Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

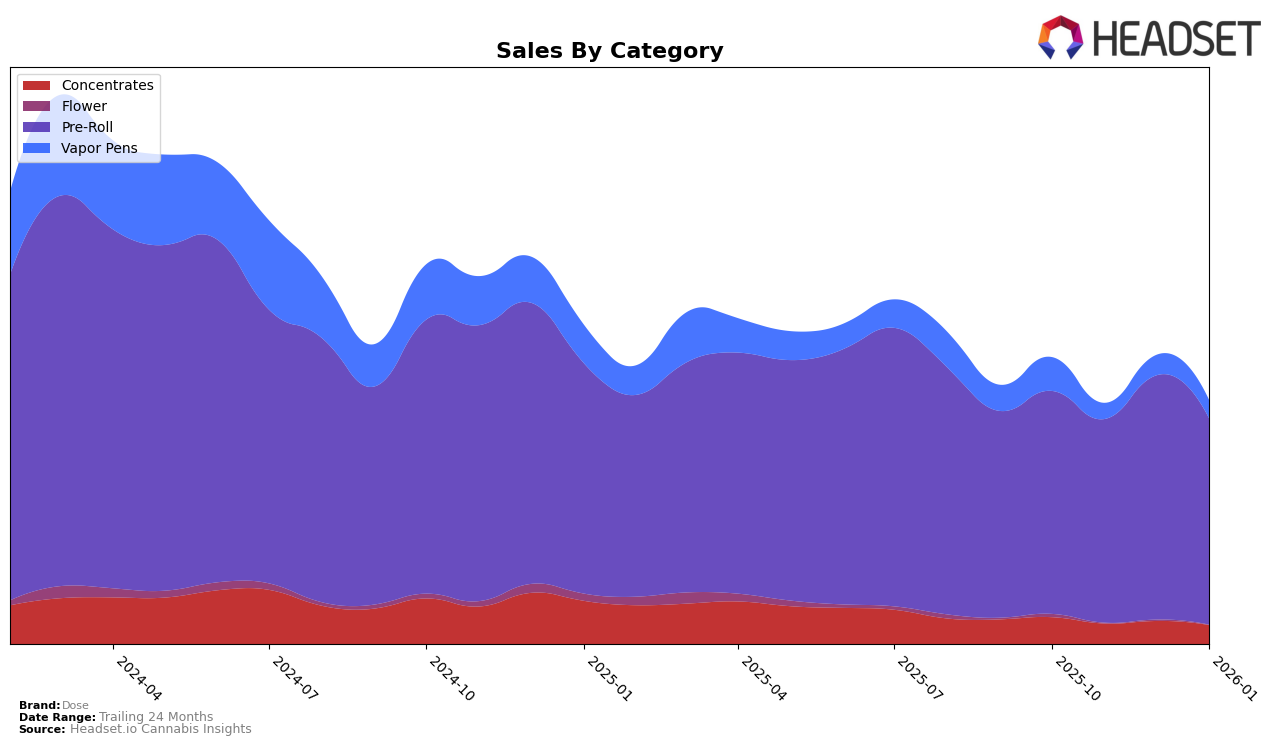

In the state of Washington, Dose has shown varying performance across different cannabis product categories. In the Concentrates category, Dose has not managed to break into the top 30 brands, with rankings of 91 in October 2025, 93 in December 2025, and 97 in January 2026. This indicates a downward trend, highlighting a potential area for improvement. The sales figures have also declined over this period, suggesting a decrease in market presence or consumer preference within this category. Such trends might warrant a strategic review or a potential shift in marketing focus to regain traction in the Concentrates market.

