Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

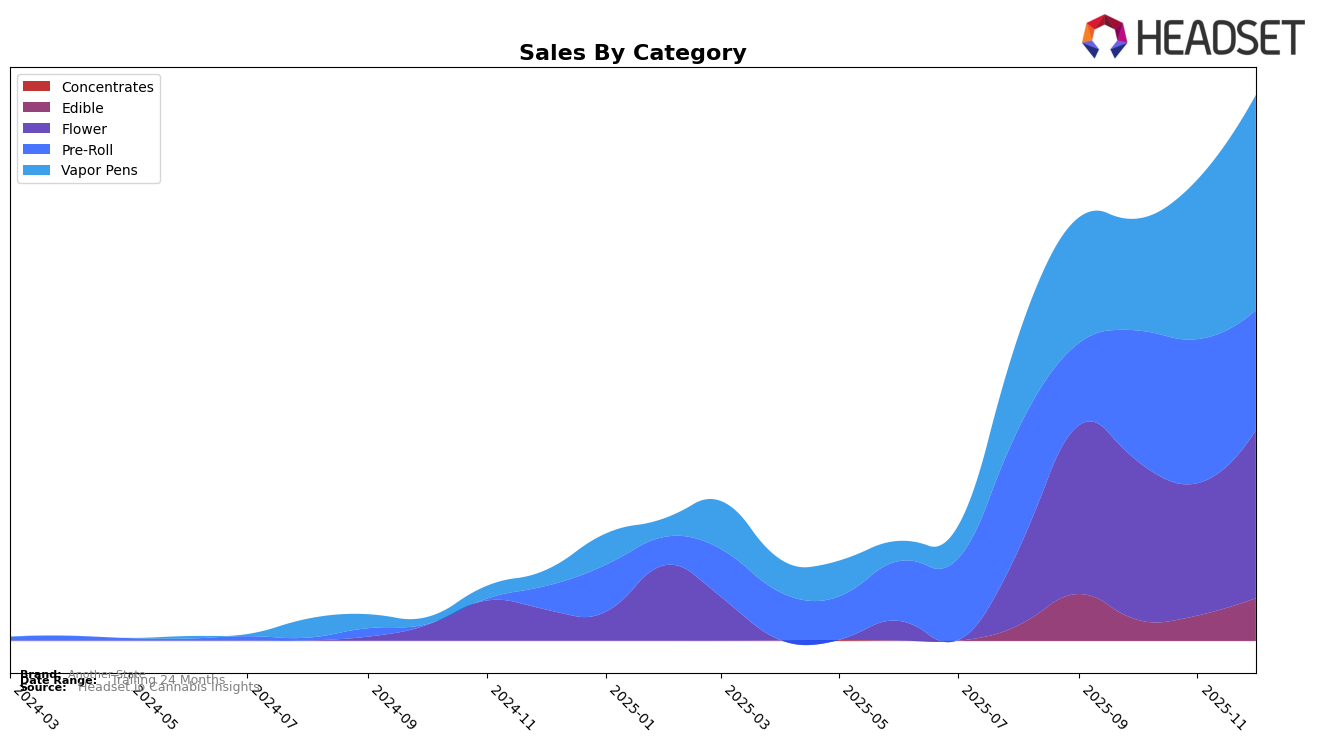

In the cannabis market, Another State has shown varied performance across different categories and states. In Illinois, the brand's presence in the Pre-Roll category has fluctuated, with a noticeable drop from 41st in November to 54th in December 2025. This indicates a challenge in maintaining a strong foothold in the top 30, as they were not ranked in September. Conversely, their performance in the Vapor Pens category has been more consistent, maintaining a position at 77th in both September and October, though they did not rank in the top 30 in November and December. This consistency suggests a stable but modest presence in this product line within the state.

