Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

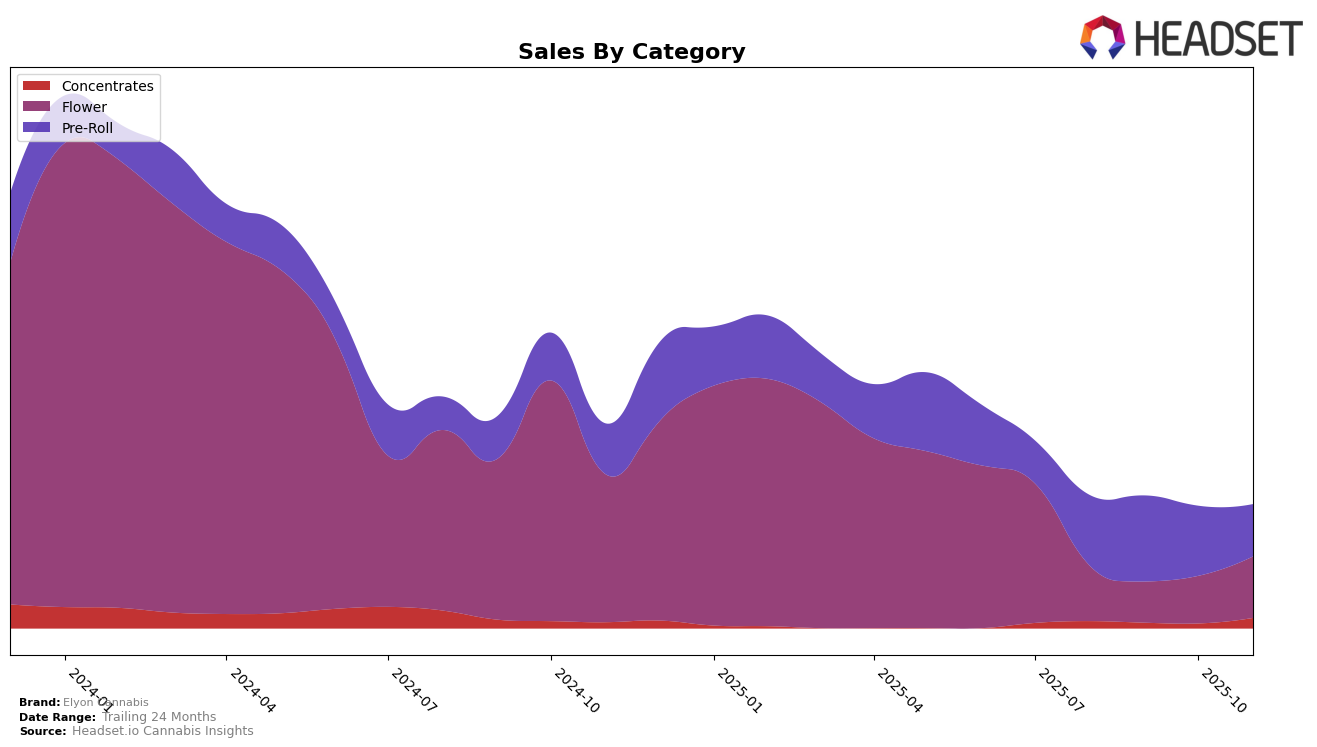

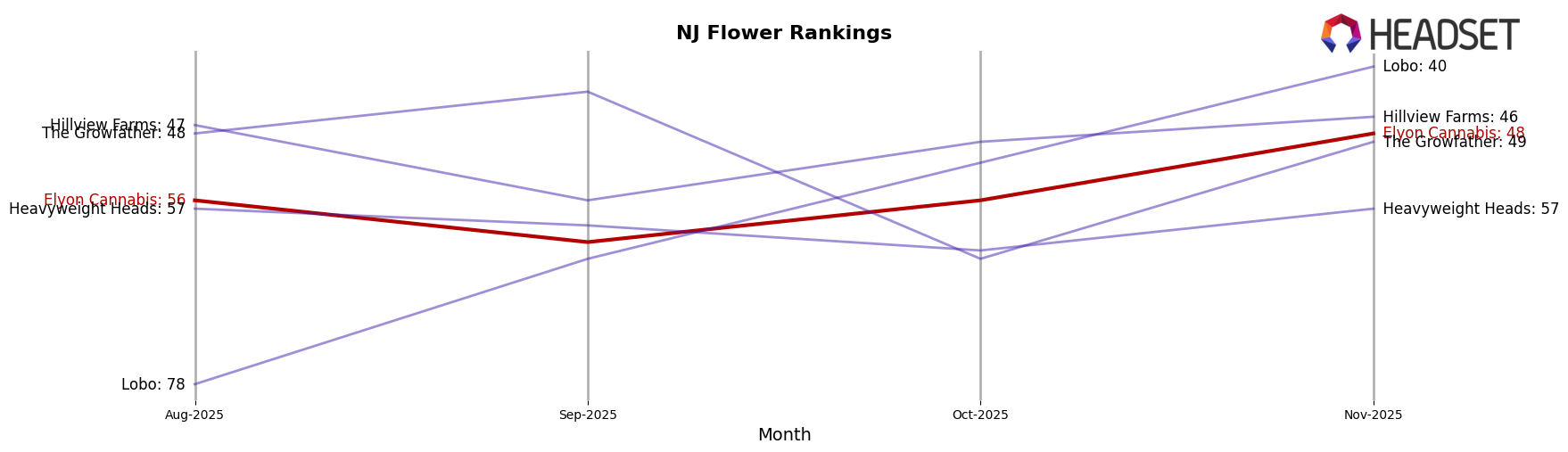

Elyon Cannabis has shown varied performance across different product categories in the state of New Jersey. In the Concentrates category, the brand made a notable appearance in the top 30 in both August and November 2025, with a ranking of 30th. This indicates a re-entry into the competitive landscape after a brief absence in September and October. Meanwhile, the Flower category has seen a positive trajectory, with Elyon Cannabis improving its rank from 56th in August to 48th by November, suggesting strengthening sales momentum. However, the brand did not break into the top 30 during this period, highlighting room for growth in this category.

In contrast, the Pre-Roll category has been more volatile for Elyon Cannabis in New Jersey. The brand experienced fluctuations in its ranking, starting at 34th in August, peaking at 25th in September, before slipping to 36th by November. This movement reflects a dynamic competitive environment and potential challenges in maintaining consistent market share. Despite these fluctuations, the brand's sales figures in the Pre-Roll category indicate a significant peak in September, which could be attributed to promotional activities or seasonal demand. Such insights into Elyon Cannabis's performance offer a glimpse into its market positioning and potential strategies for future growth.