Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

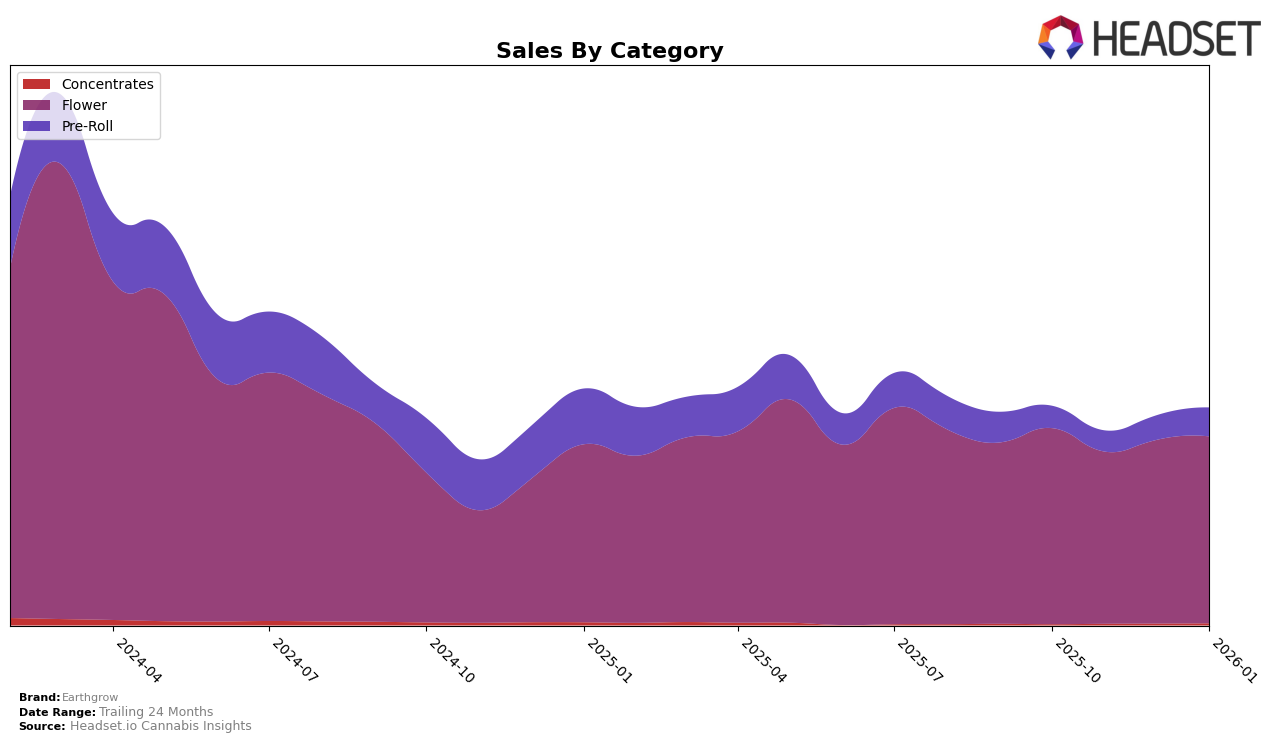

Earthgrow's performance across various categories and states has shown some interesting trends. In the Arizona market, the brand has maintained a steady presence in the Flower category, consistently ranking within the top 30. Starting at the 19th position in October 2025 and slightly fluctuating to 23rd in November, Earthgrow managed to regain some ground by January 2026, climbing back to the 20th spot. This indicates a resilience and potential growth in consumer preference for their Flower products. However, it's noteworthy that Earthgrow did not make it into the top 30 for the Pre-Roll category until December 2025, where they appeared at the 37th position. This late entry into the top rankings might suggest a slower build in market share for Pre-Rolls, but the upward trend in their ranking could hint at growing popularity.

While Earthgrow has shown progress in the Arizona market, the nuances between categories highlight areas of both strength and opportunity. For instance, despite being outside the top 30 in Pre-Rolls initially, the brand's steady climb to the 36th position by January 2026 suggests a positive trajectory. This upward movement in Pre-Roll rankings is accompanied by a notable increase in sales, indicating a strengthening consumer interest. In contrast, their Flower category performance demonstrates a more stable presence, which could be a result of established consumer loyalty or consistent product quality. These dynamics across categories and the state provide a glimpse into Earthgrow's strategic foothold and potential areas for growth, particularly in expanding their Pre-Roll market share.