Meanwhile, in New Jersey, Another State has demonstrated a more dynamic presence. Their ranking in the Edibles category has seen significant fluctuations, dropping to 43rd in October before climbing back to 30th in December, highlighting potential volatility or strategic adjustments in this segment. In the Vapor Pens category, the brand has shown a positive trend, improving from 30th in October to 19th by December, suggesting growing consumer preference or successful marketing efforts. The Flower category has seen a steady position around the mid-30s, indicating a stable market performance. The Pre-Roll category also shows a competitive edge, with rankings improving from 32nd in September to 28th in December, demonstrating resilience and potential growth in this area.

Competitive Landscape

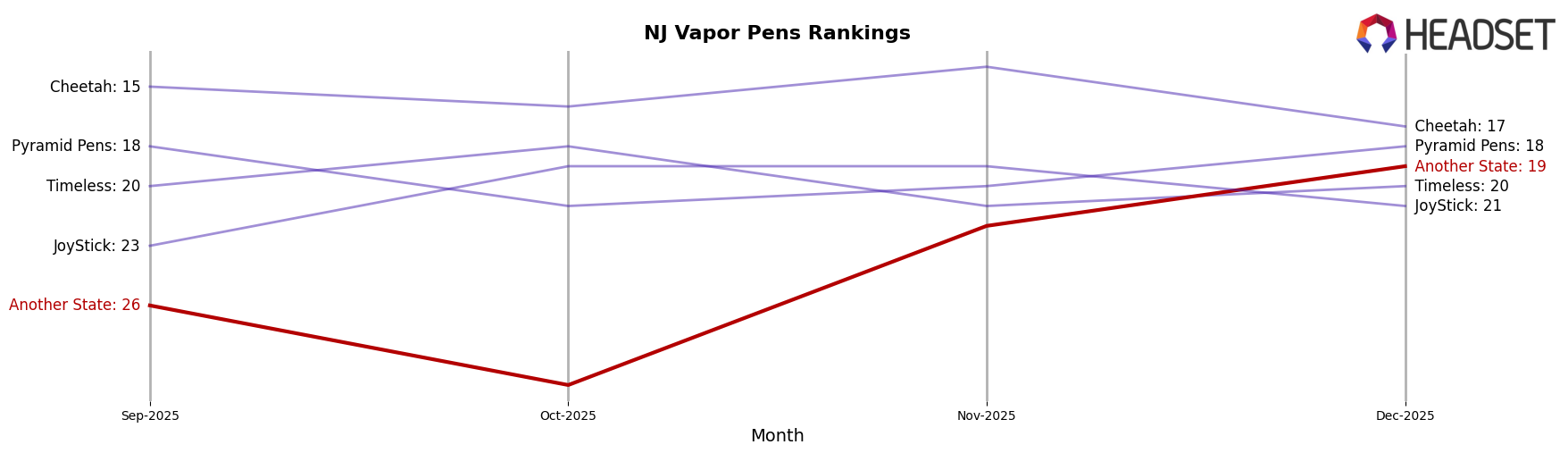

In the competitive landscape of vapor pens in New Jersey, Another State has demonstrated a notable upward trajectory in its rankings over the last few months of 2025. Starting from a rank of 26 in September, it climbed to 19 by December, indicating a significant improvement in market presence. This is a positive sign for Another State, especially considering that brands like Timeless and JoyStick have shown fluctuating ranks, with Timeless dropping out of the top 20 in November. Despite starting with lower sales figures, Another State managed to close the gap with competitors, achieving sales growth that brought it closer to brands such as Pyramid Pens, which also experienced rank volatility. The consistent rise in rank and sales for Another State suggests a strengthening brand presence and potential for continued growth in the New Jersey vapor pen market.

Notable Products

In December 2025, the top-performing product for Another State was the Sour Zkittlez Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, which climbed to the number one position with sales of 3,061 units. The Tropicana Cookies Distillate Cartridge (1g) in the Vapor Pens category also performed well, advancing to the second position from its previous fourth place in November. The Lime OG Pre-Roll 3-Pack (1.5g) maintained a strong presence by securing the third spot, improving from fifth place in November. Notably, the Baby Yoda Pre-Roll 3-Pack (1.5g) made its debut on the rankings in December at fourth place. Meanwhile, the Rainbow Belts Distillate Cartridge (1g) entered the rankings in November and held the fifth position in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.