Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

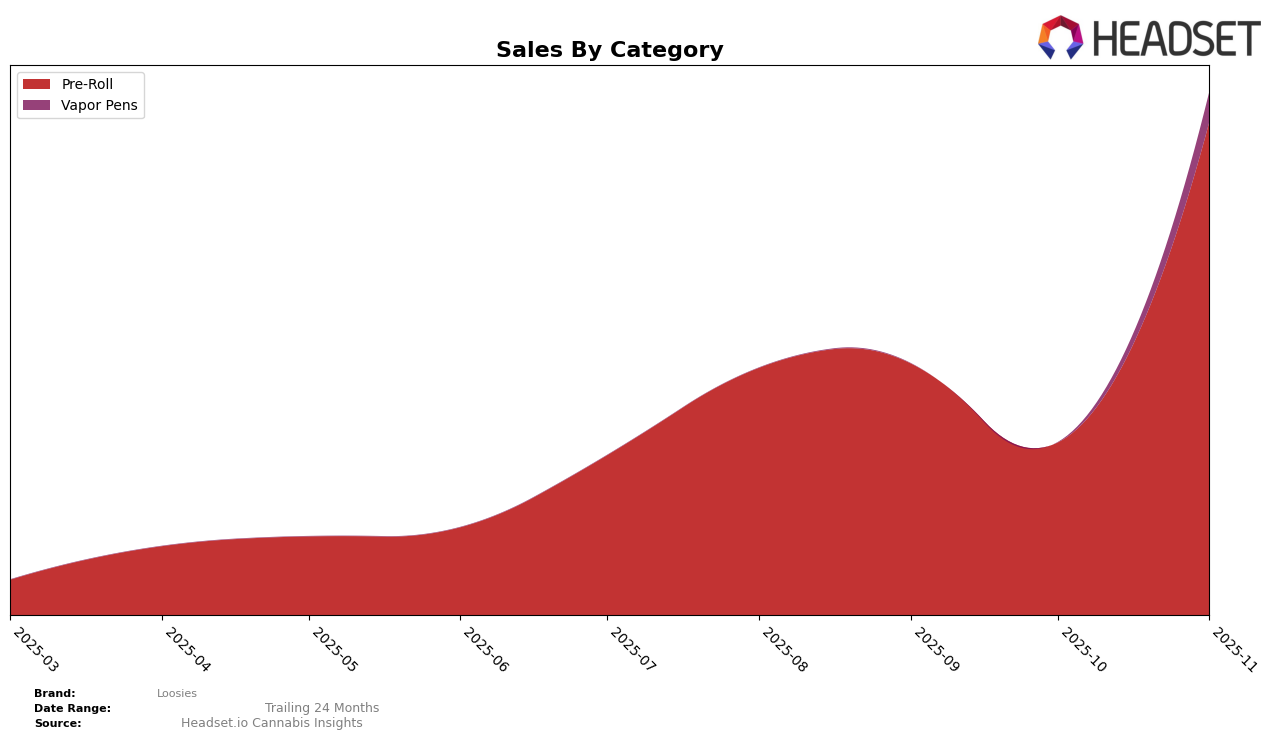

In the pre-roll category, Loosies has shown a varied performance across different states. In New Jersey, Loosies maintained a presence in the rankings, starting at 29th place in August 2025, dipping to 47th in October, and then recovering to 27th in November. This fluctuation suggests a competitive market in New Jersey, but Loosies' ability to bounce back into the top 30 by November indicates resilience. Meanwhile, in Michigan, Loosies did not make it into the top 30 for pre-rolls from August to November 2025, suggesting challenges in penetrating this market or heightened competition in the state.

For vapor pens, Loosies' performance in New Jersey was less prominent, as they did not rank in the top 30 until reaching 71st in November 2025. This late appearance in the rankings could point to either a recent strategic push into the vapor pen market or a particularly saturated market making it difficult to gain traction. The data indicates that while Loosies has a foothold in the pre-roll segment in New Jersey, it faces hurdles in expanding its presence in the vapor pen category. This highlights a potential area for growth or strategic focus if they aim to improve their market position in the state.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Loosies made a notable entry in November 2025, securing the 60th rank. This is a significant achievement considering that Loosies was not in the top 20 brands in the preceding months. The brand's emergence can be seen against the backdrop of fluctuating performances by other competitors. For instance, Grown Rogue experienced a decline, dropping from 41st to 59th rank from October to November, while Skymint improved from 67th to 53rd rank in the same period. Meanwhile, Presidential and Hytek showed relatively stable performances, with minor rank changes. Loosies' entry into the top 60 suggests a potential upward trajectory, especially as some competitors face volatility, indicating a promising opportunity for growth and increased market share in the coming months.

Notable Products

In November 2025, Block Party Pre-Roll (1g) emerged as the top-performing product for Loosies, achieving the number one rank with notable sales of 25,967 units. Skywalker OG Pre-Roll (1g) followed closely behind at the second position, improving from its fourth rank in October with sales climbing to 24,980 units. City Kush Pre-Roll (1g) secured the third position, moving up from fifth place in October. Strawberry Cough Pre-Roll (1g), which was second in October, dropped to fourth place. Green Crack Pre-Roll (1g) maintained a consistent presence in the rankings, finishing fifth in November, after being ranked fourth in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.