Competitive Landscape

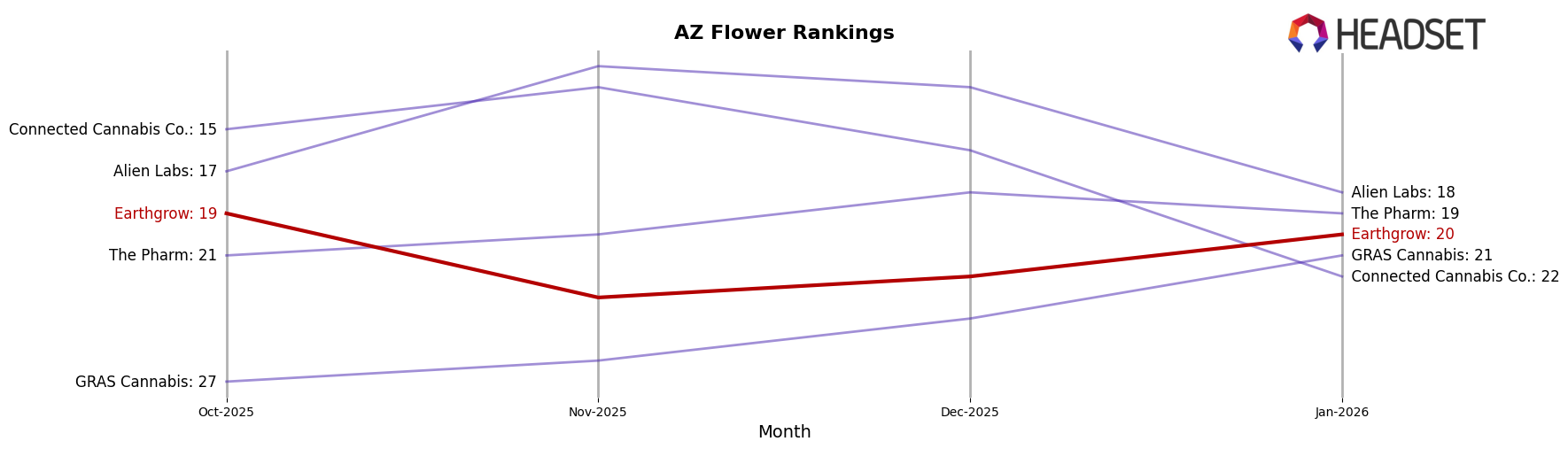

In the competitive landscape of the Flower category in Arizona, Earthgrow has experienced fluctuations in its market position over the past few months. Starting from October 2025, Earthgrow was ranked 19th but saw a dip in November and December, falling to 23rd and 22nd respectively, before recovering slightly to 20th in January 2026. This indicates a volatile market presence, especially when compared to competitors like Alien Labs, which improved its rank from 17th in October to 12th in November, maintaining a stronger position through December before dropping to 18th in January. Meanwhile, Connected Cannabis Co. also demonstrated a competitive edge, ranking consistently higher than Earthgrow until January when it fell out of the top 20. Despite Earthgrow's sales showing a slight upward trend from December to January, the brand faces stiff competition from The Pharm and GRAS Cannabis, both of which have shown resilience in maintaining or improving their rankings. Earthgrow's challenge lies in stabilizing its rank and capitalizing on its sales momentum to climb higher in the competitive Arizona Flower market.

Notable Products

In January 2026, Kndy Fumez (Bulk) emerged as the top-performing product for Earthgrow, ascending to the number one position from its previous third place in December 2025, with impressive sales of 4982 units. Violet Fog (14g) closely followed in second place, showing a significant rise from its absence in the December rankings. Gas Face (Bulk) maintained a consistent presence in the top three, securing the third spot, the same as in its last recorded position in November 2025. Dulce De Uva (Bulk) slipped from second in November to fourth place by January. Cap Junky (Bulk) rounded out the top five, dropping from its December fourth place, indicating a slight decline in its performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.