, eventually reaching a rank of 46 by January 2026. This late entry into the ranking highlights a competitive landscape and possibly untapped potential for Phas3 to explore. Overall, the data reflects a mixed but promising outlook for Phas3, with specific areas poised for growth and others requiring strategic adjustments.

Competitive Landscape

In the competitive landscape of the Flower category in Maryland, Phas3 has experienced notable fluctuations in its rank and sales over the past few months. Starting from October 2025, Phas3 was ranked 25th but saw a decline to 38th by January 2026. This downward trend in rank is mirrored in its sales figures, which decreased from a peak in November 2025 to a lower point in January 2026. In comparison, (the) Essence started strong at 19th in October 2025 but also experienced a decline, ending at 36th in January 2026. Meanwhile, Verano and Khalifa Kush have shown varying performance, with Khalifa Kush improving its rank to 37th by January 2026, surpassing Verano, which dropped to 39th. The data suggests that while Phas3 faces challenges in maintaining its rank amidst fluctuating sales, competitors like Khalifa Kush are gaining ground, indicating a dynamic and competitive market environment in Maryland's Flower category.

Notable Products

In January 2026, the top-performing product from Phas3 was the Alaskan Thunder Fuck Pre-Roll 2-Pack (1g), which secured the number one rank with sales of 2173 units. Following closely, the Panama Red Pre-Roll 2-Pack (1g) climbed to the second position, showing a significant improvement from its fifth-place ranking in December 2025. The Lemon Skunk Pre-Roll 2-Pack (1g) debuted this month in third place with strong sales figures. Panama Red (3.5g) and Green Crack (3.5g) were ranked fourth and fifth, respectively, indicating consistent performance in the Flower category. Notably, the pre-roll category showed a strong presence in the top rankings, suggesting a growing consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.