Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

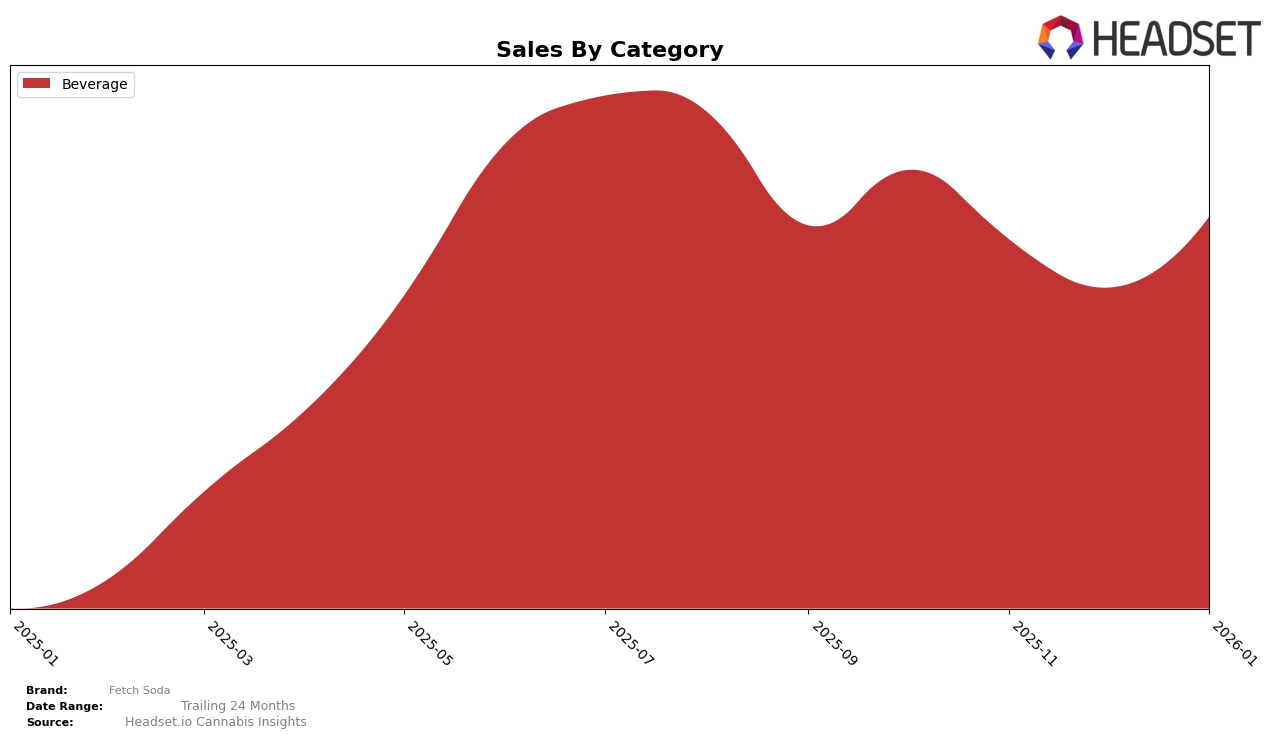

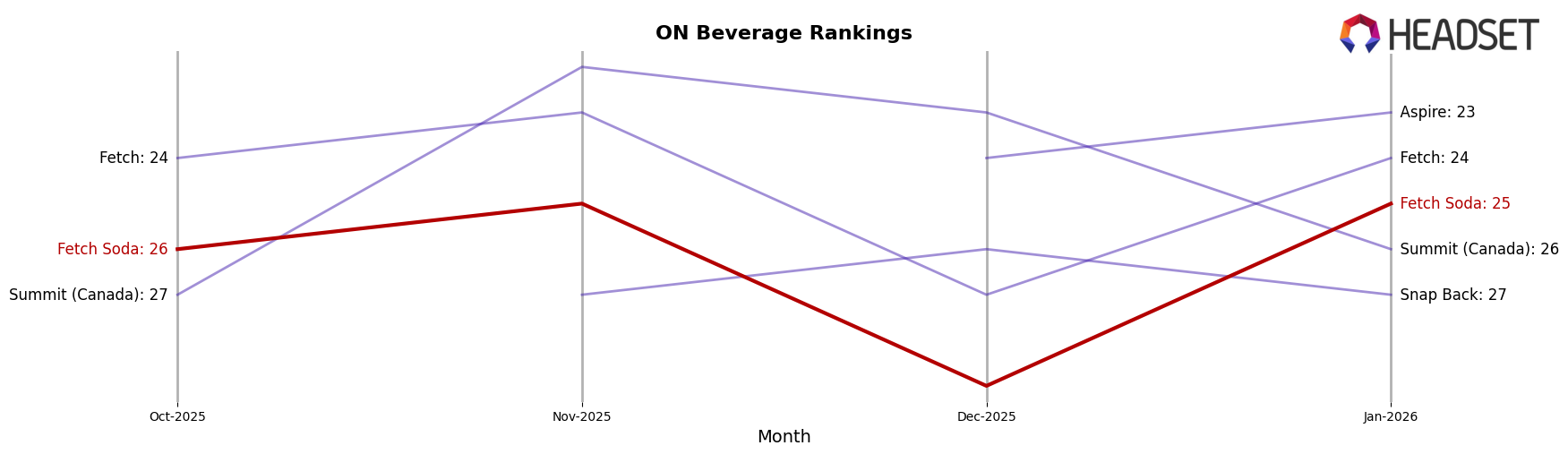

In the province of Ontario, Fetch Soda has shown a consistent presence in the beverage category rankings over the last few months. Starting at rank 26 in October 2025, Fetch Soda experienced a slight improvement to rank 25 in November, although it dropped to rank 29 in December. By January 2026, the brand managed to regain its position at rank 25. This fluctuation indicates a competitive market landscape in Ontario, where Fetch Soda is maintaining its presence but faces challenges in climbing higher in the rankings. Notably, the sales figures reflect a dip from October to December, with a slight recovery in January, suggesting a seasonal or strategic influence on sales performance.

While Fetch Soda's presence in Ontario is noteworthy, the absence of rankings in other states or provinces suggests that the brand has not yet broken into the top 30 in those markets. This could be seen as a potential area for growth or expansion, depending on the brand's strategic goals. The ability to maintain a position within the top 30 in Ontario's beverage category indicates a level of brand recognition and customer loyalty that could be leveraged in other regions. However, the brand's current focus seems to be concentrated in Ontario, as evidenced by the lack of data from other regions. This concentrated market strategy might be beneficial for honing brand strength in a key market before expanding more broadly.