Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

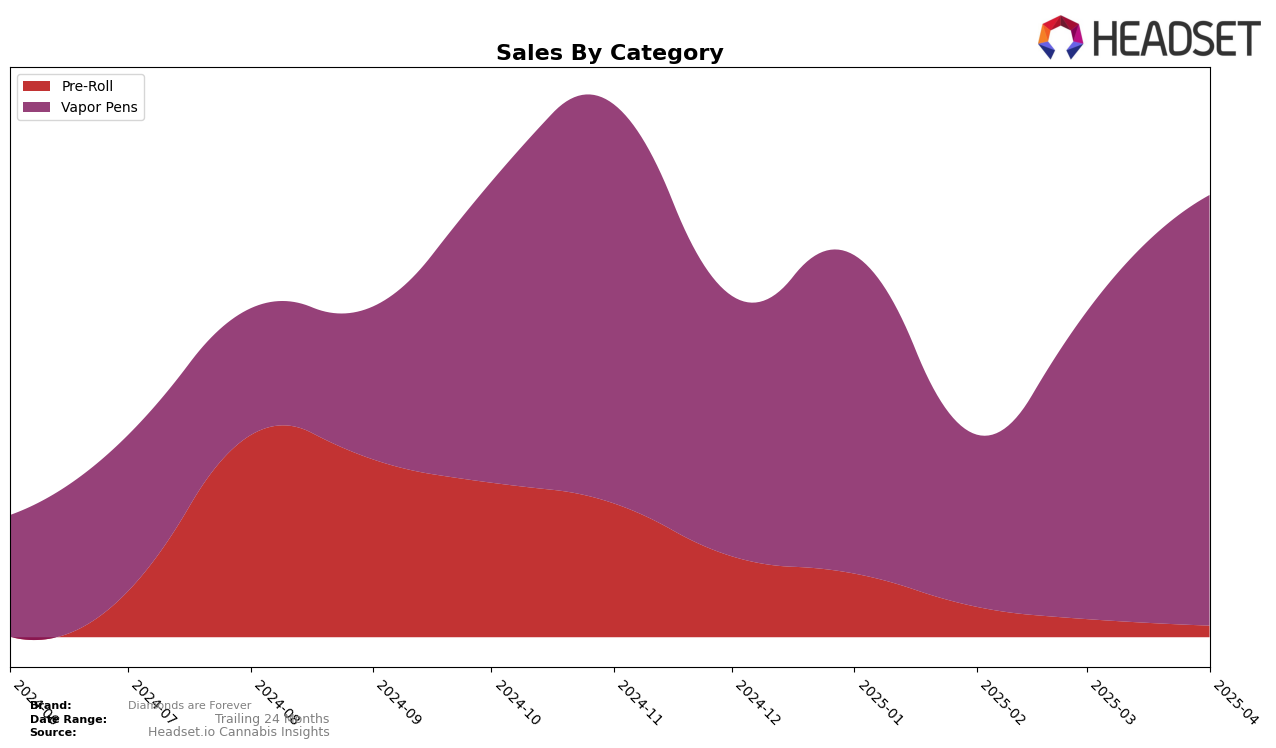

In the vapor pens category, Diamonds are Forever has shown a noteworthy upward trajectory in Alberta. Starting the year in January 2025 at a rank of 40, the brand made significant strides, climbing to rank 28 by April 2025. This improvement indicates a positive reception and growing market presence within the province. The brand's sales figures also reflect this trend, with a notable increase from February to April, suggesting effective market strategies or product offerings that resonate well with consumers. The absence of a top 30 ranking in earlier months highlights the brand's recent success in gaining traction in Alberta's competitive vapor pen market.

While the progress in Alberta is encouraging, it is important to note that Diamonds are Forever does not appear in the top 30 rankings in other states or provinces for the vapor pens category. This absence suggests that the brand's market penetration and consumer appeal might be more localized or that it is facing stiffer competition in other regions. Understanding the factors contributing to its success in Alberta could provide valuable insights for the brand's expansion strategies elsewhere. The data hints at a potential for growth, but further analysis would be needed to identify specific opportunities and challenges in different markets.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Diamonds are Forever has shown a notable improvement in its market position from January to April 2025. Starting at a rank of 40 in January, Diamonds are Forever climbed to 28 by April, indicating a positive trend in consumer preference and market penetration. This upward movement is significant, especially when compared to competitors like Glacial Gold, which also improved its ranking but remained at 27, and Foray, which fluctuated slightly but ended at 30. Versus experienced a decline, dropping from 28 to 29, while Tuck Shop maintained a strong presence, ending at 26. The sales trajectory for Diamonds are Forever also reflects this positive shift, with a significant increase in April, suggesting effective marketing strategies or product offerings that resonate well with consumers. This competitive analysis highlights Diamonds are Forever's potential to continue its upward trajectory in the Alberta vapor pen market.

Notable Products

In April 2025, the top-performing product from Diamonds are Forever was the Black Kyber Crystal FSE Cartridge 1g, maintaining its number one ranking since January, with a notable sales figure of 3768 units. The Black Mountain Side FSE Cartridge 1g secured the second position, consistent with its ranking in March, although its sales saw a slight decrease from the previous month. The Purple Toque FSE Cartridge 1g held steady at the third position, showing a gradual increase in sales over the months. The Black Kyber Crystal Infused Pre-Roll 3-Pack 1.5g remained in fourth place, experiencing a decline in sales compared to earlier months. Overall, the rankings for April 2025 show stability in the top three products, with minimal fluctuations in their positions since the beginning of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.