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Elyon Cannabis has demonstrated a notable upward trend in its rank from August to November 2025, moving from 56th to 48th position. This improvement is significant when compared to competitors like Lobo, which showed a fluctuating performance, missing the top 20 in October but rebounding to 40th in November. Meanwhile, Heavyweight Heads maintained a relatively stable presence, albeit with a slight dip in rank, which could suggest a plateau in their market influence. The Growfather experienced a sharp decline in October, dropping to 63rd, but quickly recovered to 49th in November, indicating volatility in their sales strategy. Hillview Farms consistently outperformed Elyon Cannabis, maintaining a higher rank throughout the period. Despite this, Elyon Cannabis's sales growth from September to November, particularly the surge in November, suggests a strengthening market position, potentially driven by strategic adjustments or increased consumer preference.

Notable Products

In November 2025, the Gelato Pre-Roll (1.25g) emerged as the top-performing product for Elyon Cannabis, climbing to the number one rank with sales of $1,228. The Blueberry x Purple Kush (3.5g) secured the second position, making a notable entry in the Flower category. The Sour Blackberry Pre-Roll (1.25g) followed closely in third place, while the Grape Gas Pre-Roll (1.1g) and Double Runtz Diamond Infused Pre-Roll (1.1g) occupied the fourth and fifth ranks, respectively. Compared to previous months, Gelato Pre-Roll improved from second place in October, indicating a positive trend in its popularity. Other products, such as Blueberry x Purple Kush, made their debut in the rankings, showing a shift in consumer preferences towards new offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.