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Fetch Soda has experienced notable fluctuations in its market position over the past few months. Starting from October 2025, Fetch Soda was ranked 26th, slightly behind Fetch at 24th. By November, Fetch Soda improved its rank to 25th, although it still trailed behind Fetch and Summit (Canada), which held the 23rd and 22nd positions, respectively. December saw a dip for Fetch Soda to 29th, marking its lowest rank, while Aspire entered the rankings at 24th, indicating a competitive push. By January 2026, Fetch Soda rebounded to 25th, maintaining a close competition with Fetch at 24th and surpassing Snap Back, which ranked 27th. Despite these rank changes, Fetch Soda's sales showed a downward trend from October to December, before slightly recovering in January, highlighting the need for strategic marketing efforts to regain and sustain higher market positions amidst strong competition.

Notable Products

In January 2026, Zero Lemon Lime Soda (10mg THC, 12oz, 355ml) continued to dominate as the top-performing product for Fetch Soda, maintaining its consistent first-place ranking with sales reaching 2,790 units. Zero Classic Cola (10mg THC, 12oz, 355ml) also held its steady second position, while Cream Soda (10mg THC, 12oz, 355ml) climbed from fourth to third place, indicating a notable increase in popularity. The Cream Soda (600mg THC, 12oz, 355ml) was not ranked in January, suggesting a potential decline or discontinuation. Meanwhile, Lemon Lime Soda (10mg, 12oz, 355ml) appeared for the first time in the rankings, debuting in fifth place, which could indicate a new addition to the product lineup or a previous underperformance in sales tracking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.