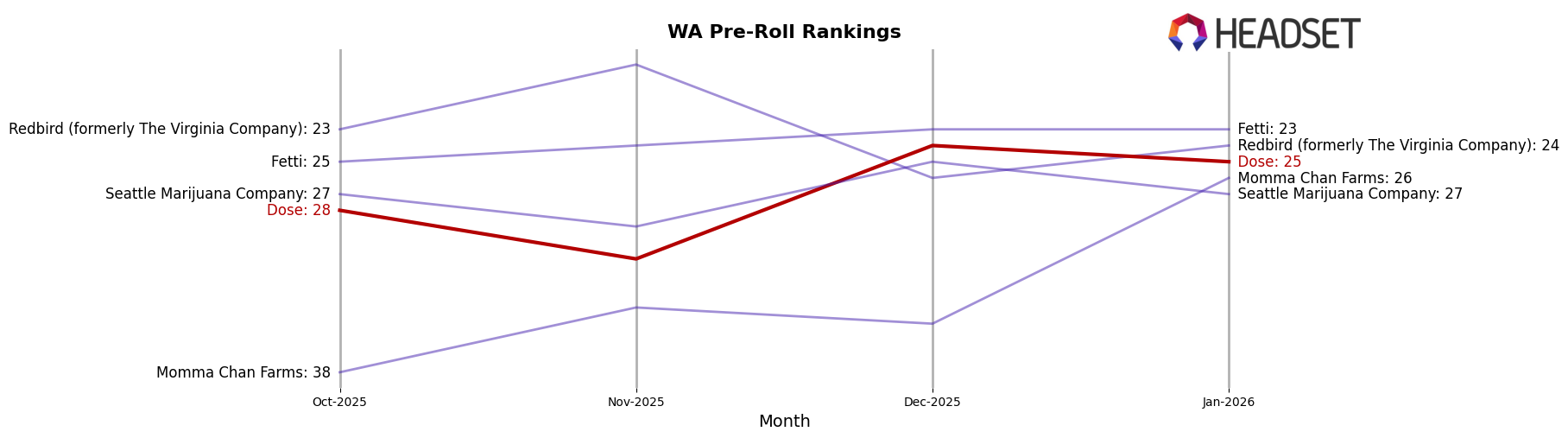

Conversely, in the Pre-Roll category, Dose has maintained a relatively stronger presence in Washington. The brand's ranking improved from 28 in October 2025 to 24 in December 2025 before slightly dropping to 25 in January 2026. This fluctuation in rankings indicates a competitive market landscape but also demonstrates Dose's ability to stay within the top 30, unlike in the Concentrates category. Despite the slight dip in January 2026, the sales figures in this category have shown resilience, with a peak in December 2025. This suggests that Dose has a solid foothold in the Pre-Roll market, which may offer opportunities for further growth and consolidation.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Dose has shown a fluctuating performance in recent months. While Dose improved its rank from 31st in November 2025 to 24th in December 2025, it slightly declined to 25th in January 2026. This indicates a volatile positioning compared to competitors like Redbird (formerly The Virginia Company), which consistently maintained a higher rank, peaking at 19th in November 2025. Similarly, Fetti has shown stable performance, consistently ranking within the top 25, and even achieving 23rd place in January 2026. Meanwhile, Seattle Marijuana Company has closely trailed Dose, often exchanging ranks, but fell to 27th in January 2026. Despite these challenges, Dose's ability to climb from 31st to 24th in a single month demonstrates potential for upward momentum, though sustaining this will require strategic efforts to outpace competitors with more stable rankings.

Notable Products

In January 2026, Blueberry Muffins Infused Pre-Roll (1g) retained its top position as the best-selling product for Dose, with sales reaching 1210 units. Wedding Cake Infused Pre-Roll (1g) emerged as the second best-seller, marking its debut in the rankings with a strong performance. Blue Dream Infused Pre-Roll (1g) secured the third spot, also making its first appearance in the rankings. GrandDaddy Purple Infused Pre-Roll (1g) experienced a decline, dropping from second place in December 2025 to fourth in January 2026. Birthday Cake Infused Pre-Roll (1g) rounded out the top five, slipping from fourth to fifth place compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.