Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

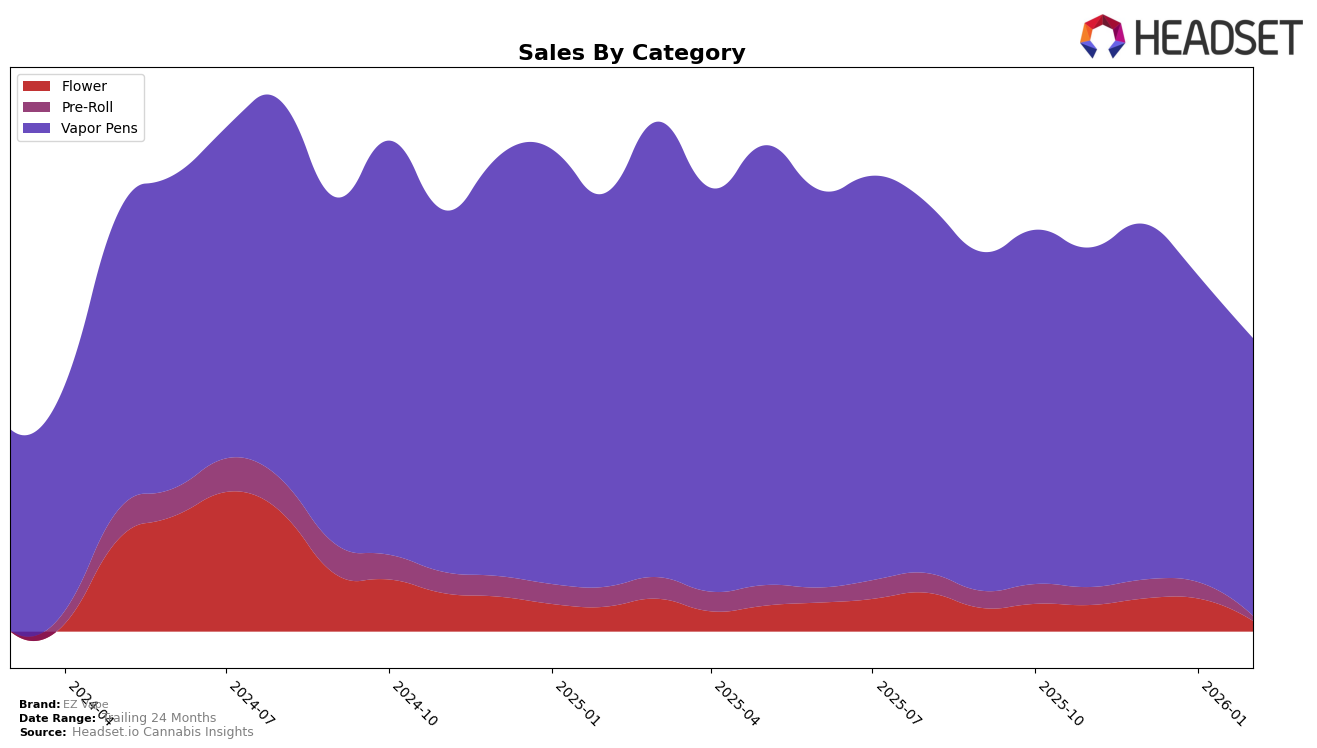

EZ Vape has demonstrated varied performance across different product categories in Washington. In the Vapor Pens category, the brand maintained a strong presence, consistently ranking in the top 15. Despite a slight dip from 10th place in November and December 2025 to 13th in January 2026, they managed to rebound slightly to 12th in February 2026. This indicates a resilient demand for their vapor pen products, even in the face of fluctuating sales volumes. However, the brand did not make it into the top 30 for the Flower category during the months analyzed, suggesting potential challenges or opportunities for growth in that segment.

In the Pre-Roll category, EZ Vape showed a stable yet modest performance. The brand improved its ranking from 89th in November 2025 to 84th in December, maintaining a position in the mid-80s through January 2026. While this indicates some positive momentum, their absence from the top 30 highlights a significant gap compared to leading competitors. The sales trajectory for Pre-Rolls, which saw a decline in January after a rise in December, might suggest seasonal variations or shifts in consumer preferences. Understanding these dynamics could be crucial for EZ Vape as they strategize future market penetration efforts in Washington.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, EZ Vape has experienced some fluctuations in its ranking over the past few months, which could impact its market position and sales strategy. Starting from a solid 10th place in November and December 2025, EZ Vape slipped to 13th in January 2026 before recovering slightly to 12th in February 2026. This decline in rank coincides with a dip in sales from December to January, although there was a slight recovery in February. Notably, Ooowee has shown a consistent upward trend, moving from 12th to 10th place, and maintaining that position in February, potentially capturing some of the market share that EZ Vape lost. Similarly, Hustler's Ambition has also improved its rank, climbing from 14th in November to 11th in January and February, indicating a competitive pressure on EZ Vape. Meanwhile, Fire Bros. and Lifted Cannabis Co have maintained relatively stable positions, with Fire Bros. slightly declining in rank and Lifted Cannabis Co remaining at 14th. These dynamics suggest that EZ Vape may need to adapt its strategies to regain its competitive edge and stabilize its sales trajectory in the Washington vapor pen market.

Notable Products

In February 2026, Skywalker OG Cured Resin Disposable (1g) maintained its top position as the leading product for EZ Vape, with sales reaching 2174 units. Lemon Cake Cured Resin Disposable (1g) showed a notable rise, advancing from fourth to second place compared to the previous month. Do-Si-Dos Distillate Disposable (1g) experienced a slight drop, moving from second to third place. Runtz BHO Disposable (1g) improved its standing from fifth to fourth place. Zkittlez Distillate Disposable (1g) witnessed a decline, slipping from third to fifth place over the same period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.