Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

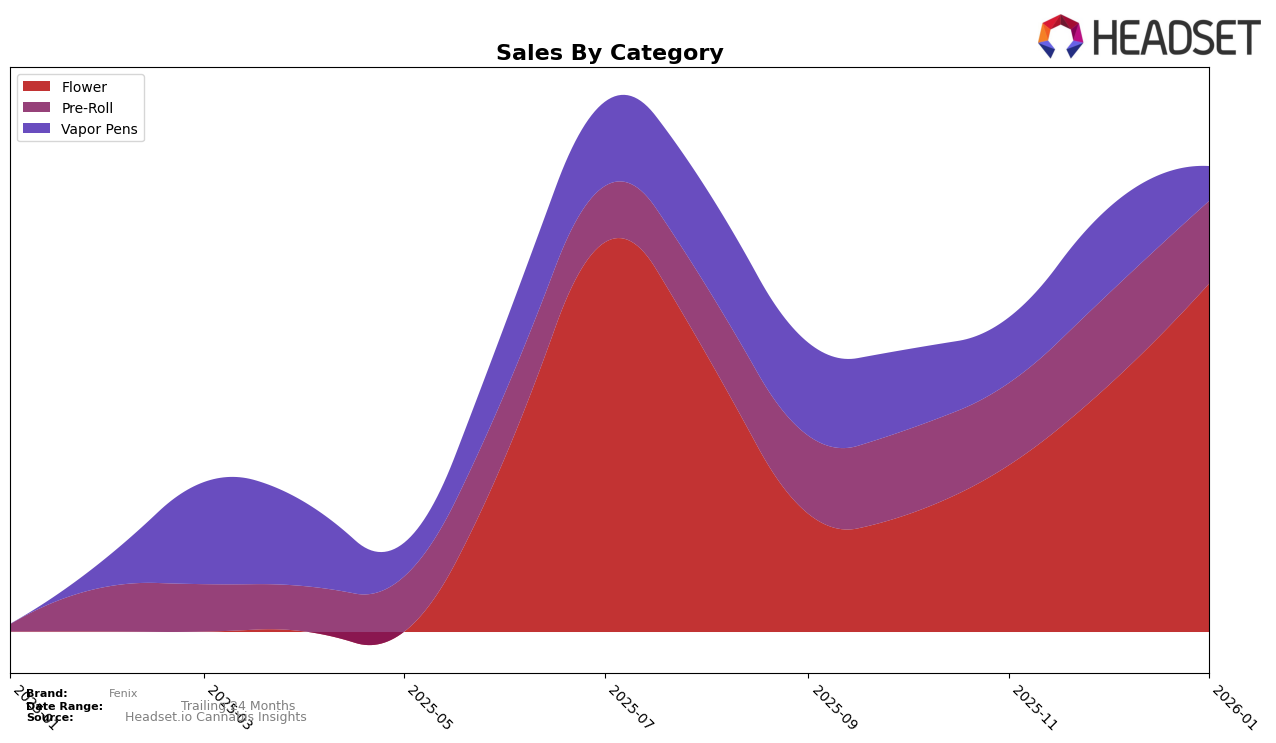

In Arizona, Fenix has made significant strides in the Flower category, moving from a ranking of 20 in October 2025 to an impressive 5 by January 2026. This upward trajectory is indicative of a strong performance, perhaps driven by strategic initiatives or changing consumer preferences. Meanwhile, in the Pre-Roll category, Fenix has maintained a steady position, hovering around the 6th and 7th ranks throughout the observed months. This consistency suggests a stable demand for their products in this category, reflecting well on their market presence and brand loyalty.

However, not all categories have shown positive trends for Fenix. In the Vapor Pens category, the brand's ranking has seen a decline, dropping from 16th in October 2025 to 27th by January 2026. This fall out of the top 20 could signal increasing competition or shifts in consumer behavior away from their offerings. Interestingly, Fenix's movement across these categories highlights the dynamic nature of the cannabis market in Arizona, where success can vary significantly between product types. It's worth noting that the absence of a top 30 ranking in certain categories or states could either indicate areas for potential growth or challenges that the brand needs to address.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Fenix has shown a remarkable upward trajectory in its rankings from October 2025 to January 2026. Starting at the 20th position in October, Fenix climbed to the 5th spot by January, indicating a significant improvement in market presence and consumer preference. This upward movement is particularly notable when compared to brands like Abundant Organics, which fluctuated between the 8th and 15th positions, and Dr. Greenthumb's, which maintained a relatively stable rank around the 6th position. Despite the fierce competition from top players like Find. and Brown Bag, which consistently held top positions, Fenix's sales growth trajectory suggests a strong consumer response, likely driven by strategic marketing efforts or product innovations. This trend positions Fenix as a rising contender in the Arizona flower market, with potential to challenge the established leaders if the momentum continues.

Notable Products

In January 2026, the top-performing product from Fenix was AK47 Infused Pre-Roll (1g), which climbed to the number one spot with sales reaching 10,270 units. Pineapple Donut Pre-Roll (1g) made a strong debut, securing the second position without previous rankings. Brain Stain Pre-Roll (1g) maintained its presence in the top three, although it slipped from second to third place compared to December 2025. Apple Strudel Pre-Roll (1g) entered the list at fourth place, showcasing a new contender in the pre-roll category. Finally, Brain Stain (14g) reappeared in the rankings at fifth position, indicating a slight decline from its previous fourth place in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.