Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

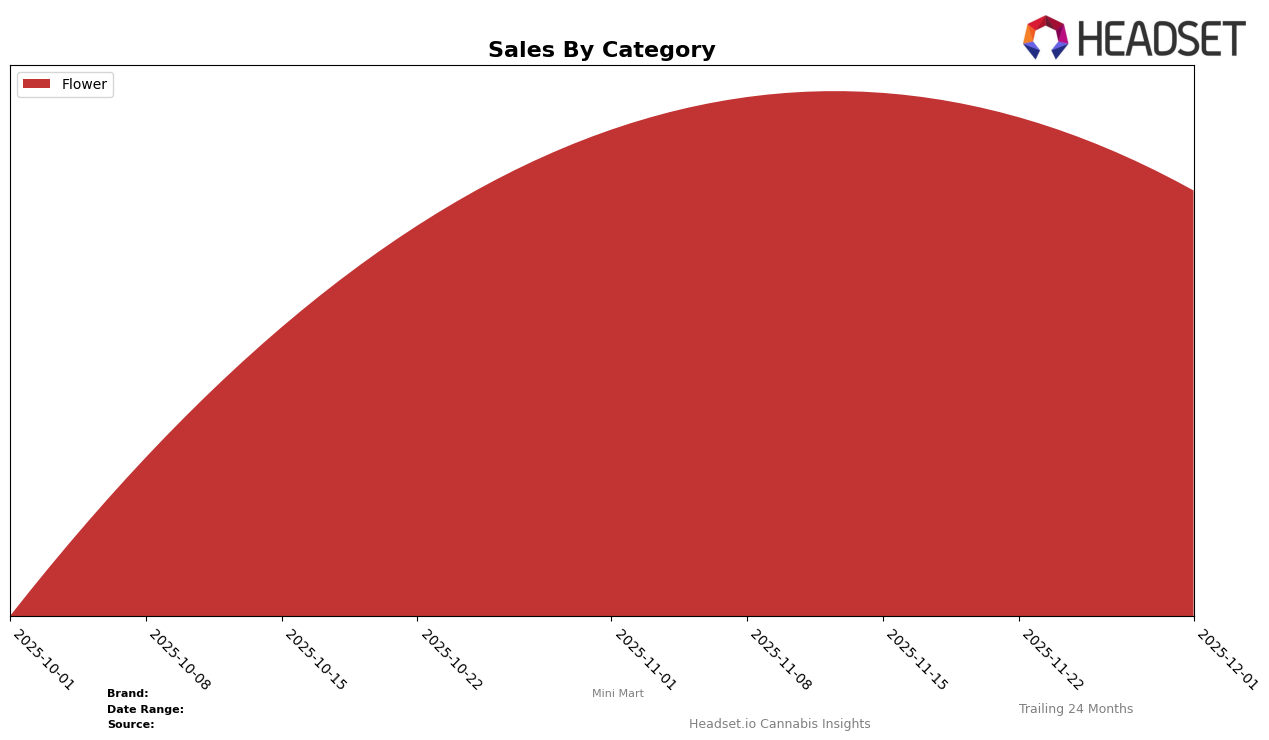

Mini Mart's performance across various categories and states reveals some intriguing trends, particularly in the New York market. In the Flower category, Mini Mart saw a significant improvement in its ranking from October to November 2025, moving from 62nd in October to 17th in November, before stabilizing slightly at 18th in December. This notable leap in ranking indicates a strong market penetration and growing consumer preference for their Flower products. However, the absence of a ranking in September suggests that the brand was not within the top 30, highlighting a rapid rise in popularity towards the end of the year.

While Mini Mart's Flower category has shown remarkable growth in New York, it's important to note that the brand's presence in other categories or states is not detailed here. This could imply either a focused strategy on the Flower category within New York or potential challenges in gaining traction in other areas. The substantial increase in sales from September to October, with October sales reaching $815,356, underscores the brand's successful market strategy, although the slight drop in sales in November and December suggests a need for sustained efforts to maintain their upward trajectory. Overall, Mini Mart's performance in New York's Flower category is a positive indicator of its potential, but there's room to explore opportunities in other regions and categories.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Mini Mart has demonstrated a significant improvement in its market position from October to December 2025. Initially absent from the top 20 in September, Mini Mart surged to rank 17 in November, maintaining a strong position at 18 in December. This upward trajectory is indicative of a robust sales performance, with a notable leap in sales from October to November. In contrast, The Plug Pack experienced a decline, dropping from 10th place in November to 17th in December, despite previously leading with higher sales figures. Meanwhile, Electraleaf maintained a stable position around the 16th rank, showcasing consistent sales figures. Platinum Reserve saw a fluctuating rank, ending December at 19th, while RIPPED re-entered the top 20 in November at 19th, maintaining this position in December. The dynamic shifts in rankings highlight Mini Mart's competitive edge and potential for continued growth in the New York Flower market.

Notable Products

In December 2025, Platinum Punch (3.5g) led the sales for Mini Mart, securing the top position with notable sales of 3892 units. Following closely, Super Boof (3.5g) and Cadillac Runtz (3.5g) were ranked second and third, respectively, with strong sales figures. Gush Mintz (3.5g) and Durban Poison (3.5g) rounded out the top five products. Compared to previous months, these products have consistently climbed the ranks, indicating a growing preference among consumers. The Flower category dominated the top spots, showcasing its popularity and strong market presence in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.