Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

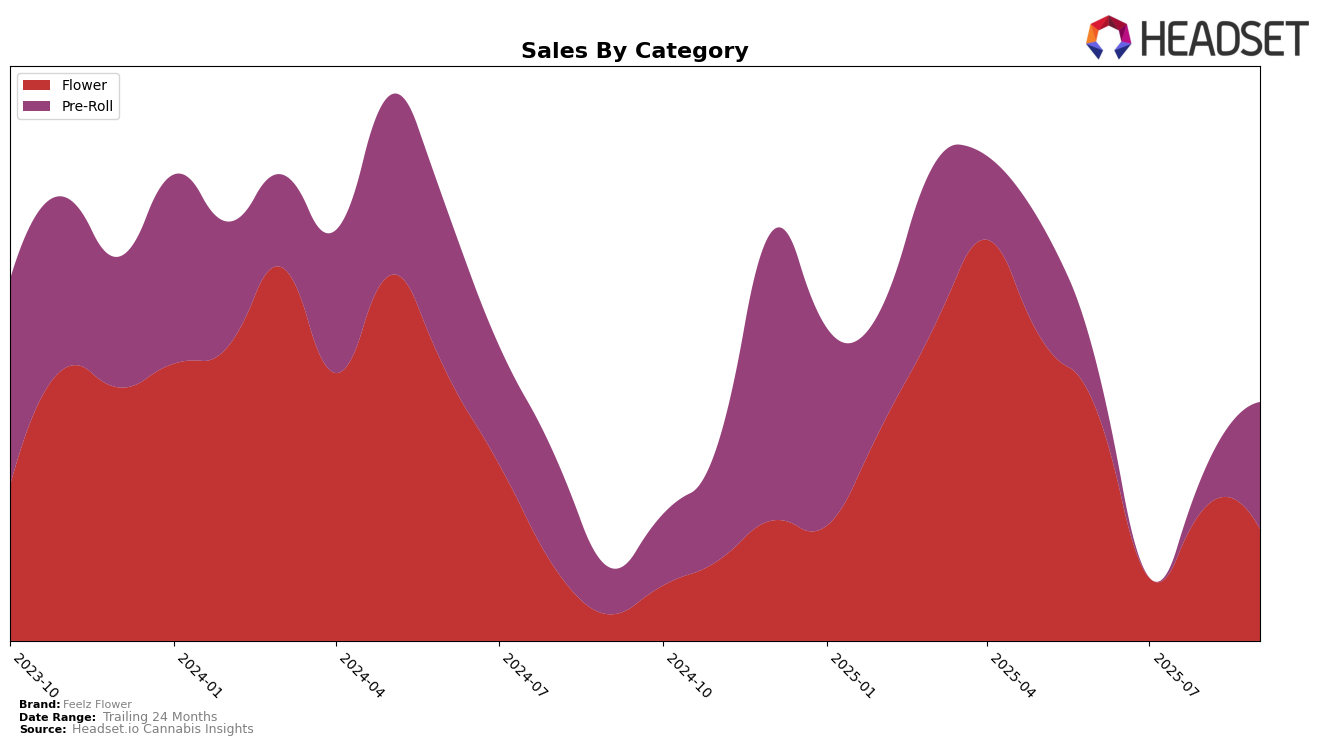

Feelz Flower has demonstrated a fluctuating performance in the New Jersey market, particularly in the Flower category. The brand's ranking in this category started at 41st in June 2025, dropped to 61st in July, improved slightly to 50th in August, and then settled at 53rd in September. This inconsistent performance reflects a challenging competitive environment. Despite these fluctuations, it's noteworthy that Feelz Flower managed to remain within the top 60 brands each month, indicating a persistent presence in the market. The sales figures, peaking in June, suggest that while the brand's market position may be volatile, there is still a significant consumer base for their Flower products.

In contrast, Feelz Flower's performance in the Pre-Roll category in New Jersey shows a more promising trajectory. Starting from a 56th place ranking in June, the brand's position worsened to 76th in July but then improved significantly to 53rd in August and climbed into the top 30 by September, securing the 28th spot. This upward trend highlights a growing acceptance and preference for Feelz Flower's Pre-Roll products among consumers. The sharp increase in sales from July to September further underscores this positive momentum. The ability to break into the top 30 in September is a significant achievement and could suggest potential for further growth in this category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New Jersey, Feelz Flower has shown a remarkable improvement in its ranking from 76th in July 2025 to 28th by September 2025, indicating a significant surge in market presence and sales performance. This upward trajectory is noteworthy, especially when compared to competitors like Elyon Cannabis, which improved from 62nd to 30th during the same period, and Loosies, which consistently maintained a higher rank, moving from 36th to 26th. Meanwhile, The Botanist has been a strong competitor, consistently ranking in the top 30, although it experienced a drop in August 2025, indicating a temporary absence from the top 20. Another State also showed stability, maintaining a rank of 27th in both August and September. Feelz Flower's impressive climb in rank suggests a strategic advantage and potential market share gain, positioning it as a rising contender in the New Jersey Pre-Roll market.

Notable Products

In September 2025, Feelz Flower's top-performing product was the Amaretto Mintz Pre-Roll 10-Pack (5g), which achieved the highest rank with notable sales of 574 units. Following closely was the In Da Couch Smalls (7g) in second place, and GG4 (7g) secured the third position. The OG Kush Pre-Roll 10-Pack (5g) saw a drop in rank to fourth place from its previous top position in August. Glitter Bomb Pre-Roll 10-Pack (5g) rounded out the top five, maintaining a consistent presence in the rankings. The shifts in rankings indicate a dynamic market with varied consumer preferences month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.