Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

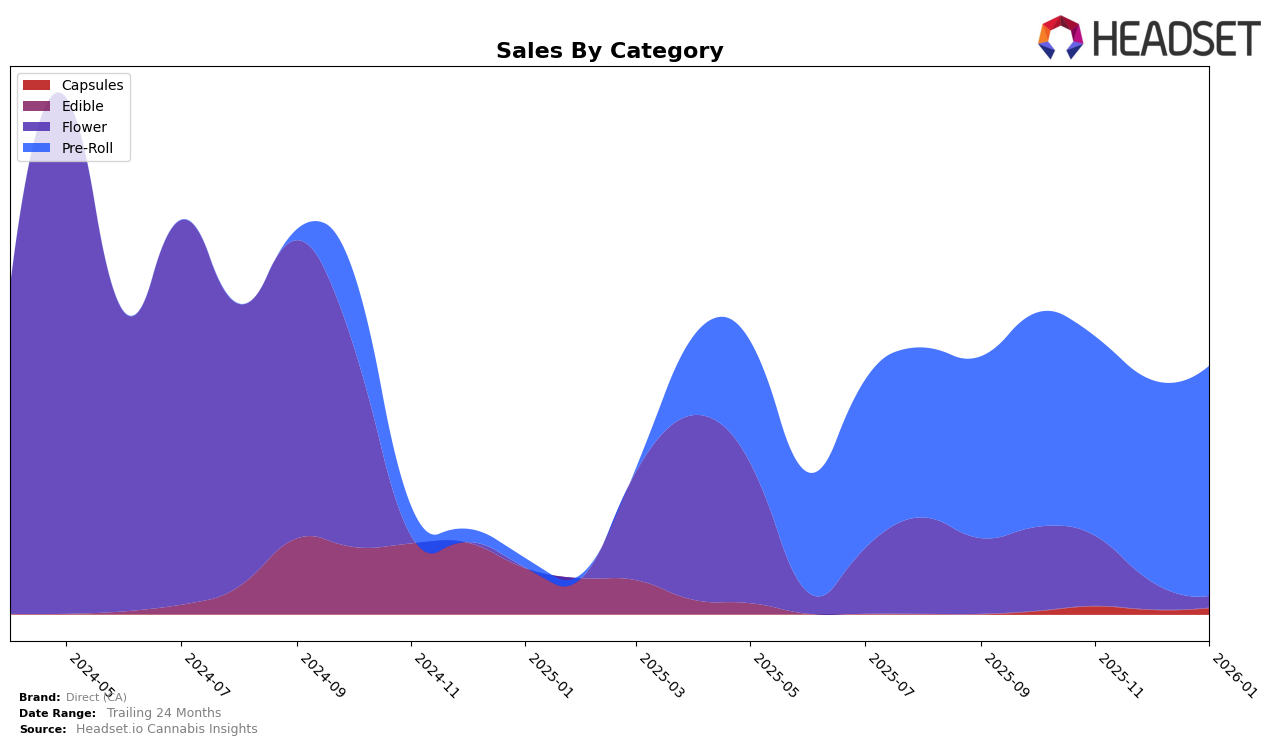

Direct (CA) has shown varied performance across different categories and states, with notable activity in the California market. In the Pre-Roll category, Direct (CA) has not appeared in the top 30 rankings from October 2025 to January 2026, indicating a potential area for growth or increased competition in this category within the state. This absence from the top rankings could suggest challenges in gaining traction or maintaining a competitive edge in California's dynamic market, where consumer preferences and brand loyalties can shift rapidly.

The sales data for Direct (CA) in the Pre-Roll category in California reveals a decline from $92,000 in October 2025. This trend might reflect broader market conditions or internal strategic shifts. While the brand has not secured a top position in the rankings, the sales figures provide insight into its market presence. Understanding these dynamics can be crucial for stakeholders looking to capitalize on emerging opportunities or address competitive pressures within the cannabis industry in California.

```Competitive Landscape

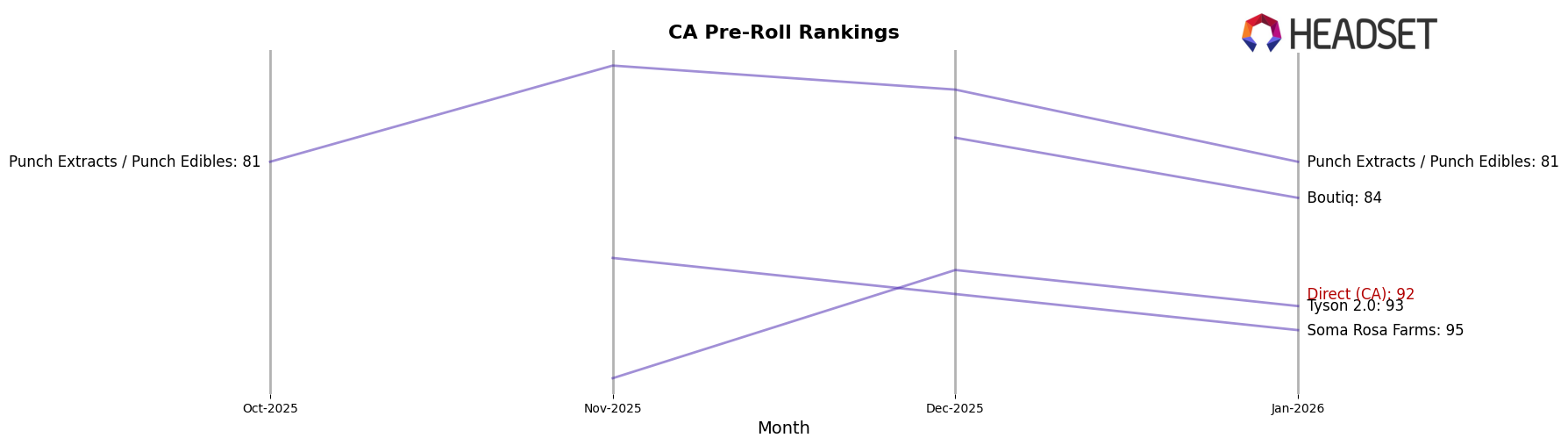

In the competitive landscape of the California Pre-Roll category, Direct (CA) has shown a notable entry into the rankings by January 2026, securing the 92nd position. This marks a significant milestone for Direct (CA), as it was not ranked in the top 20 in the preceding months, indicating a positive trajectory in market presence. In comparison, Punch Extracts / Punch Edibles maintained a relatively stable position, fluctuating between 73rd and 81st, while experiencing a dip in sales from November to January. Soma Rosa Farms and Tyson 2.0 also showed variability in their rankings, with Tyson 2.0 improving from 99th in November to 93rd in January, despite a decrease in sales. Boutiq, on the other hand, entered the rankings in December at 79th but fell to 84th by January. These dynamics suggest a competitive market where Direct (CA) is gaining traction, potentially at the expense of some established players, highlighting an opportunity for Direct (CA) to capitalize on its upward momentum.

Notable Products

In January 2026, Skywalker OG Pre-Roll (1g) maintained its position as the top-performing product for Direct (CA), achieving sales of 5822. Lemon Haze Pre-Roll (1g) climbed to the second spot, showing a consistent upward trend from its fourth-place ranking in October 2025. Jack Herer Pre-Roll (1g) experienced a slight decline, moving from first place in November 2025 to third in January 2026. Gelato 33 Pre-Roll (1g) remained stable in fourth place, following a rise from fifth place in November. Guava Pre-Roll (1g) re-entered the rankings in January, securing the fifth position after not being ranked in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.