Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

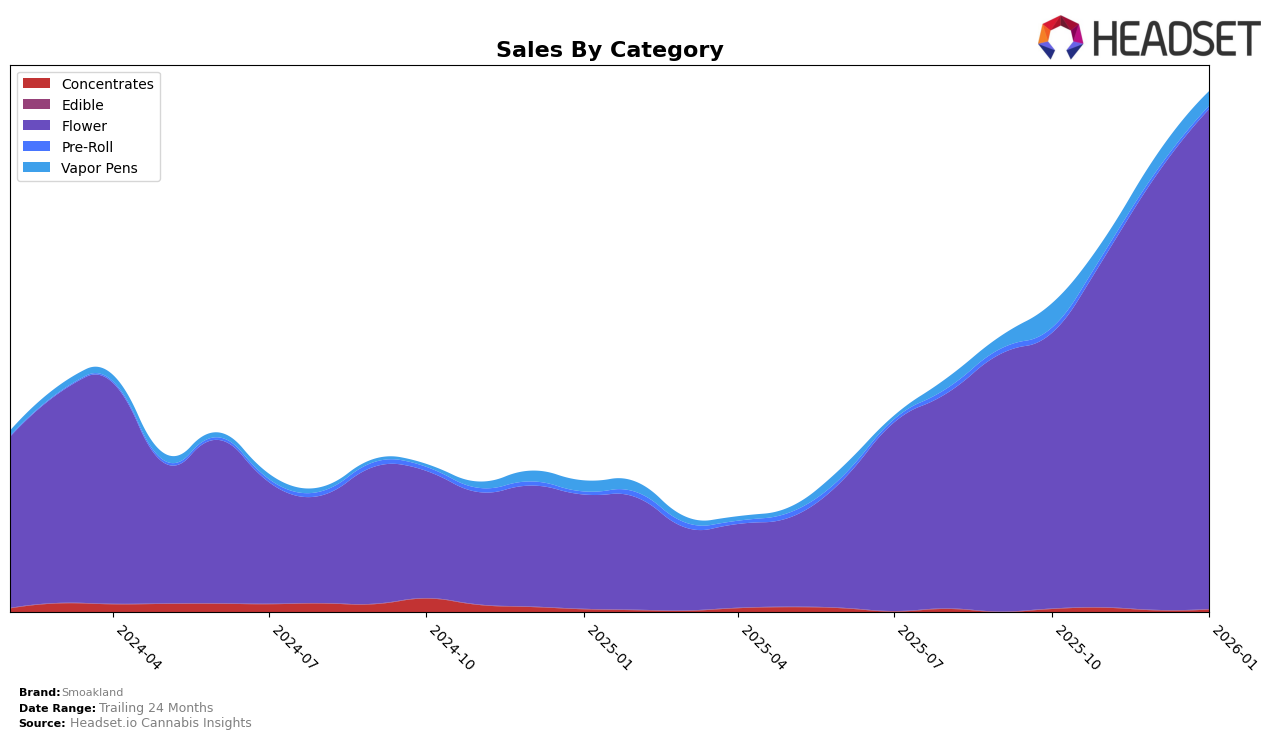

In the state of California, Smoakland's performance in the Flower category has been notably absent from the top rankings over the past few months. This indicates a potential challenge in maintaining competitiveness in one of the largest cannabis markets in the U.S. Despite the lack of a ranking in the top 30 from October 2025 to January 2026, the brand's sales figures in October 2025 were significant, suggesting that while they may not be leading the category, they still maintain a presence in the market. This absence from the top 30 could be seen as a negative indicator, suggesting that Smoakland might need to reassess its strategies in California to regain a competitive edge.

Conversely, in New York, Smoakland has shown a positive trajectory in the Flower category, improving its rank from 20th in October 2025 to 12th by January 2026. This upward movement is complemented by a consistent increase in sales, indicating a growing consumer base and possibly effective market strategies. The steady climb in rankings highlights Smoakland's strengthening position in New York, contrasting sharply with their performance in California. This suggests that the brand might be focusing more resources or finding more success in this particular market, which could be a strategic focus for their future growth plans.

