Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

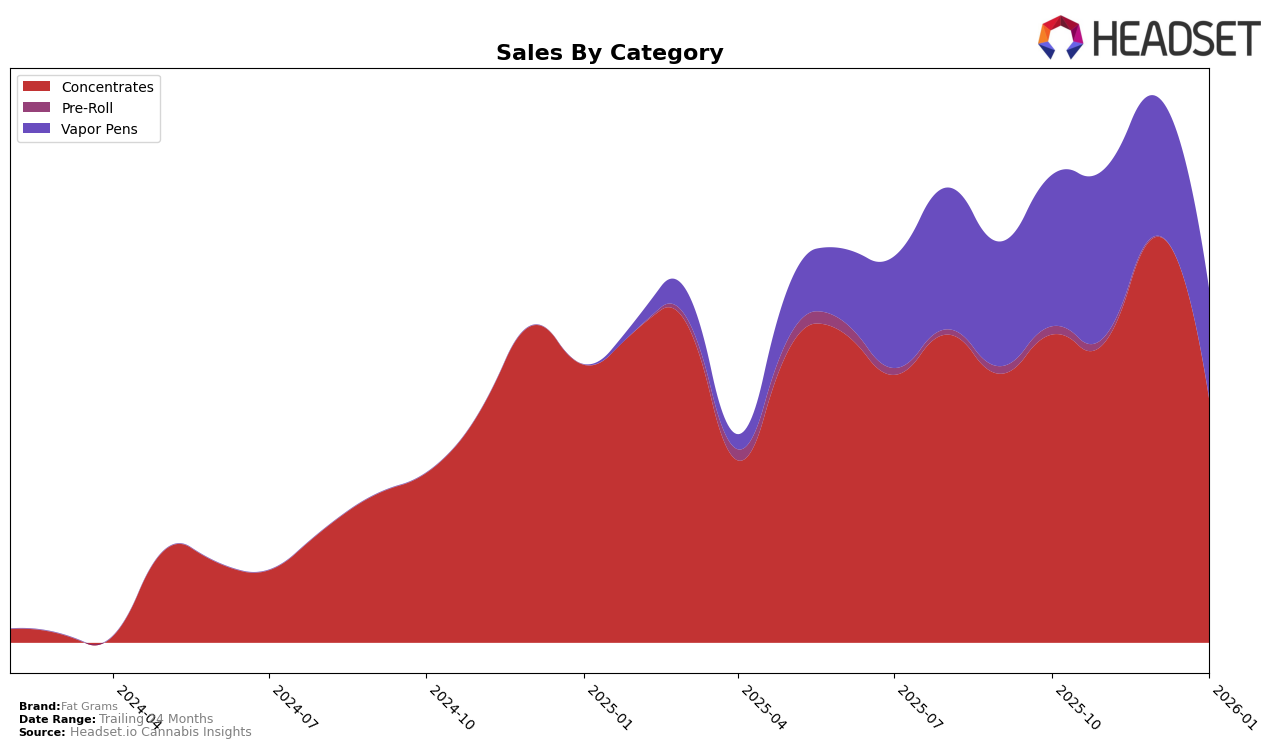

Fat Grams showed varied performance across different categories in Colorado over the past months. In the Concentrates category, the brand experienced fluctuations, starting at the 12th position in October 2025, moving to 14th in November, peaking at 9th in December, and then dropping to 15th in January 2026. This indicates a strong performance in December, likely driven by increased demand during the holiday season. However, the drop in January suggests challenges in maintaining momentum post-holidays. It's noteworthy that while they remained within the top 15 for Concentrates, they did not make it to the top 30 in other states, highlighting a localized strength in Colorado.

In the Vapor Pens category, Fat Grams faced more significant challenges in Colorado. Starting from the 50th position in October 2025, they saw a slight improvement in November, ranking 46th, followed by a dip to 49th in December, and further dropping to 55th by January 2026. This downward trend suggests a struggle to gain traction in the Vapor Pens market, potentially due to increased competition or shifting consumer preferences. The absence of a top 30 ranking in other states for this category underscores the need for strategic adjustments to improve their standing and capture a larger market share. Despite these challenges, the brand's ability to maintain a presence in the rankings, albeit lower, reflects a consistent but limited consumer base.

Competitive Landscape

In the competitive landscape of concentrates in Colorado, Fat Grams has experienced notable fluctuations in rank and sales over the past few months. While Fat Grams achieved a peak rank of 9th in December 2025, it saw a decline to 15th by January 2026. This shift is particularly significant when compared to competitors like Nuhi, which improved its position from 20th in December to 14th in January, and Rare Dankness, which made a remarkable jump from being outside the top 20 in December to 13th in January. Despite these changes, Fat Grams maintained a strong sales performance, especially in December, where it outperformed others with a substantial increase. However, the subsequent decline in January sales suggests a potential challenge in sustaining momentum against rising competitors like El Sol Labs, which consistently remained in the top 20. Understanding these dynamics is crucial for Fat Grams to strategize effectively and regain its competitive edge in the Colorado concentrates market.

Notable Products

In January 2026, Fat Grams' top-performing product was Don Mega Wax (2g) in the Concentrates category, maintaining its number one rank from October 2025, with sales increasing to 639 units. Green Banana Live Resin Disposable (2g) emerged as the second-best performer in the Vapor Pens category, marking its first appearance in the rankings. Bazillionaire Wax (2g) secured the third position in Concentrates, showing strong market entry. Red Howler Wax (2g) followed closely in fourth place, while C. Fumez Live Resin Disposable (2g) rounded out the top five in Vapor Pens. This month saw new entries dominating the top ranks, indicating a shift in consumer preferences towards these newly ranked products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.