Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

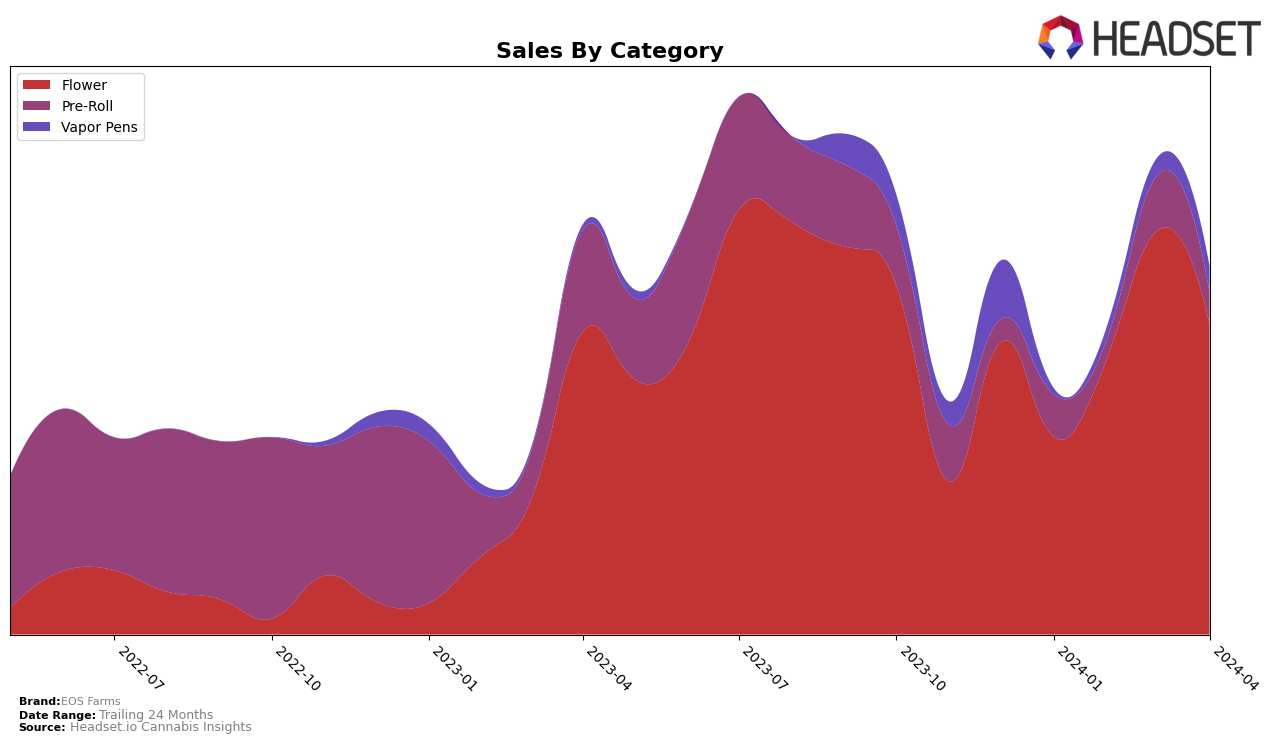

In Massachusetts, EOS Farms has shown a notable performance across different cannabis categories, with a particularly strong presence in the Flower category. Starting outside of the top 30 in January 2024, EOS Farms made an impressive climb to the 16th position by March, before slightly dropping back to 25th in April. This fluctuation in ranking, alongside a peak in sales reaching over 600,000 in March, indicates a significant interest and demand for their Flower products. However, their Pre-Roll and Vapor Pens categories tell a different story. Despite an increase in sales for Pre-Rolls in March and a steady improvement in Vapor Pens rankings from not being in the top 30 to 56th by April, these categories have struggled to maintain a consistent upward trajectory, reflecting a potential area for growth or reevaluation.

While EOS Farms demonstrates a strong capability in market penetration and sales growth, especially within the Flower category, their performance in Pre-Rolls and Vapor Pens in Massachusetts suggests a varied consumer reception across product lines. The absence from the top 30 rankings in the Vapor Pens category until February, followed by a gradual rise, reveals a slow but positive momentum that could hint at growing consumer interest or improved marketing efforts. On the other hand, the fluctuating rankings and sales in the Pre-Roll category could indicate challenges in consumer preference or competitive positioning. These insights not only highlight EOS Farms' strengths and areas for potential expansion but also underscore the importance of strategic focus and adaptation in different product segments to sustain and enhance market presence.

Competitive Landscape

In the competitive landscape of the Flower category within the Massachusetts market, EOS Farms has shown a notable trajectory in its performance over the first four months of 2024. Starting at a rank of 34 in January, EOS Farms made a significant leap to the 16th position by March, before slightly dropping to the 25th rank in April. This fluctuation in rank is indicative of the brand's dynamic presence in the market, amidst stiff competition. Notably, LIT, which held higher ranks initially, saw a decline from 11th in January to 27th by April, suggesting a potential opportunity for EOS Farms to capture a larger market share. Conversely, Ocean Breeze and Springtime have shown upward mobility in the same period, with Ocean Breeze jumping from a rank outside the top 50 to 26th and Springtime making an impressive climb from 84th to 24th. These movements highlight a highly competitive environment where brands like EOS Farms must continuously innovate and adapt to maintain and improve their market position. The performance of Kynd Cannabis Company, fluctuating in and out of the top 20, further illustrates the volatile nature of the market rankings and the challenge for EOS Farms in securing a top spot consistently.

Notable Products

In April 2024, EOS Farms saw Blue Congo Kush Pre-ground (7g) leading their sales with an impressive figure of 1981 units, marking its debut at the top of the rankings for the month. Following closely, Dream Queen Pre-Ground (7g) secured the second position, showing a slight improvement from its previous third place in March, with Water Mountain Queen Pre-ground (7g) stepping down to third after leading in February and holding second in March. Blue Chemdawg Pre-Ground (7g) and Blue Dream Pre-Roll (1g) rounded out the top five, with the former climbing up from a fifth position in March and the latter making a comeback into the top ranks after falling out of the top positions since January. This month's rankings highlight a dynamic shift in consumer preferences within EOS Farms, showcasing a notable demand for pre-ground flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.