Competitive Landscape

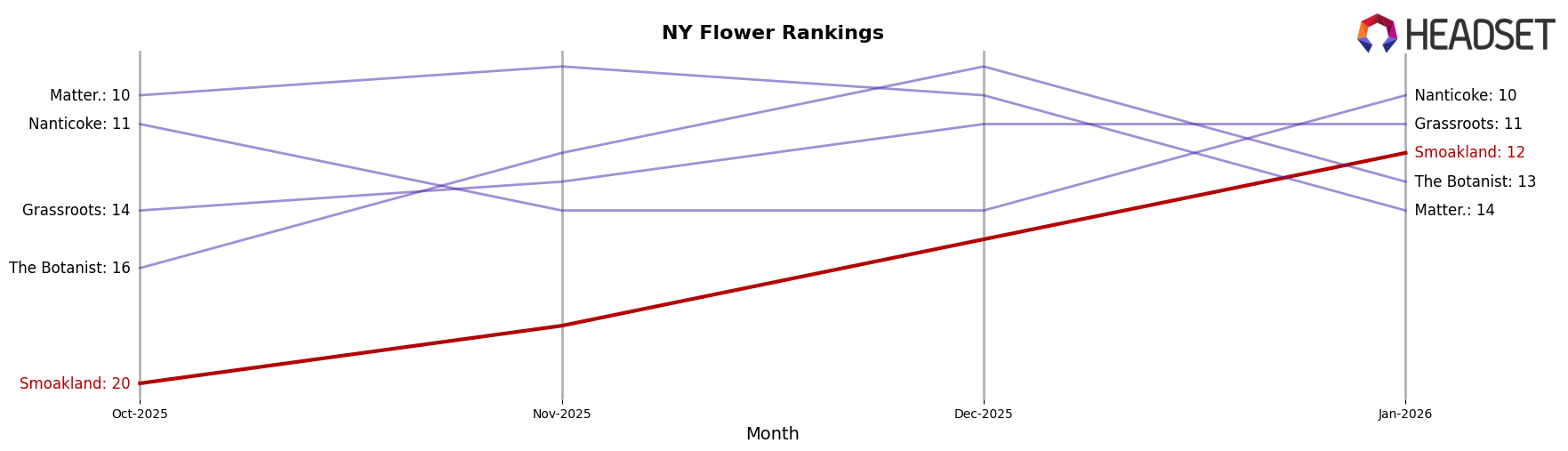

In the competitive landscape of the New York flower category, Smoakland has shown a notable upward trajectory in its rankings over the past few months. Starting from the 20th position in October 2025, Smoakland has climbed to the 12th spot by January 2026. This steady improvement in rank is indicative of a significant increase in sales, with Smoakland's sales figures rising from $596,733 in October 2025 to $1,302,811 in January 2026. Despite this growth, Smoakland still trails behind competitors such as Grassroots, which maintained a consistent rank around the 11th position with slightly higher sales, and The Botanist, which experienced fluctuations in rank but achieved peak sales in December 2025. Meanwhile, Matter. and Nanticoke have also been strong contenders, with Matter. starting strong but dropping to the 14th position by January 2026, and Nanticoke showing a resilient performance by securing the 10th rank. Smoakland's consistent upward trend suggests a growing market presence and potential for further advancement in the competitive New York flower market.

Notable Products

In January 2026, Sour Diesel (28g) maintained its position as the top-selling product for Smoakland, with sales reaching 2197 units, marking a consistent performance since October 2025. NY Diesel (28g) emerged as the second highest seller, followed by Maui Wowie (28g) in third place, both making their debut in the rankings for this month. Panama Haze (28g) secured the fourth spot, while OG Kush Shake (28g) rounded out the top five. The introduction of NY Diesel and Maui Wowie indicates a shift in consumer preference towards new offerings. Notably, the top three products are all Flower category, suggesting a strong demand for this category in the current market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.